The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better- informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

ECONOMIC OVERVIEW

Oregon added 30,800 new jobs in 2018, representing an annual growth rate of 1.6%. Though the job growth rate norm for the past 20 years has been 2% or more, this slowdown does not concern me. It’s to be expected at this stage in the economic cycle.

The Southwest Washington market (Clark, Cowlitz, Skamania, and Klickitat counties) added 6,680 new jobs over the past 12 months, which represents an annual growth rate of 3.1%.

Oregon’s unemployment rate was 4.1% in December, matching the level at the end of 2017. In Southwest Washington, the unemployment rate was 5.2%, down from 5.3% at the end of last year.

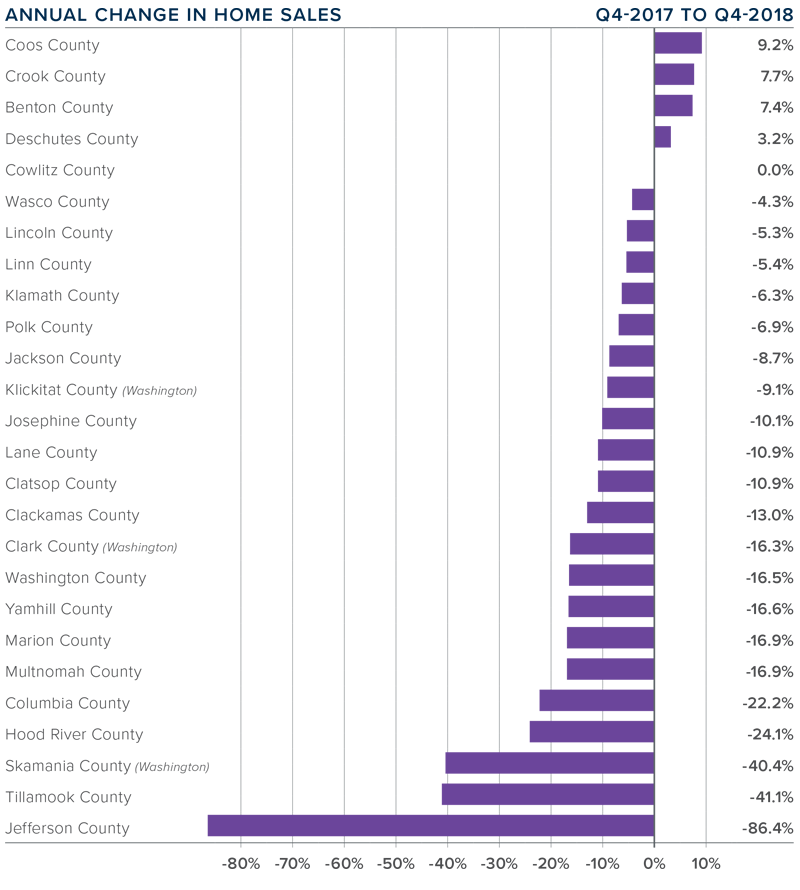

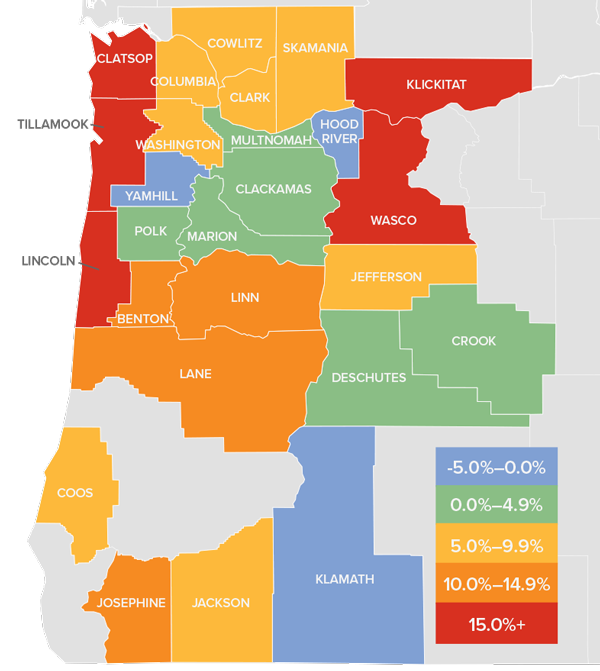

HOME SALES ACTIVITY

- Fourth quarter home sales dropped 13.5% compared to the same period last year, with a total of 13,264 transactions occurring.

- Sales rose the most in Coos County, which saw a 9.2% increase compared to the fourth quarter of 2017. There was also a solid increase in Crook and Benton counties. Home sales fell most in Jefferson, Tillamook, and Skamania counties.

- Year-over-year sales rose in four counties, remained static in one, and dropped in the other 21 counties contained in this report.

- The drop in sales activity can primarily be attributed to rising interest rates and an increase in the number of homes for sale which is allowing buyers to take more time during their home search.

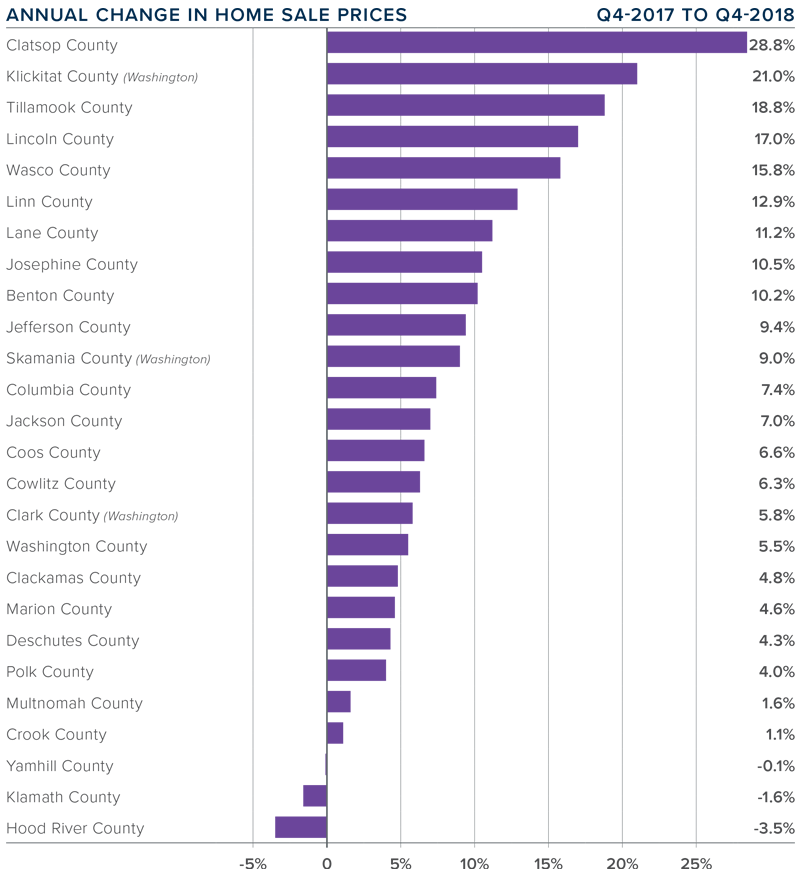

HOME PRICES

- The average home price in the region rose 5.2% year over year to $374,827 but dropped 4% compared to the third quarter of 2018. This is not necessarily a concern since we normally see a drop during the final quarter of the year.

- Clatsop County led the market with the strongest annual price growth. Homes there sold for 28.8% more than a year ago. This is likely because it’s a very small market and prone to significant swings.

- All but three counties experienced price growth compared to a year ago, with nine of them experiencing double-digit increases.

- The takeaway is that price growth continues to slow as some markets reach an affordability ceiling.

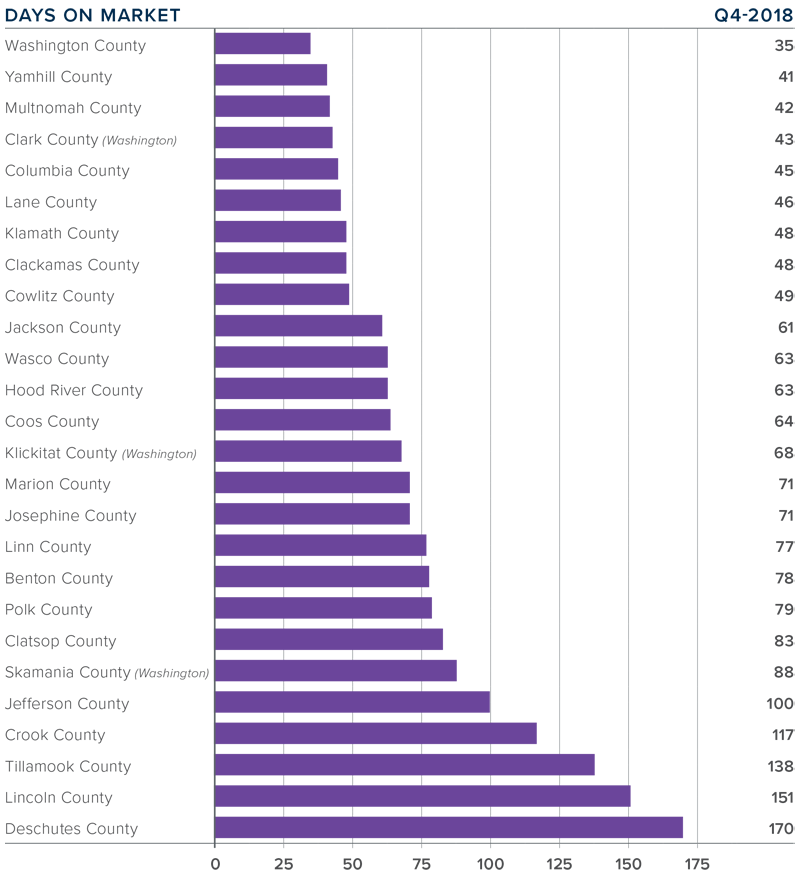

DAYS ON MARKET

- The average number of days it took to sell a home in the region dropped five days compared to the fourth quarter of 2017 but was up ten days compared to the third quarter of 2018.

- The average time it took to sell a home last quarter was 75 days.

- Fifteen counties saw the length of time it took to sell a home drop or remain static compared to a year ago. Eleven counties saw market time rise.

- Homes sold the fastest in Washington (35 days), Yamhill (41 days), and Multnomah (42 days) counties.

CONCLUSIONS

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although slowing, the region’s economy is still strong, and I believe this will continue to drive demand for housing. That said, and as I mentioned in the third quarter Gardner Report, there is clearly a shift starting to occur as listings rise and sales growth slows. I do not believe this is a cause for concern, rather an ongoing move toward a more balanced market.

For the fourth quarter, I have moved the needle further toward buyers, but the market still favors home sellers.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governor’s Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link