The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

ECONOMIC OVERVIEW

We are seeing some “green shoots” in the regional economy, but employment levels across the Southern Californian counties contained in this report are still well below where they were before COVID-19 hit. For perspective, the region shed more than two million jobs between March and May. That said, it appears as if we turned the corner in June, and the latest data available (August) shows the region has recovered more than 640,000 of the lost jobs.

Although some jobs are returning, the current level remains well below where it was in the spring. It is, therefore, unsurprising to see the unemployment rate remain elevated. In August, unemployment averaged 13.4% across the region. It was lowest in Orange and San Diego counties, at 9.9%. It was highest, at 16.6%, in Los Angeles County. I expect we will continue to see jobs return, but the rate will be tepid. A hard-struck economy, in concert with ongoing wildfires, will act as headwinds to a full economic recovery.

HOME SALES

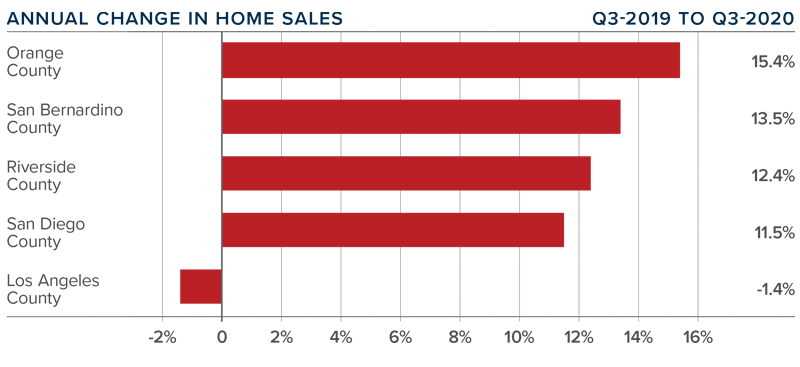

- There were 53,498 homes sold in the third quarter of 2020, representing a year-over-year increase of 8%. This number was up a remarkable 59.2% from the second quarter.

- Pending home sales (an indicator of future closings) rose 39.8% from the second quarter, suggesting closings in the final quarter of 2020 will be positive.

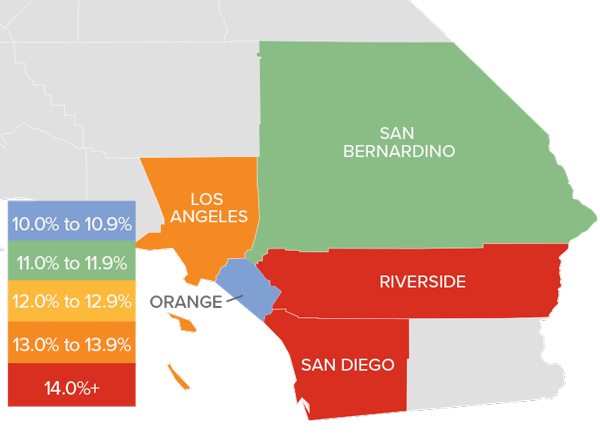

- Third quarter sales rose in all but one county relative to a year ago. The exception was Los Angeles County, where sales dropped 1.4%. Outside of L.A., the growth in transactions was impressive across the board.

- There was an average of only 23,225 homes for sale in the third quarter—down 40.4% from a year ago and 13.8% lower than in the second quarter of this year. Choice for buyers in the market remains very limited.

HOME PRICES

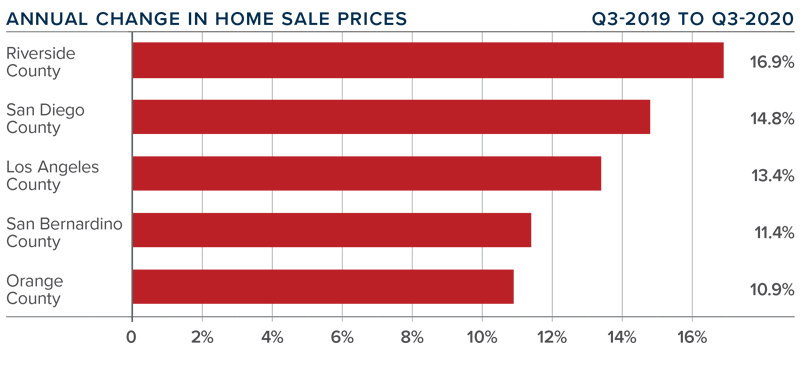

- Year-over-year, the average sale price in the region was $812,553. This was 12.2% higher than a year ago and 11.8% higher than in the second quarter of 2020.

- Very competitive mortgage rates are allowing prices to rise at well-above-average rates. Although this has been very good for would-be buyers, affordability concerns continue to increase given that prices are rising faster than mortgage rates have been dropping.

- The region saw double-digit price growth across all counties contained in this report, with very significant increases in the relatively affordable Riverside County.

- I predict mortgage rates will remain very low, and that will drive demand. Prices will continue to rise, especially as there is a significant lack of homes for sale—demand is clearly exceeding supply. At some point, price growth will slow, but it is unlikely to happen this year.

DAYS ON MARKET

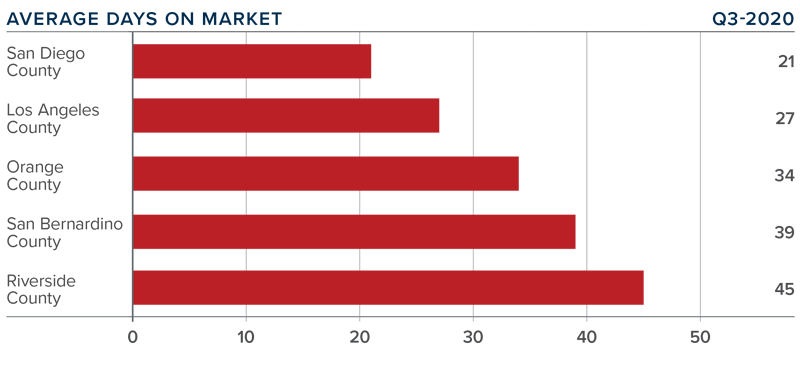

- In the third quarter, the average time it took to sell a home in the region was 33 days, which is 9 fewer days than a year ago and 2 fewer days than in the second quarter of 2020.

- Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the third quarter it took an average of only 21 days to sell a home. This is 8 fewer days than it took a year ago.

- All markets contained in this report saw the time it took to sell a house drop compared to the third quarter of 2019.

- The drop in market time is a function of limited inventory levels and significant demand.

CONCLUSIONS

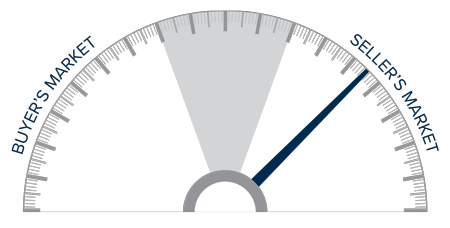

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Buyer demand has reappeared—even in the face of an economy with significant levels of unemployment. Housing is clearly a bright spot in an otherwise moribund economy. Demand is likely to remain strong, but this could change if workers are allowed to continue working remotely indefinitely and decide to move to more affordable markets both inside and outside of the state.

Even given the possible headwinds mentioned here, I am moving the needle a little more in favor of sellers as solid demand is still in place.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link