The following analysis of the Eastern Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

It appears as if the massive COVID-19-induced contraction in employment Washington State experienced—along with the rest of the nation—is behind us (at least for now). Employment across Washington State started to drop in March, but April was the real shock: total employment dropped almost 460,000 between March and April, a decline of 13%. However, this turned around remarkably quickly, with 52,500 jobs added in May. Worthy of note is that, in May alone, Eastern Washington recovered 5,200 of the 47,000 jobs that were lost in March and April. However, the unemployment rate in Eastern Washington was still a high 13.4% in May. Although it is certainly too early to say we are out of the woods, we seem to be headed in a positive direction and, assuming we respect the state’s mandates regarding social distancing and mask wearing, I remain hopeful that Washington will not have to re-enter any form of lockdown.

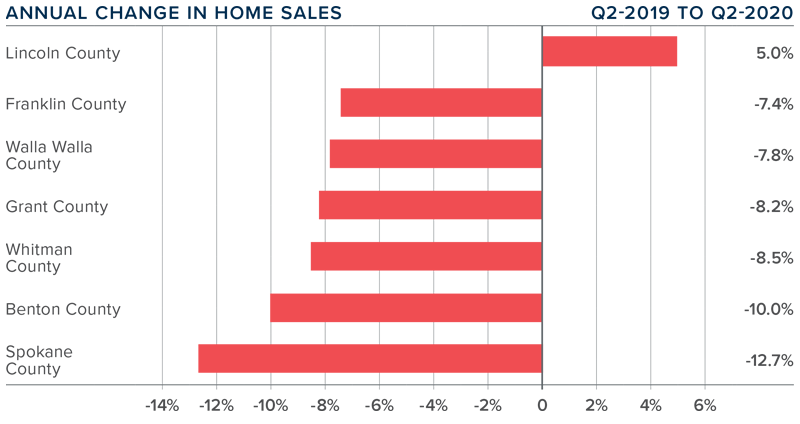

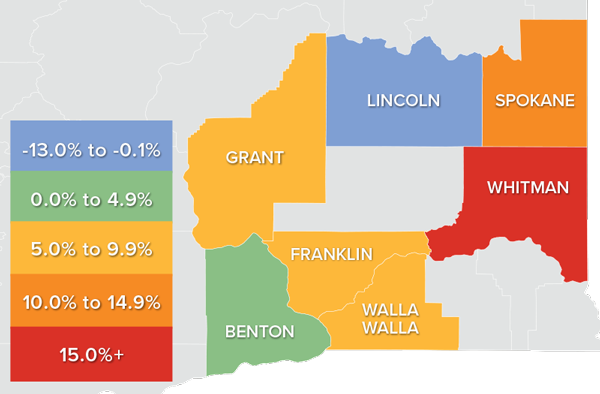

HOME SALES

- Home sales throughout Eastern Washington were down 11% compared to the same quarter in 2019, with a total of 3,101 closed sales.

- Pending home sales in the region were 36.4% higher than in the first quarter of the year, suggesting that closed sales will pick up again in the third quarter.

- Sales activity dropped in all but the very small Lincoln County, though growth there was only one unit.

- The average number of homes for sale in the quarter was 45.1% lower than a year ago, but 10.5% higher than in the first quarter of 2020. This is positive, but inventory levels are well below historic averages.

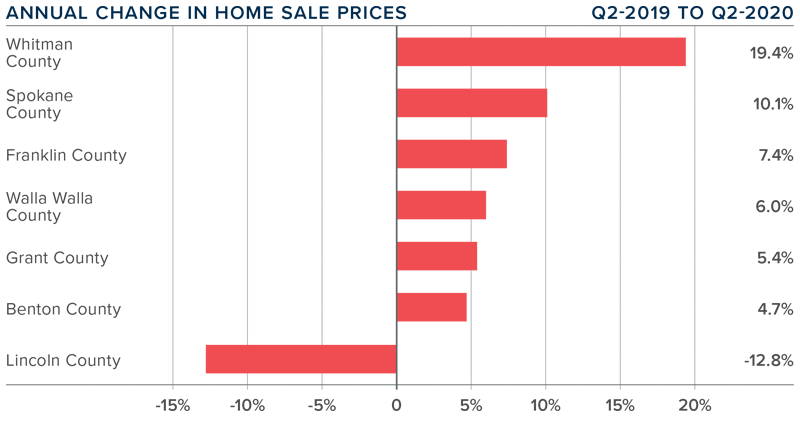

HOME PRICES

- Year-over-year, the average home price in Eastern Washington rose a significant 8.4% to $318,275. Prices were also 7% higher than in the first quarter of 2020.

- As mentioned in the previous section, low inventory levels are pervasive and, even with the bump in the second quarter over the first, listing activity is still very low.

- Prices rose in every county other than Lincoln. Whitman and Spokane counties showed double-digit gains.

- The takeaways are that average home-price growth in Eastern Washington remains well above the long-term average and, so far, there have been no real price impacts from COVID-19.

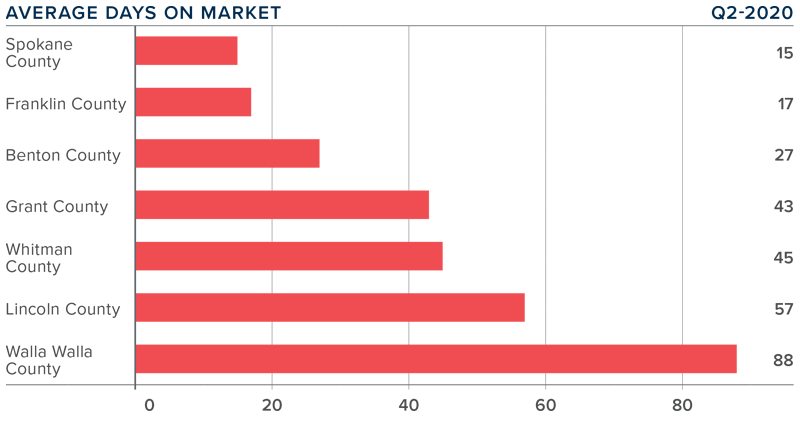

DAYS ON MARKET

- The average time it took to sell a home in Eastern Washington in the second quarter of 2020 was 42 days.

- During the second quarter, it took ten fewer days to sell a home in Eastern Washington than it did a year ago.

- All markets other than Whitman saw the length of time it took to sell a home drop compared to the second quarter of 2019.

- It took 21 fewer days to sell a home in the second quarter than it did in the first.

CONCLUSIONS

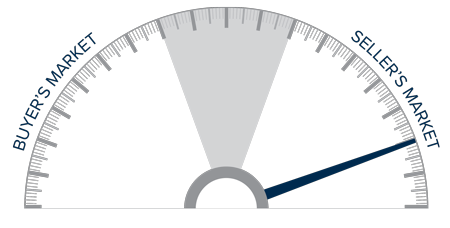

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Given robust demand and historically low interest rates, it certainly remains a seller’s market, and I don’t expect this to change in the foreseeable future. The overall housing market has exhibited remarkable resilience, and housing demand has rebounded faster than most would have expected. I do not anticipate any drop in demand, but I am watching housing affordability. Prices cannot continue to rise at the pace the market is currently seeing without exacerbating affordability issues. The needle above remains unchanged from the first quarter due to ongoing uncertainty surrounding COVID-19.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link