The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The region continues to recover from the very significant COVID-19-induced contraction in employment earlier in the year. Oregon lost a remarkable 252,800 jobs in April alone, but the contraction was remarkably short. Numbers started to improve in May, with more than 112,000 jobs returning. The Southwest Washington region saw a drop in total employment of almost 30,000 jobs, but that also turned around in May, with more than 14,500 jobs returning.

The massive drop in employment drove the unemployment rate. Oregon was up to 14.9% in April, but that rate has now dropped to 7.7%. The unemployment rate in Southwest Washington dropped from 14.6% to 9.4%. The recovery is palpable, though the pace has slowed. The kinds of jobs returning differ, with service industry jobs taking far longer to ramp up. I still expect to see further improvement as we move through the balance of the year, but the increase in jobs is likely to continue to be muted until a vaccine is freely available.

HOME SALES

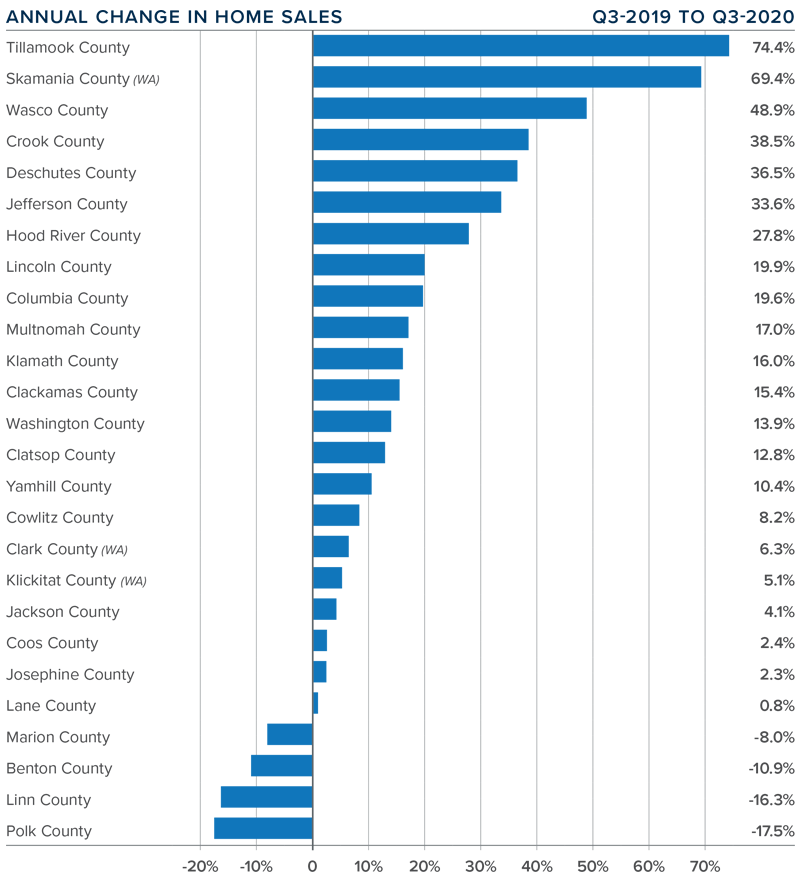

- Third quarter home sales have recovered very rapidly, with total transactions up 11.1% compared to the same period a year ago. A total of 20,649 homes sold.

- Unsurprisingly, sales rose in a vast majority of counties, but there were modest declines in sales in four counties. However, most of these are small markets that can be subject to significant swings.

- Growth was 44% higher than in the second quarter of 2020.

- Housing is clearly recovering faster than the economy as a whole, and pending sales suggest that the fourth quarter will be a good one. That said, the state is still suffering from a lack of supply, which will ultimately limit the number of home sales.

HOME PRICES

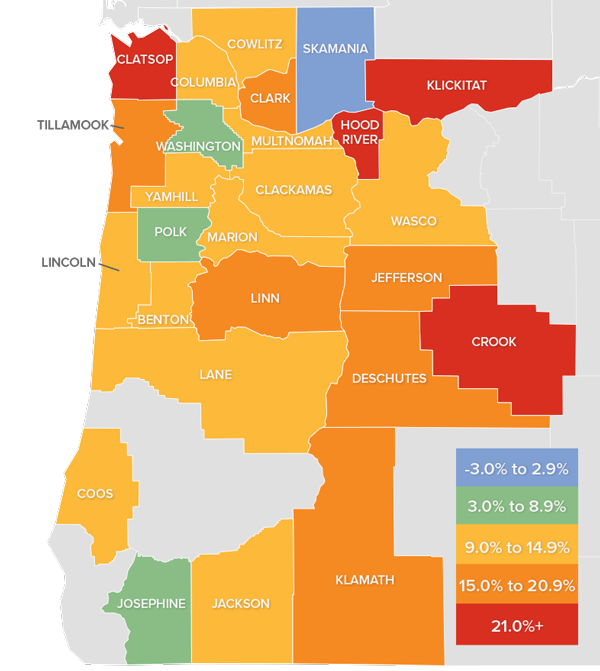

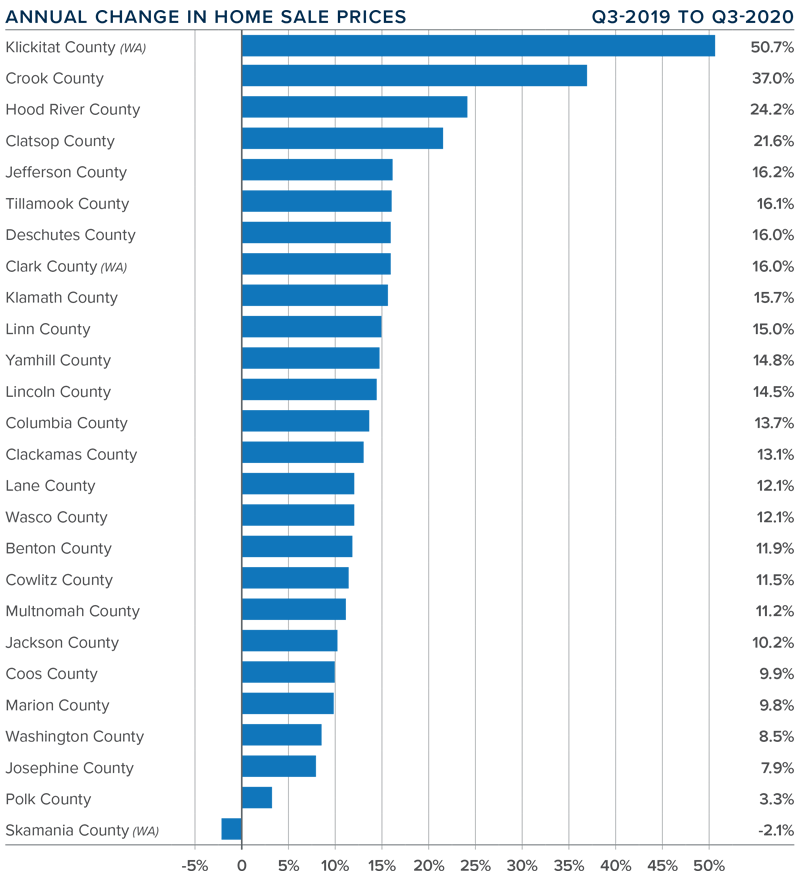

- The average home price in the region rose a significant 14.1% year-over-year to $460,527. Prices were 9.4% higher compared to the second quarter of 2020.

- Klickitat County led the market with the strongest annual price growth but, again, this is a very small market prone to significant swings. Prices were lower in Skamania County, but the decline was very modest.

- All but one of the counties contained in this report experienced price growth compared to the third quarter of 2019. Annual price growth picked up significantly in the third quarter.

- The takeaway here is that home prices are rising at a significant pace as buyers enjoy historically low mortgage rates. That said, prices are now rising faster than rates are falling and this suggests we will see a slowing down in the pace of home-price appreciation.

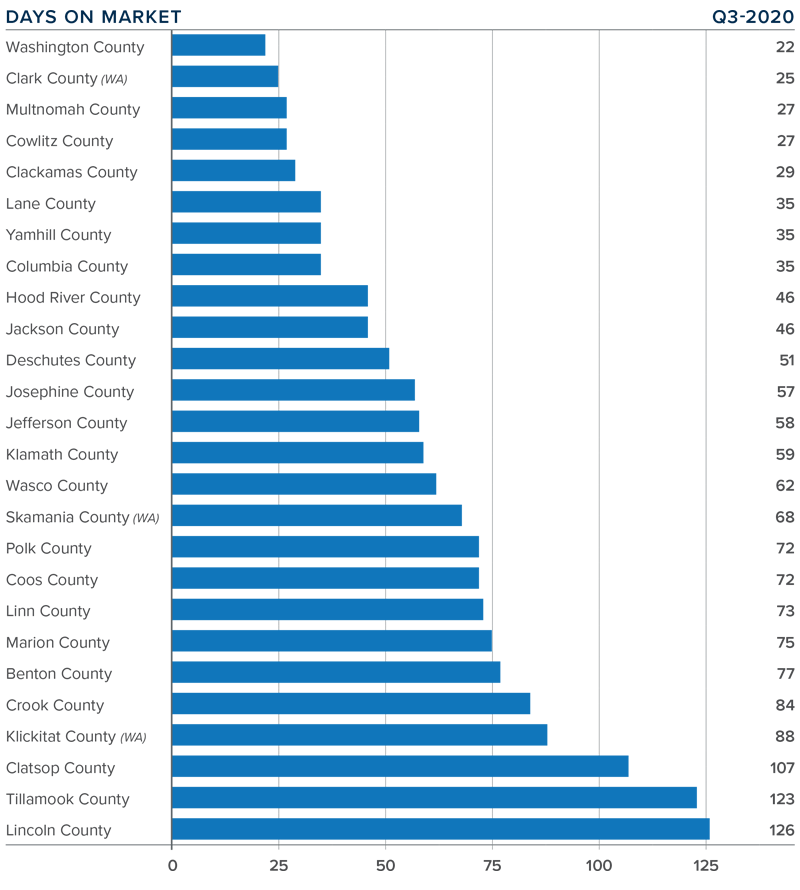

DAYS ON MARKET

- The average number of days it took to sell a home in the region actually rose two days compared to the third quarter of 2019, though it took five fewer days to sell a home than in the second quarter of 2020.

- The average time it took to sell a home in the third quarter was 61 days.

- Sixteen counties saw the length of time it took to sell a home drop compared to a year ago; ten counties saw market time rise.

- Homes again sold the fastest in Washington County, where it only took 22 days to sell.

CONCLUSIONS

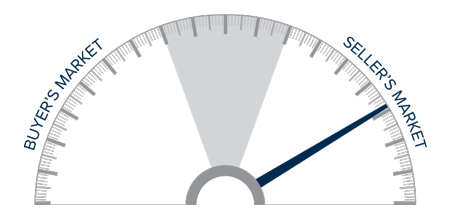

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Closed sales are up by a significant percentage, prices are increasing at very robust rates, and it is clear that demand is significantly exceeding supply. When combined with historically low interest rates, it’s clear the market has rebounded and now significantly favors home sellers.

Given these factors, I have moved the needle further in the favor of sellers.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link