The following analysis of select counties of the Northwest Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Oregon counties contained in this report continue to add jobs, but employment levels are still down 56,300 jobs from the pre-pandemic peak. As I mentioned in the second quarter Gardner Report, this is mainly due to the Portland market: Multnomah County employment levels are still down by over 83,000 jobs. Despite this, the unemployment rate within the Oregon counties in this report came in at a very healthy 3.4%, which is down from the pandemic peak of 12.8%.

Southwest Washington saw a full recovery by the summer of 2021, but the job market in that region is considerably smaller. That said, more jobs continue to be added, with employment levels now 12,800 positions higher than the pre-pandemic peak. During the third quarter, the unemployment rate was 4.6%, which is down from 14.2% at the start of the pandemic.

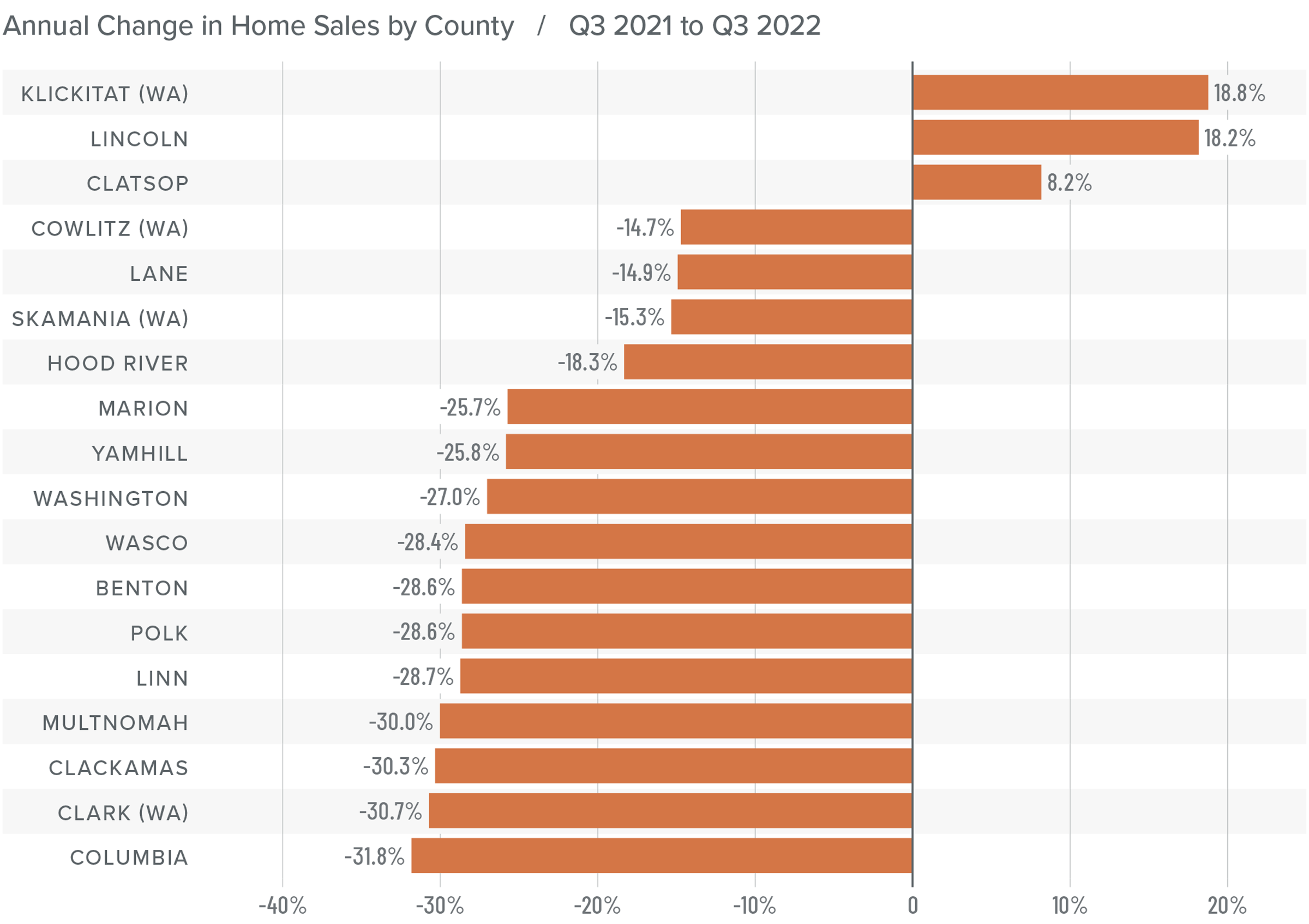

Northwest Oregon and Southwest Washington Home Sales

❱ In the third quarter of 2022, 12,549 homes sold, which is 26.4% lower than a year ago and 13.8% lower than in the second quarter of 2022.

❱ Listing activity has risen across the region, but the current level is still well below the long-term average. Lower sales can be attributed to higher financing costs and lower affordability.

❱ Year over year, sales rose in three counties but fell in the balance of the market. Compared to the second quarter of this year, sales rose in Benton, Clatsop, Cowlitz, and Klickitat counties.

❱ The region is acting like most across the country. More homes are becoming available, but many would-be buyers are waiting for mortgage rates to stabilize or drop, which is impacting sales.

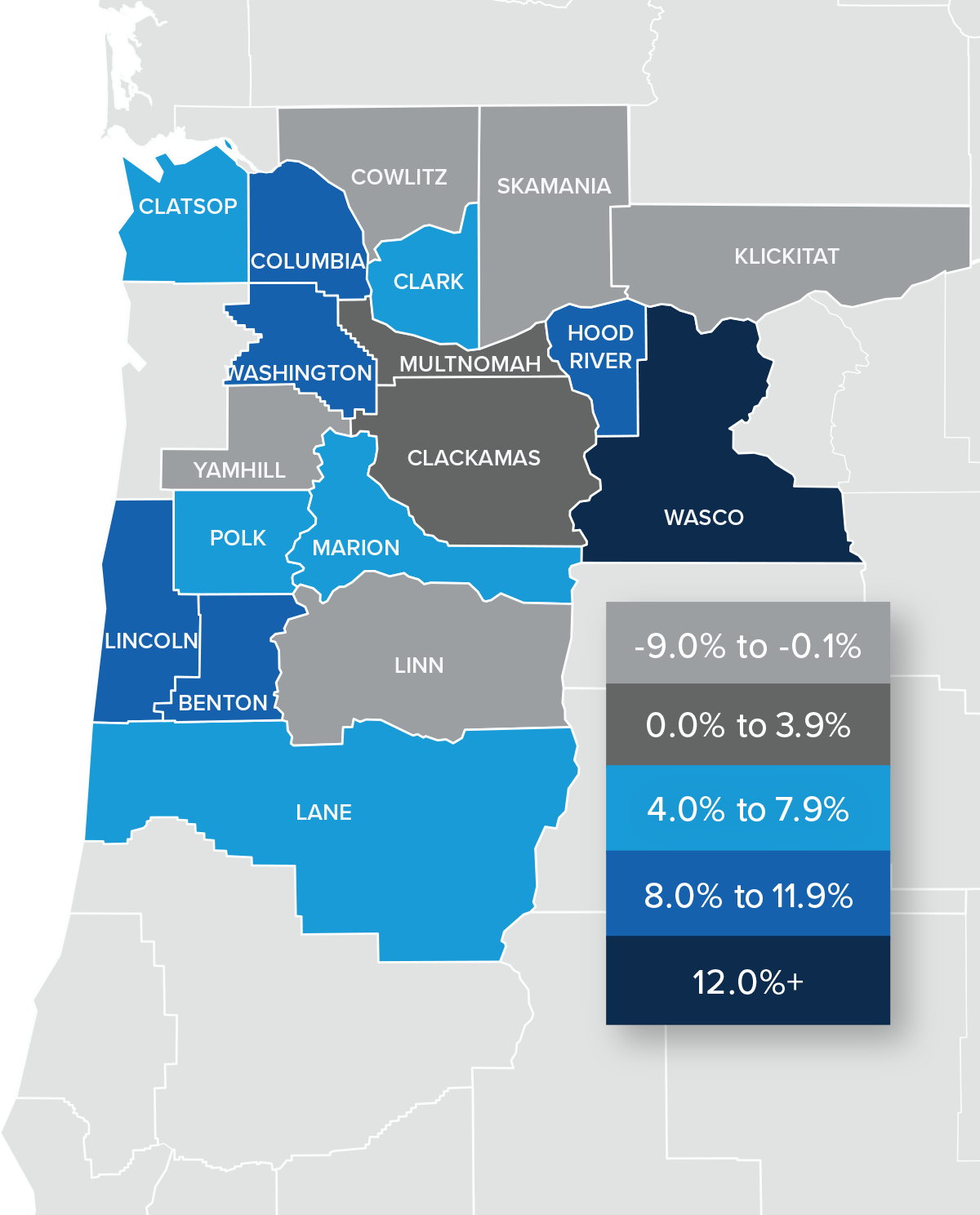

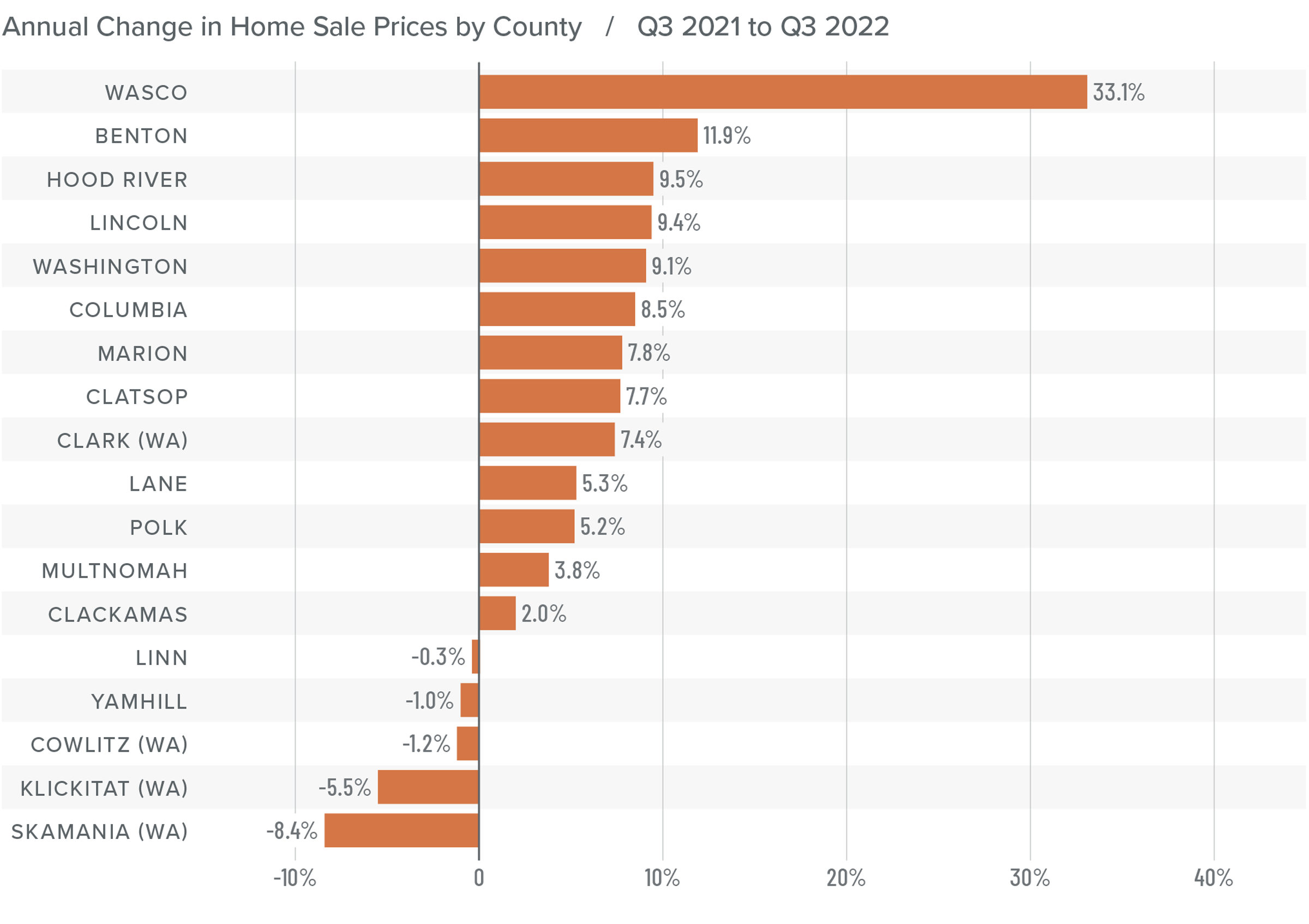

Northwest Oregon and Southwest Washington Home Prices

❱ The average home sale price in the region rose 5% year over year to $566,595. Prices were 3.9% lower than in the second quarter of this year.

❱ Relative to the second quarter of 2022, average prices rose in Benton, Clatsop, Lincoln, and Wasco counties. They remained static in Marion County but fell in the balance of the markets.

❱ All but five counties saw average sale prices rise compared to a year ago, but the pace of growth is certainly slowing.

❱ Clearly, rising mortgage rates have started to impact home prices. Median list prices are still rising in almost all markets compared to the second quarter, which suggests that sellers continue to be confident. That said, I expect to see either list prices start to soften or sellers take their homes off the market until they see conditions improving.

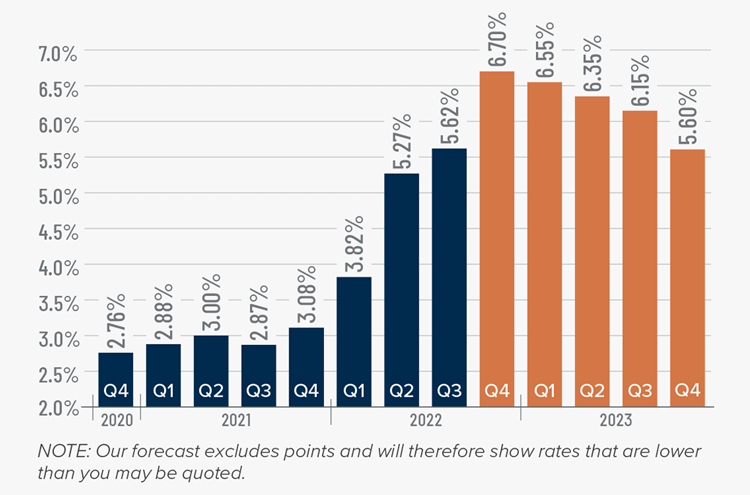

Mortgage Rates

This remains an uncertain period for mortgage rates. When the Federal Reserve slowed bond purchases in 2013, investors were accused of having a “taper tantrum,” and we are seeing a similar reaction today. The Fed appears to be content to watch the housing market go through a period of pain as they throw all their tools at reducing inflation.

As a result, mortgage rates are out of sync with treasury yields, which not only continues to push rates much higher, but also creates violent swings in both directions. My current forecast calls for rates to peak in the fourth quarter of this year before starting to slowly pull back. That said, they will remain in the 6% range until the end of 2023.

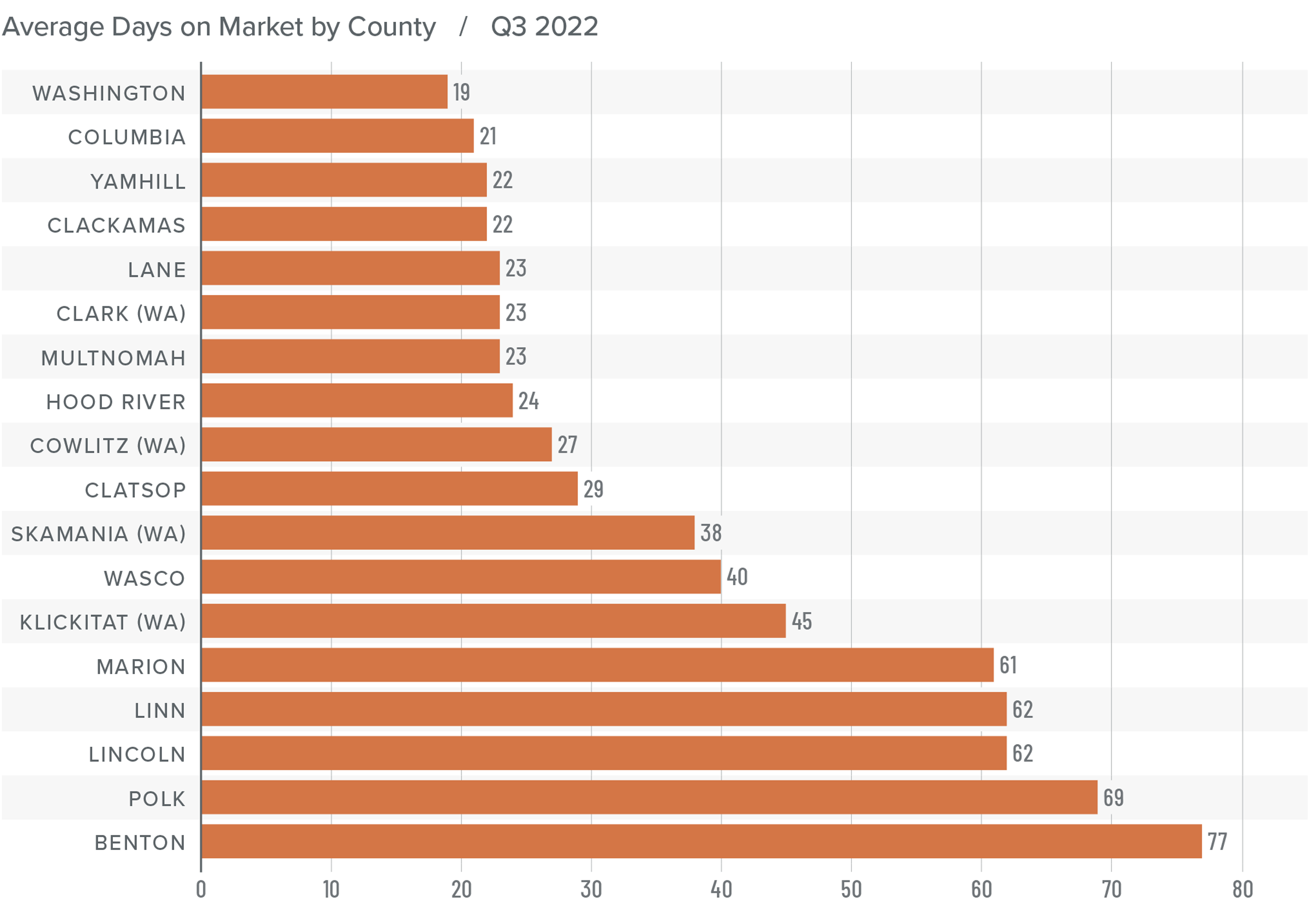

Northwest Oregon and Southwest Washington Days on Market

❱ The average number of days it took to sell a home in the region rose eight days compared to the same period a year ago. It took five more days for homes to sell compared to the second quarter of this year.

❱ The average time it took to sell a home in the third quarter of 2022 was 38 days.

❱ Lincoln County was the only market where the length of time it took for a home to sell fell compared to the same period a year ago. Compared to the second quarter of 2022, market time fell in Hood River, Linn, and Skamania counties.

❱ Although days on market have risen, they are still well below the pre-pandemic level. As mentioned earlier, uncertainty surrounding the housing market (mainly due to mortgage rates) is making buyers significantly more cautious. I expect this to change as we move into the new year.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although the labor market is slowly recovering, the specter of an economic slowdown in 2023 is starting to weigh on the market. The rapid pace of home-price growth in 2020 and 2021 was never going to last forever. The market is currently going through a period of reversion, which will slow it to a more sustainable pace. Although this may be painful to watch for some, it is necessary. Sellers have seen the value of their homes skyrocket over the past two years, so even if we experience a modest downturn in home prices, they are still in a very good situation. I would add that 58% of homeowners with a mortgage in Northwest Oregon/ Southwest Washington have more than 50% equity in their homes.

All that considered, I am moving the needle more toward balance, but until buyers and sellers start to feel more confident in the local and national economy, the market is likely to continue experiencing uncertainty. This will lead to lower sales activity and put downward pressure on prices.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link