This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

Hi. I’m Jeff Tucker, the principal economist at Windermere Real Estate, and these are the numbers to know right now. The first number this week:

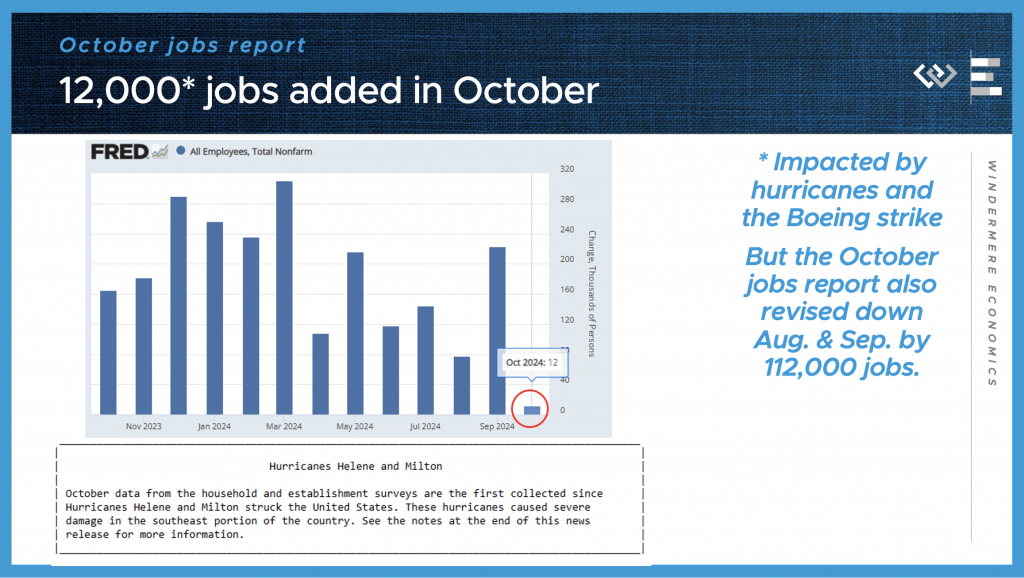

12,000 … with a big asterisk!

That’s the number of jobs the economy added in October, and the asterisk is there to call out how this month’s jobs report was impacted by Hurricanes Helene and Milton!

The Bureau of Labor Statistics even included a special note at the top of this month’s Employment Situation Report, highlighting the fact that this report was based on the first survey of employers since the hurricane struck, and response rates for their survey were unusually low. They also emphasized that it was not possible to estimate how much the hurricanes reduced the headline job growth number.

Nonetheless, economists had been expecting about 100,000 more jobs than this to be added, even knowing that the total would be reduced by the hurricanes and the ongoing strike by workers at Boeing. Further, in this report they also revised down their estimates of job growth in August and September, by a combined 112,000 jobs. Last month we talked about what a big upward surprise the September jobs report was, and this information tempers that impression a little bit.

All in all, it’s hard to interpret this month’s jobs report but on balance it makes me revise my impression of the labor market a little bit downward. One very likely takeaway is that the Fed is now viewed as almost certain to go ahead and cut their benchmark overnight rate by a quarter point at their next meeting ending on Thursday November 7. That will continue the normalization process for short-term interest rates, although as we saw in September, cutting short-term rates is not at all a guarantee of falling mortgage rates.

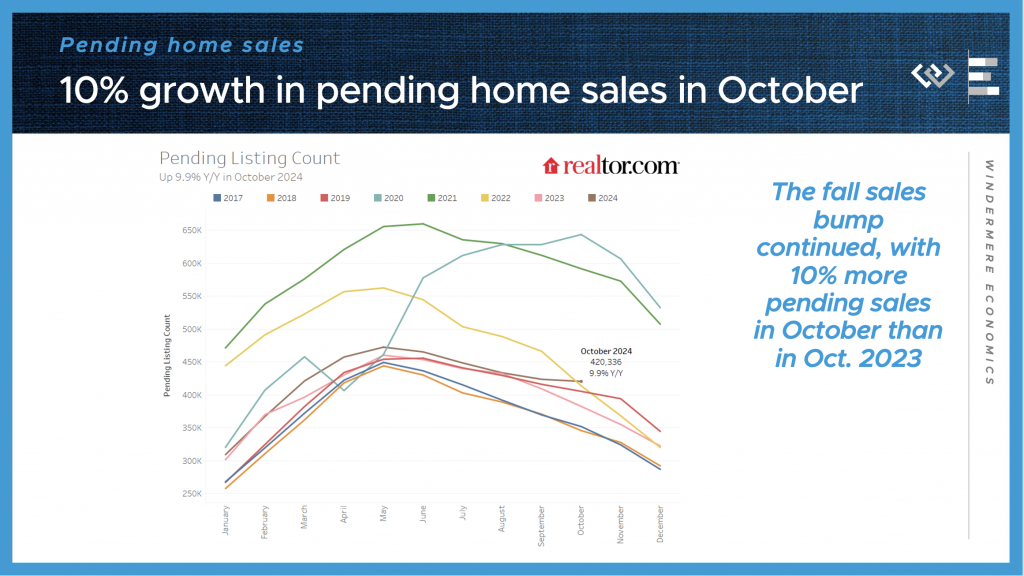

10%

That’s how much pending home sales grew in October from the same month one year ago, according to the latest data from Realtor.com. This is a strong data point confirming that the housing market saw an upward surge in activity here in the first half of the fall season. The most likely reasons for the bump in pending sales included a healthier supply of listings for buyers to choose from, and I believe a lot of buyers woke up to the news that interest rates had fallen over the year, especially in September but even still in early October.

Looking ahead, we are now going into the coolest time of the year for home sales, just seasonally speaking, and unfortunately the recent rebound in mortgage rates is likely to help put the market back on ice for at least a couple months.

Which brings me to our final number to know right now:

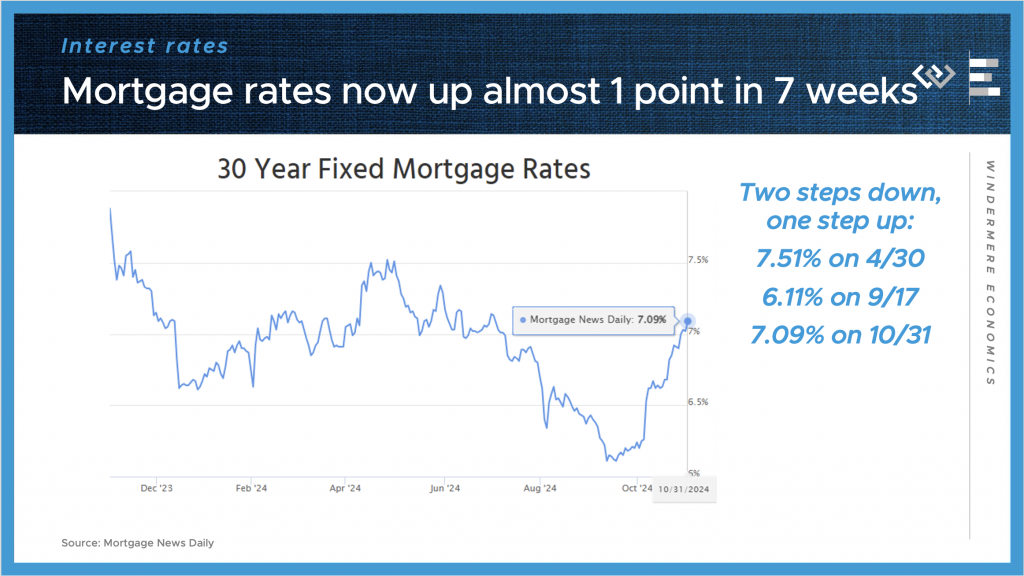

7.09%

That’s where the 30-year mortgage rate stood on Thursday October 31st, according to Mortgage News Daily. It’s now up almost a full point in just 7 weeks, from its low on September 17. The upward movement in the last couple months is a pretty surprising trend break, after it declined by more than a point from April through September, and I think it reflects the strong economic news we’ve gotten lately about job growth especially in September, as well as very strong annualized real GDP growth of 2.8% in the third quarter. I’ve mentioned before that election uncertainty may be contributing as well, and that theory will be put to the test as we wait to see what rates do after the election.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link