The following analysis of the Big Island real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Hawaii’s economy continues to add jobs, but the rate of growth is tepid. Over the past 12 months, Hawaii added just 1,400 new jobs, representing a growth rate of 0.2%. Even with this lack of job formation, the state has a very healthy 2.8% unemployment rate.

On the Big Island, year-over-year employment dropped 4.7% to 84,600 persons and has been negative for the past eight months. The unemployment rate was a respectable 3.7%, up from 2.6% a year ago. As stated in the last Gardner Report, the Island continues to see its civilian workforce contract and this may be a reason for the lack of job growth. Notably, there are over 3,900 job openings on the Big Island. Additionally, the area is still recovering from the 2018 volcanic eruption which hit the Island’s economy very hard.

HOME SALES

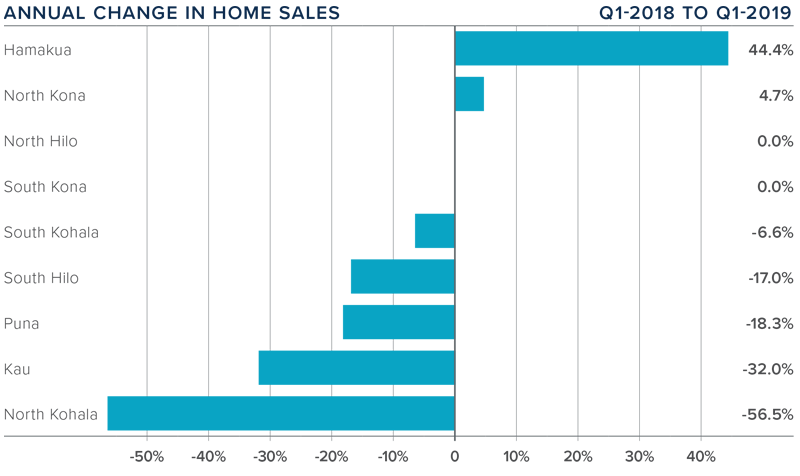

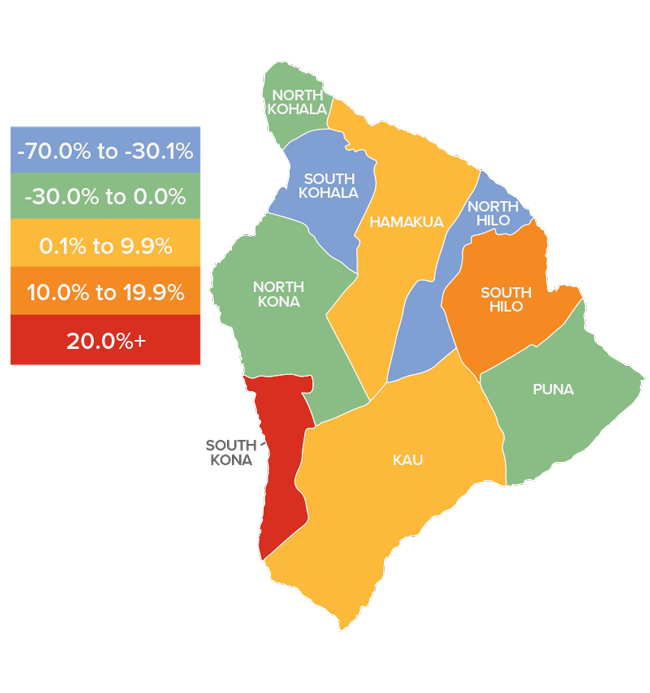

- In the first quarter of 2019, 689 homes traded hands, a drop of 10.4% compared to the first quarter of 2018 and 5.9% lower than the fourth quarter of 2018.

- The only markets that saw growth in sales were Hamakua and North Kona, which rose by a very significant 44% and 4.7% respectively. There was a significant decline in sales in North Kohala, but it is a very small market and the 56.5% drop equated to a loss of only 13 sales.

- The regional drop in sales came as inventory levels rose 15.4% from a year ago and 11.2% from the fourth quarter of 2018. There may well be some hangover from the 2018 volcanic eruption, but that reason might be growing stale. I will continue to monitor the data as we move through 2019 to see if this is still the case or if there are other reasons for the contraction.

- Inventories rose in six of the markets analyzed: North Kohala, South Hilo, North and South Kona, Kau, and Puna. South Kohala, Hamakua, and North Hilo saw modest drops. Buyers have more choice and continue to be far more selective — and patient — in making an offer on a home.

HOME PRICES

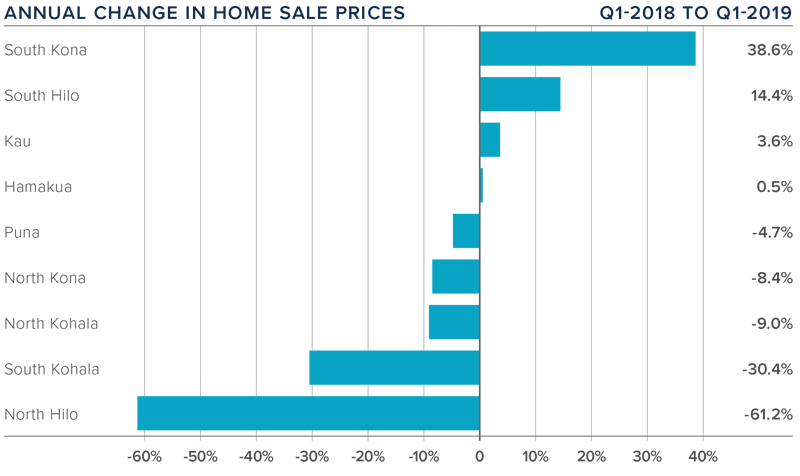

- The average home price in the region dropped 7.1% year-over-year to $541,135.

- Affordability is still an issue, but the current low interest rate environment may stimulate buyers as we move through the later spring season. I expect to see prices start to pick up, but at fairly modest rates.

- Appreciation was strongest in the South Kona market, where prices rose by 38.6%—again, a function of it being a very small area with limited sales. Three additional areas saw prices rise between the first quarter of 2018 and the first quarter of 2019, and five markets saw average sale prices drop.

- Despite ongoing affordability issues in many Big Island market areas, I still expect home prices to rise in 2019.

DAYS ON MARKET

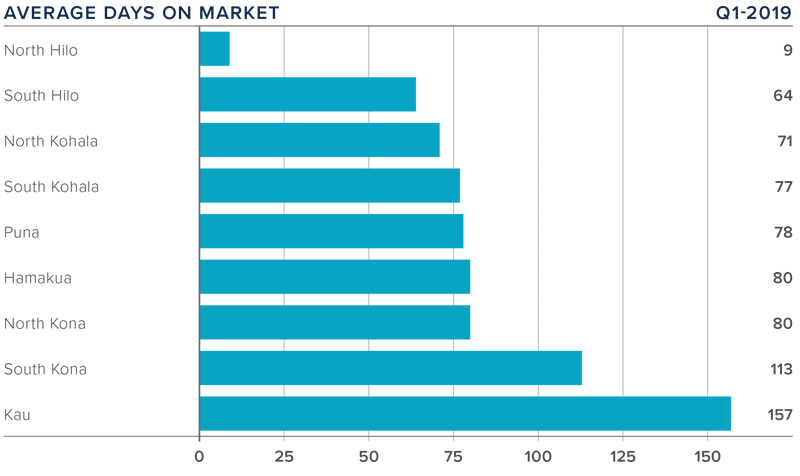

- The average time it took to sell a home on the Big Island dropped 22 days compared to the first quarter of 2018.

- Notably, the amount of time it took to sell a home dropped across the board.

- In the first quarter, it took an average of 81 days to sell a home. Homes sold fastest in North Hilo and slowest in Kau.

- The recent drop in mortgage interest rates will likely continue to stimulate demand as we move through 2019.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the first quarter of 2019, I have placed the needle close to the middle. Although we saw a decline in sales and prices compared to the first quarter of 2018, I anticipate prices will rise as inventory levels — although trending higher — will not be sufficient to meet demand. Locational attributes will be increasingly important in the coming year as buyers become more selective than we have seen in quite some time. Additionally, the market may take a pause until home buyers get more clarity regarding Bill 108, which could have a substantial effect on investors who are purchasing vacation rental properties.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link