The following analysis of the Big Island real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The State of Hawaii saw employment grow at an annual rate of 1.1%, with 6,000 jobs added over the past 12 months. In September, the state’s unemployment rate was 2.7%, marginally higher than the 2.6% rate of a year ago.

On the Big Island, total employment continues to contract, losing 3,829 jobs over the past year. Annualized employment growth has been negative for the past 12 months. That said, the island’s unemployment rate was a healthy 3.5%, but that is still up from 3.2% a year ago.

HOME SALES

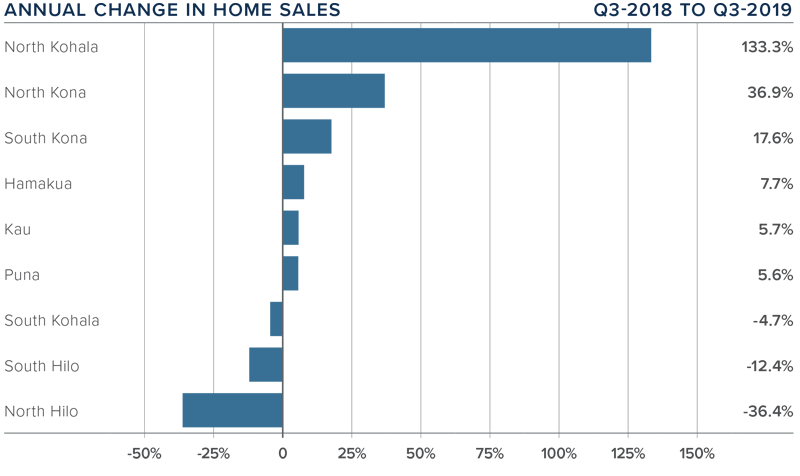

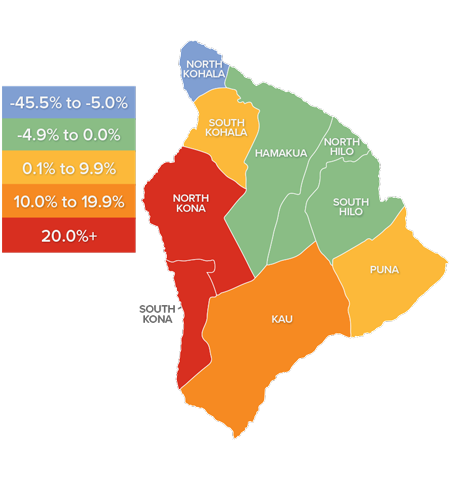

- In the third quarter of 2019, 829 homes sold. This was an increase of 9.7% compared to the third quarter of 2018 but 9.2% lower than the second quarter of 2019.

- Sales were higher in six markets and dropped in three. There was significant growth in sales in the North Kohala market, as well as North and South Kona. The markets that experienced sales declines are all relatively small which makes them more prone to swings, so I’m not overly concerned that this is a trend.

- The growth in sales came as inventory levels rose 9% from a year ago. The average number of homes for sale in the quarter was up 5.2% from the second quarter of this year.

- Pending home sales dropped 8.7% compared to the second quarter of this year, suggesting that closings in the fourth quarter may be a little disappointing.

HOME PRICES

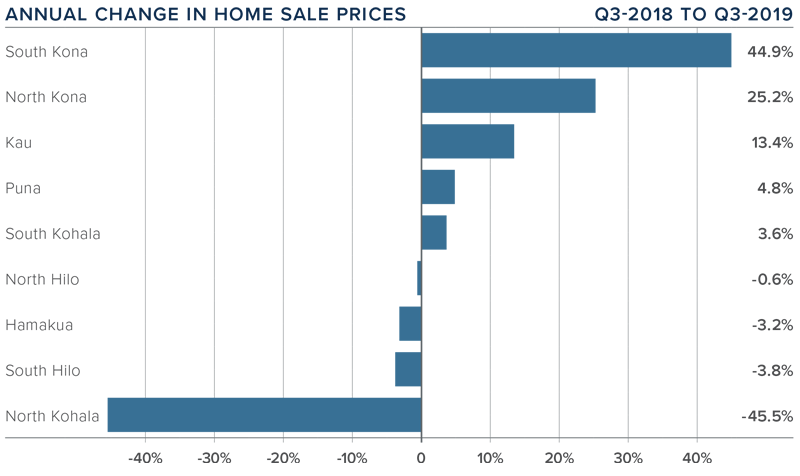

The average home price in the region rose 16.7% year-over-year to $584,756. Prices also rose between the second and third quarters of this year by 11.3%.

The average home price in the region rose 16.7% year-over-year to $584,756. Prices also rose between the second and third quarters of this year by 11.3%.- Affordability remains an issue, but the current low-interest-rate environment has been motivating buyers, and prices continue to rise.

- Prices rose in five markets but dropped in four. Appreciation was strongest in the small South Kona market, where prices rose 44.9%. The biggest drop in prices was in the small North Kohala market.

- All things considered and despite ongoing affordability issues in many Big Island market areas, I still expect home prices to rise through the balance of the year and into 2020.

DAYS ON MARKET

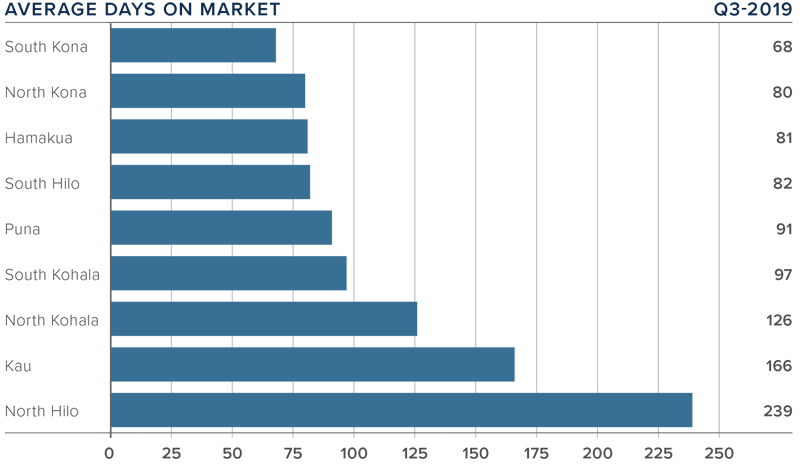

- The average time it took to sell a home on the Big Island dropped ten days compared to the third quarter of 2018.

- The amount of time it took to sell a home dropped in four market areas and rose in five.

- In the third quarter, it took an average of 114 days to sell a home, with homes selling fastest in North and South Kona and slowest in North Hilo.

- It took six days longer to sell a home in the third quarter than in the second quarter of this year.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the third quarter of this year, I have left the needle fairly close to the middle. Inventory levels remain low, prices are higher, and interest rates are lower, which all favor home sellers. However, pending and closed sales are down, and days on market has risen, which favors buyers. On the whole, we are approaching a balanced market on the Big Island.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link