As you file your 2011 taxes, this is a good time to think about how you can make the most of certain tax benefits now or in your future. For example, if you became a homeowner last year, you are now eligible to take advantage of one of the smartest ways to reduce your taxes.

You can deduct your mortgage interest payments: Typically, the biggest tax advantage of home ownership is that you can deduct the interest you pay on your mortgage. That means the mortgage interest you paid during 2011 can be deducted on your 2011 tax return. As long as your mortgage loan amount is lower than the price of your home and is less than $1.1 million, it’s usually deductible unless you’re in a particularly high tax bracket.

In the early years of owning a home your mortgage payment is mostly interest, so the amount you deduct can really add up. But remember: to take advantage of this tax benefit, you must file IRS Form 1040 (Schedule A) and itemize your deductions.

Your property taxes are deductible, too: In addition to deducting your mortgage interest, you can deduct the property taxes you pay for both a first home and a vacation home. If your property taxes are held in an escrow account, be sure to deduct only the amount that has actually been paid out. Also, if you receive a local tax refund (from the state or county, for example), you’ll need to subtract the amount of the refund from your deduction.

When you buy your house, if your closing date is not on the first day of the month, you may have to pay pro-rated property taxes in addition to prepaying your mortgage interest. If you do, the extra taxes and interest are tax-deductible.

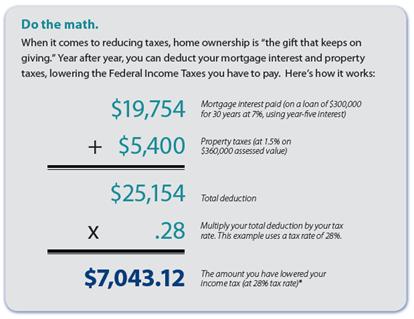

Do the math: When it comes to reducing taxes, home ownership is “the gift that keeps on giving.” Year after year, you can deduct your mortgage interest and property taxes, lowering the Federal Income Taxes you have to pay. Here’s how it works:

Essential tax-time documents: Whether you complete your taxes on your own or go to a CPA, make sure you have what you need to maximize your real-estate tax benefits.

From the U.S. Government, this is essential tax information for homeowners. This includes 2011 changes and upcoming changes in 2012.

1098 Form

Issued by your lender, this form shows you the mortgage interest and real estate taxes you paid in a given tax year; both are tax-deductible.

If you want to qualify for home-mortgage interest and real-estate tax deductions, you must itemize your deductions on IRS Form 1040 (Schedule A).

This form indicates the “points” you or your seller paid when you purchased your home; sometimes you can deduct the full amount in the year you bought your house. You can even deduct the points your seller paid, if they don’t deduct them.

A few pointers on “points”

Known by a variety of names, including origination fees, loan discounts and broker discounts, points are the money you pay your lender as part of your closing costs. A point is equal to 1% of your mortgage. You can deduct the points for the year in which you pay them if your mortgage loan is for the house you live in most of the time. In order to qualify as a deduction, the amount you pay in points must be less than the amount of your down payment. So let’s say you make a down payment of $25,000; if you pay $24,999 or less in points to your lender, you can deduct it.

Sometimes the seller pays the points; you can deduct them, too, so long as your seller doesn’t. The points must be clearly shown in your HUD1 Settlement Statement.

Home Affordable Modification Program (HAMP)

If you benefit from Pay-for-Performance Success Payments, the payments are not taxable under HAMP.

Record of home improvements

Be sure to keep accurate records of any home improvements you make. Though not deductible, these costs are added to the value of your house when your capital gains are calculated. If you live in your house for at least two of the last five years and decide to sell, any profit you make up to $500,000 ($250,000 if you’re single) is yours—tax-free.

Moving expense records

If you moved for a new job, or because your employer changed location, you may be able to deduct some of your moving expenses.

Finance your home improvements the tax-deductible way

When you take out a first or second mortgage to buy a home, build one, or improve it, whether that means updating your kitchen, adding a new roof or undertaking an extensive remodel, the IRS calls that mortgage “home acquisition debt”—and it’s a great way to gain tax benefits while upgrading your home.

For most homeowners, the interest you pay on home acquisition debt is tax-deductible on loans up to $1 million for married couples filing jointly and $500,000 each for couples filing singly.

If you’d like to know more about the tax benefits that you, as a homeowner, are eligible for, visit www.irs.gov or consult a certified public accountant.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link