Windermere Real Estate is proud to partner with Gardner Economics on this analysis of the Oregon and Southwest Washington real estate market. This report is designed to offer insight into the realities of the housing market. Numbers alone do not always give an accurate picture of local economic conditions; therefore our goal is to provide an explanation of what the statistics mean and how they impact the Oregon and Southwest Washington housing economy. We hope that this information may assist you with making an informed real estate decision. For further information about the real estate market in your area, please contact your Windermere agent.

Regional Economics

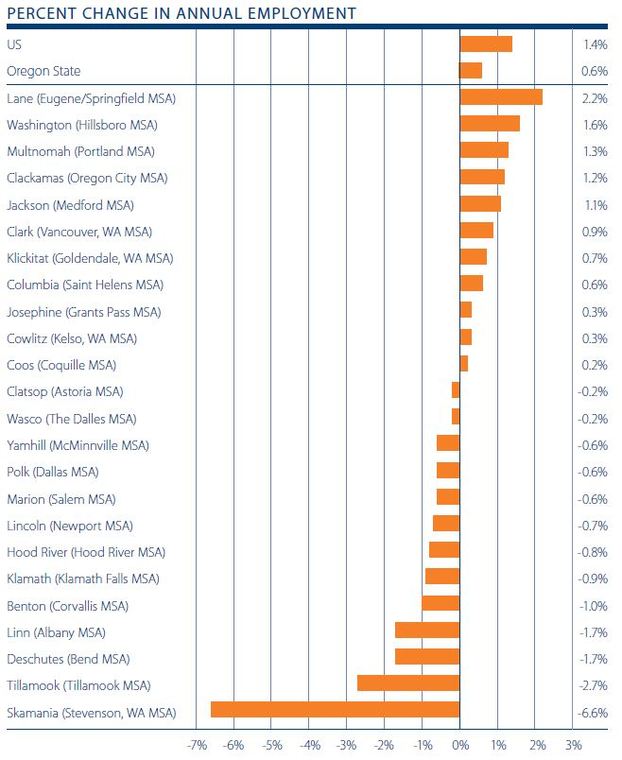

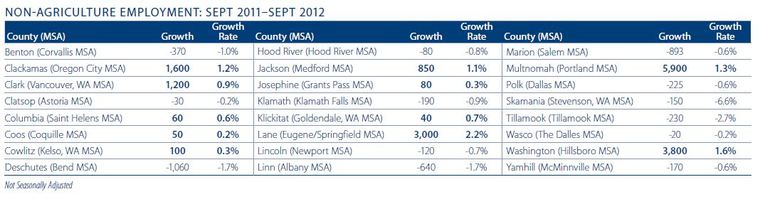

On a year-over-year basis, the Oregon counties covered by this report increased employment by three quarters of a percent, or approximately 12,500 jobs. This is the good news. On a year-over-year basis, 11 counties expanded their employee base and 13 saw employment contracting.

The greatest increase in employment came in Lane County (+2.2%). This was followed by Washington (+1.6%), Multnomah (+1.3%), Clackamas (+1.2%), and Jackson (+1.1%) Counties. On an absolute basis, Multnomah County saw the largest increase with 5,900 additional jobs. This was followed by Washington County (3,800) and Lane County where employment grew by 3,000 positions.

On the negative side, job losses were, in general, fairly modest and accounted for a total of just under 4,200 jobs spread across 13 counties. The greatest losses were seen in Deschutes County which lost 1,060 jobs. This was followed by Marion (-893) and Linn (-640) Counties. Losses in other counties measured less than 400 jobs each.

What was different from our last report was that the significant increases in employment that occurred between the first and second quarters of 2012 totally dried up and the employment base actually contracted by 1,200 jobs in the third quarter. This is a concern and I will be looking closely at the data for the fourth quarter to see if this was an anomaly or a trend.

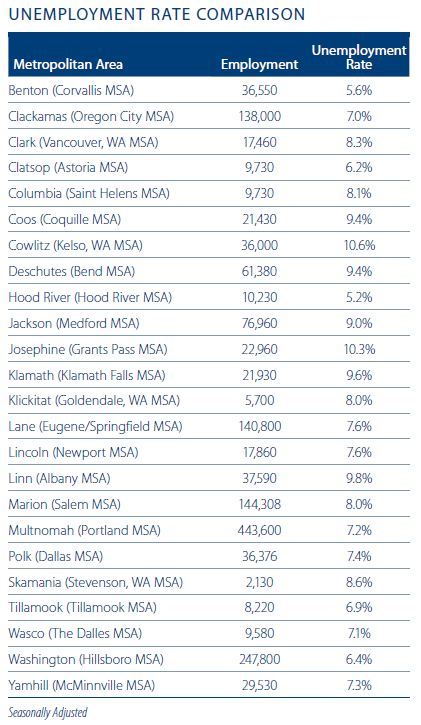

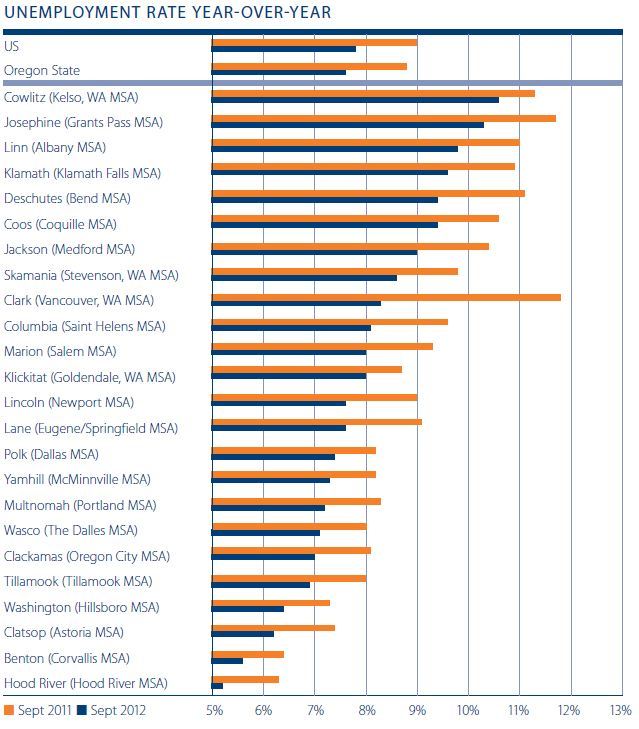

Continuing a trend that started earlier this year, the overall unemployment rate declined across the board when compared to the second quarter as well as the same period in 2011. As I have talked about before, this tends to be a function of a decline in the labor force participation rate, but it is interesting to note that we are also seeing a contraction in the labor force across all of the counties surveyed.

I am giving the employment situation a “C-” grade this quarter, down from a “C” last quarter. The job market remains in limbo and the growth that we saw in the last quarter has evaporated. We are not yet in the expansion mode that we are all hoping for.

Regional Real Estate

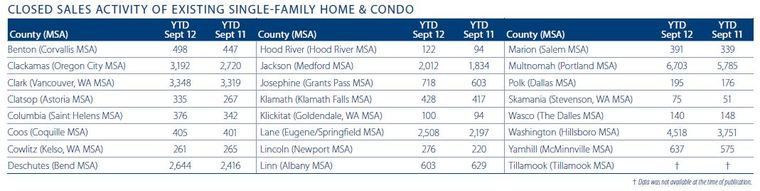

In the third quarter of 2012, the region sold 11,091 units of resale housing with the year-to-date figure of 30,485 units. The year-to-date figure was 13% higher than that seen in the same period of 2011, but sales slowed by 6% from Q2—likely a function of limited inventory for sale, a common theme across the whole of the United States.

Year-over-year, the greatest increase in sales was seen in Skamania County (+47%), Hood River County (+30%), and Clatsop and Lincoln Counties, which both grew by 25%. Washington County rounded out the top 5 with an increase of 20%. There were three counties where sale volumes dropped from the same period in 2011: Wasco (-5%), Linn (-4%), and Cowlitz (-2%).

From a transactional standpoint, the market took off in summer but the 55% growth in transactions seen between Q1 and Q2 has not been sustained. The market sold just over 11,000 properties in the third quarter, a loss of 6% from the previous quarter. Inasmuch as this is disappointing, I attribute it to lack of homes for sale. Listing inventory in all the counties surveyed either remained static or contracted in September, and many did not see a more normal increase in listings through the summer.

As I stated in my previous report, “Choice in many markets has become limited which, if it does not improve, will likely lead to a slowdown in transactions in the second half of 2012.” I appear to have been proved correct.

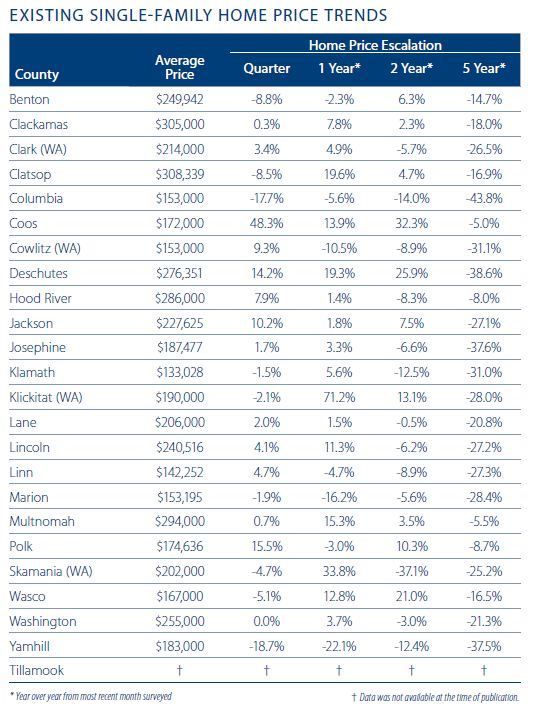

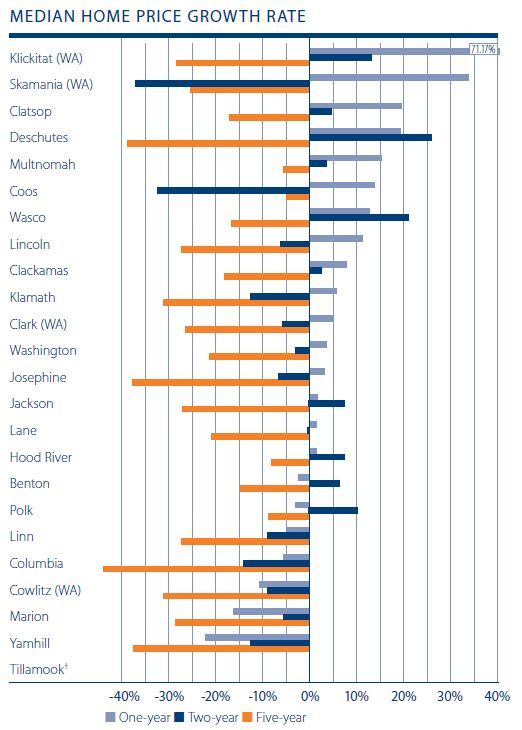

Turning our attention to home prices, 16 of the markets analyzed registered year-over-year price increases (up from 14 in the last report) with just seven showing declines in values from a year ago. In aggregate, the markets surveyed saw values increase by 5.8% over the same period in 2011.

Other than the substantial 71% growth in the small Klickitat County market, 14 other counties registered double digit gains from September 2011. When compared to prices seen in the first quarter of the year, 15 counties are higher with eight declining.

Overall, I am giving the real estate market a “C” grade this quarter. This matches that seen in the last quarter. Prices are generally on the rise, but low inventory levels may weigh on prices through the winter months.

Conclusions

The Oregon economy has taken a step backward this quarter. The job growth that was apparent in the summer has not been sustained, which is certainly disappointing. Contraction in the market’s unemployment rate offers little in the way of solace, as much of the improvement came through a decline in the labor force.

In a similar situation to that seen across much of the country, employers are waiting to see what tax changes may be in store for the new year before they even consider expanding their payrolls. I hope that this is the situation in Oregon, and I will be very interested to see if non-seasonal employment increases in fourth quarter and early 2013.

The housing market is certainly more buoyant than the economy. Listings are scarce and this has had an effect on the number of sales, but has not negatively impacted prices yet. I do hope to see listings start to grow, but I fear that we will have to wait until next year before we see any tangible improvements. I also believe that next year will show an increase in the number of bank-owned properties coming to market. Although it is too early to tell exactly what effect this will have on home prices, at this juncture I do not believe that it should have a significant impact. But this will be very heavily dependent on whether we also see an increase in non-distressed listings.

About Matthew Gardner

Mr. Gardner is a land use economist and principal with Gardner Economics and is considered by many to be one of the foremost real estate analysts in the Pacific Northwest.

In addition to managing his consulting practice, Mr. Gardner is a member of the Pacific Real Estate Institute; chairs the Board of Trustees for the Washington State Center for Real Estate Research; the Urban Land Institutes Technical Assistance Panel; and represents the Master Builders Association as an in-house economist.

He has appeared on CNN, NBC and NPR news services to discuss real estate issues, and is regularly cited in the Wall Street Journal and all local media.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link