The following analysis of select Maui real estate markets is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

COVID-19 has significantly impacted employment on Maui, causing the loss of 25,450 jobs in April alone and driving the unemployment rate up from 2.1% to 35.8%. The mandatory 14-day self-quarantine proclamation made by Governor Inge remains in place, but some jobs have started to return. In June, 5,600 jobs returned and the unemployment rate dropped slightly to a still remarkably high 23.4%. Although it is certainly too early to say we are out of the woods, the direction of jobs is mildly positive. I do expect to see further job gains, but it remains unlikely that there will be significant improvement until September when the mandatory pre-travel testing program is scheduled to start. Pre-testing should lead to more visitors who are currently staying away because of the self-isolation protocols.

HOME SALES

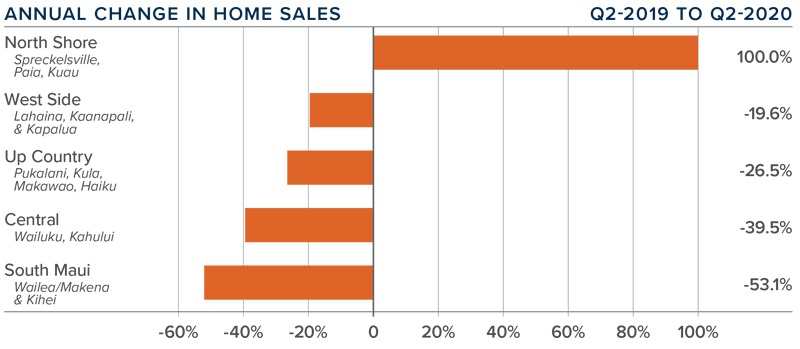

❱ In the second quarter of 2020, 356 homes sold, a drop of 39.7% compared to the second quarter of 2019, and 34.7% lower than in the first quarter of 2020.

❱ Sales did rise in the North Shore area, but the increase only amounted to 2 additional sales. The largest drop in sales was in South Maui, where 136 fewer transactions closed compared to a year ago.

❱ Sales and listings were both lower in the second quarter compared to the same quarter in 2019, but listing activity was 3.8% higher than in the first quarter of this year. However, this increase in the choice of homes for sale wasn’t enough to stimulate buyers.

❱ Pending home sales were 37.7% lower than a year ago and 28.5% lower than in the first quarter of this year. This means closings in the third quarter will not impress.

HOME PRICES

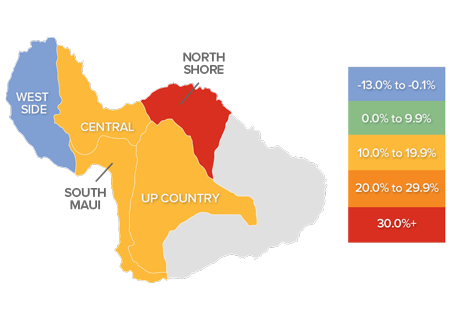

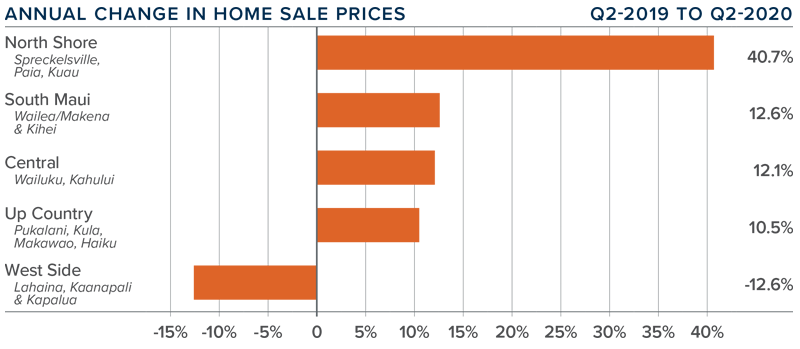

❱ Interestingly—and somewhat counterintuitively— the average home price on the island rose 6.9% year-over-year to $974,308 and was 10.7% higher compared to the first quarter of 2020.

❱ Affordability remains a significant issue and, even with significantly slower home sales, prices continue to appreciate. Thus far we have yet to see signs of a COVID-19-related slowdown in price growth.

❱ All markets other than the West Side saw prices rise significantly. North Shore had the largest increase.

❱ It is too early to say what effects COVID-19 will have on housing values on Maui. I will be watching this closely, specifically as it pertains to buyers of vacation homes.

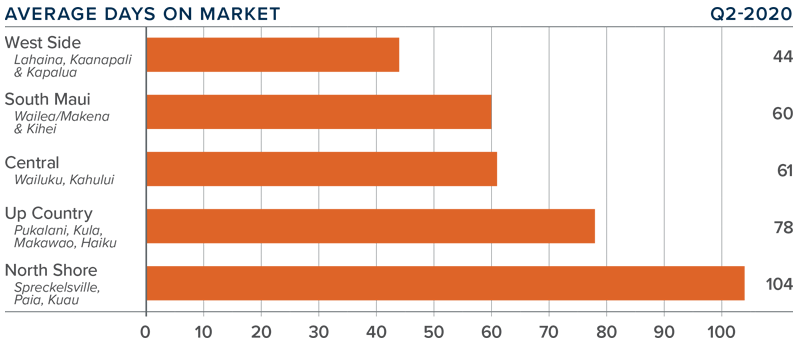

DAYS ON MARKET

❱ The average number of days it took to sell a home on Maui rose 12 days compared to the second quarter of 2019.

❱ The amount of time it took to sell a home dropped on the West Side but rose in all other areas.

❱ In the second quarter, it took an average of 69 days to sell a home. West Side homes sold at the fastest pace. It is taking the longest time to sell in North Shore.

❱ Rising market time may be due to more choice, but I believe it is more a function of price.

CONCLUSIONS

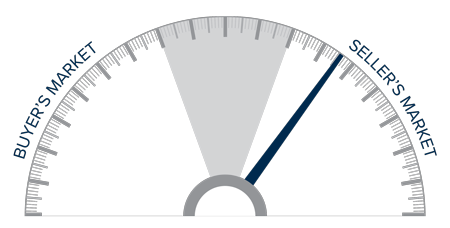

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Unsurprisingly, the Island is still reacting to the influences of COVID-19. Demand has not disappeared completely, though it is significantly lower than it should be. The pandemic is influencing the direction of the housing market, but I remain hopeful we will start to see it return to some sort of normalcy this fall.

Price growth was significant, which would normally favor sellers; however, due to lower demand, I am moving the needle more in favor of home buyers.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link