This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

The data coming in from the housing market so far this year are painting a picture of an early spring buying season that is a little friendlier for buyers. The first number to know this week:

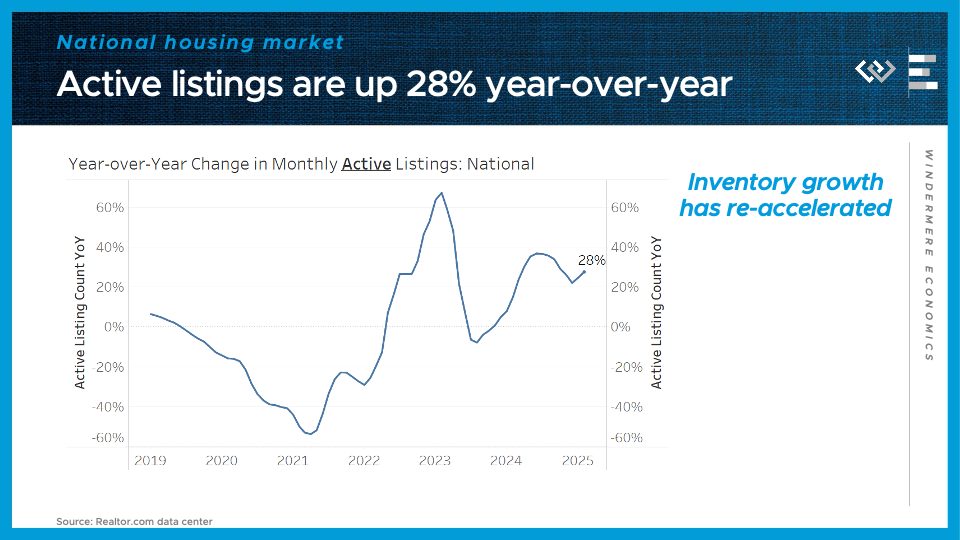

28%

That’s how many more active listings there were this February compared to February 2024. This chart of the year-over-year change really shows how that growth had been slowing late last year but is picking up again so far in 2025. That’s mainly because buyers have taken their foot off the gas, in the face of higher mortgage rates in the new year.

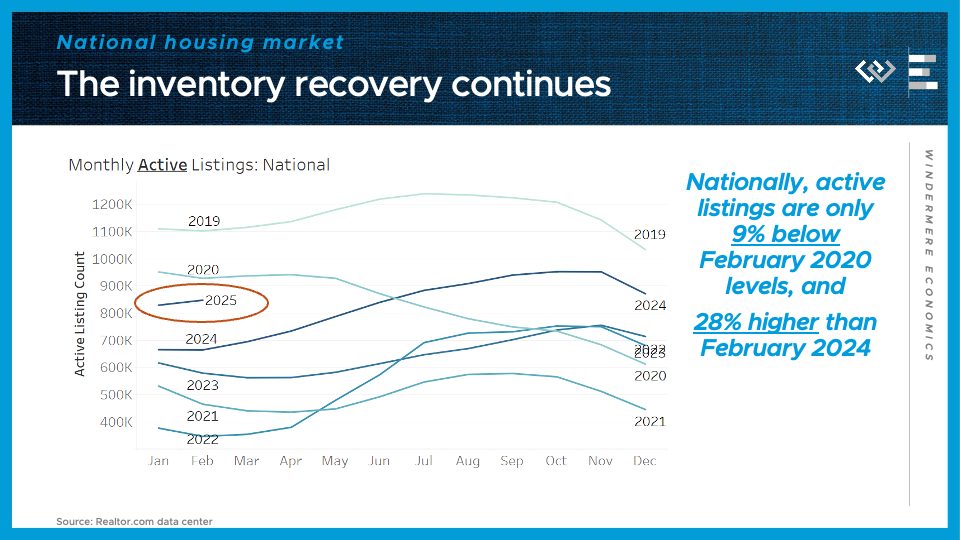

Here’s how that inventory trend shapes up against the last several years.

We are now only 9% below February 2020 levels, before the pandemic helped trigger a multi-year shortage of inventory. So for the buyers who are shopping this spring, they’ll see the most options they’ve seen in 5 years. That should keep a lid on home price appreciation this spring, and force sellers to be a bit more conservative on their asking prices. The next number to know is:

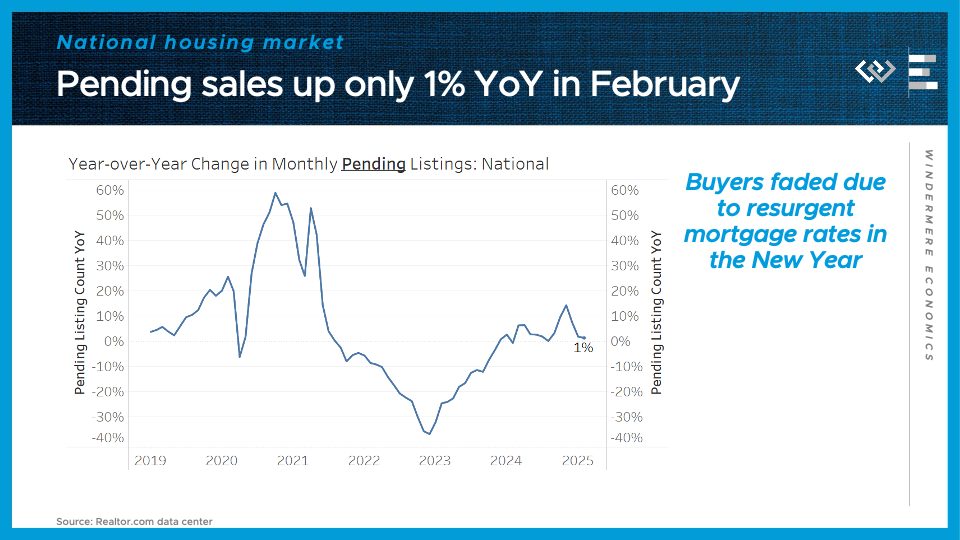

1%

Pending sales are up only 1% from the same time last year, confirming that the late-2024 surge of buyer demand is over. For buyers shopping right now that should mean less competition from other buyers to worry about. The next number to know this week:

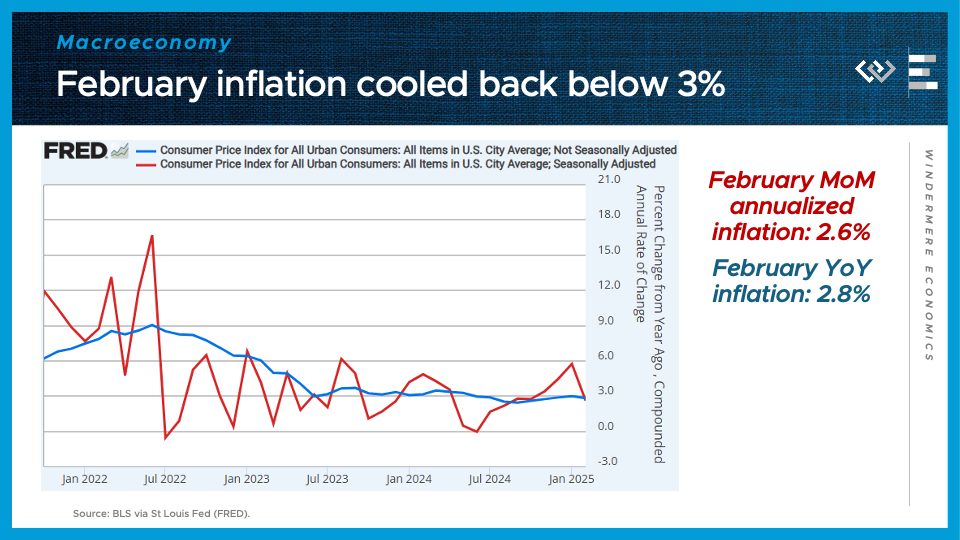

2.8%

That’s the inflation rate in February, as measured by the year-over-year change in the Consumer Price Index. That’s a welcome cooldown from 3.0% in January, and you can also see the annualized pace of monthly gains, in red here, cooled way down to 2.6%. This is a step in the right direction but there’s growing uncertainty about whether the disinflation in the price of goods will continue, especially as tariffs begin to kick in. That’s one reason the Federal Reserve is still holding steady on any further rate cuts for now. Speaking of interest rates, our last number to know this week:

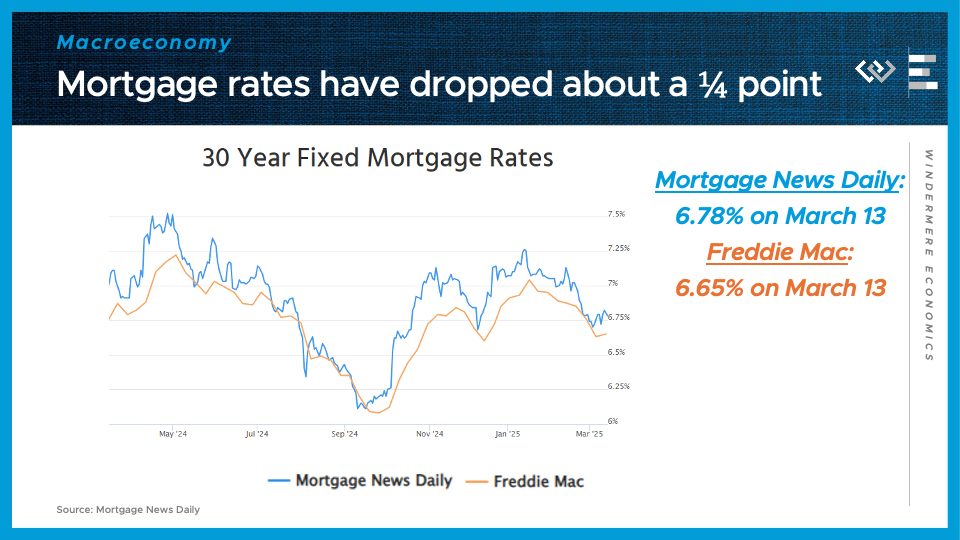

About 6 and 3/4%

That’s where 30-year mortgage rates have hovered, as of mid-March, which is about a quarter point below their recent peak at the start of the year. Combined with more inventory, that makes a recipe for pretty good shopping conditions for buyers, as we enter the heart of the spring homebuying season.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link