Hi. I’m Jeff Tucker, principal economist at Windermere Real Estate, and this is a Local Look at the December 2024 data from the Northwest MLS.

After two very strong months of data covering October and November, we got one last month of strong closed sales data in December, but a slowdown in pending sales growth suggests we shouldn’t expect a boom in closings to start out the New Year.

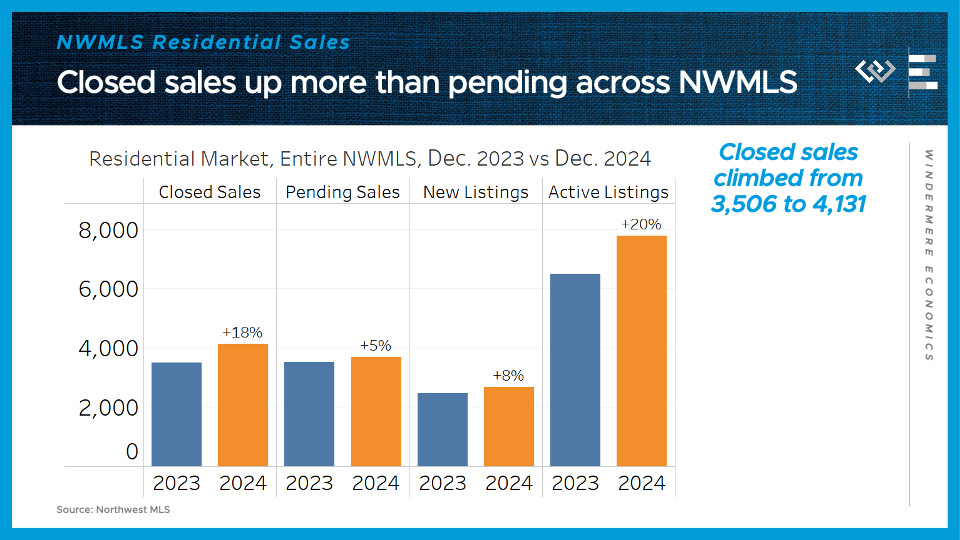

Here are the four key metrics I watch to track supply and demand in the market: closed and pending sales, which tell us a lot about demand; and listings – new and active – which tell us a lot about supply.

Closed sales of single-family homes climbed 18% year-over-year, from about 3500 to over 4100. Pending sales, which will mostly close in January, only climbed 5% from the same month last year.

On the supply side, about 8% more new listings hit the market this December compared to last one, while the level of inventory in the reservoir was 20% higher at the end of 2024 than at the end of 2023. Of course this is a quiet time of the year in the market, so we should expect all these measures of listings to pick up soon.

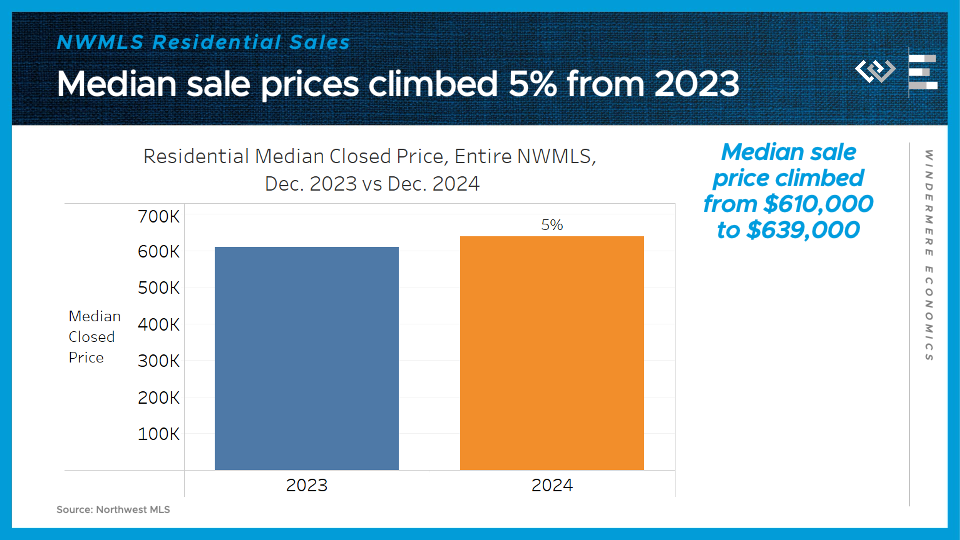

The final key metric to check in on: the median price for those closed single-family home sales climbed about 5% year-over year, from $610,000 to $639,000. That’s a bit of a cooldown from price growth in the previous couple of months, and it’s pretty similar to the pace I’m projecting for 2024.

Putting it all together, this looks like a market that had a surge of demand after the Fed began to cut rates in September, but where that demand bump is cooling off now that mortgage rates have stubbornly rebounded to nearly 7%.

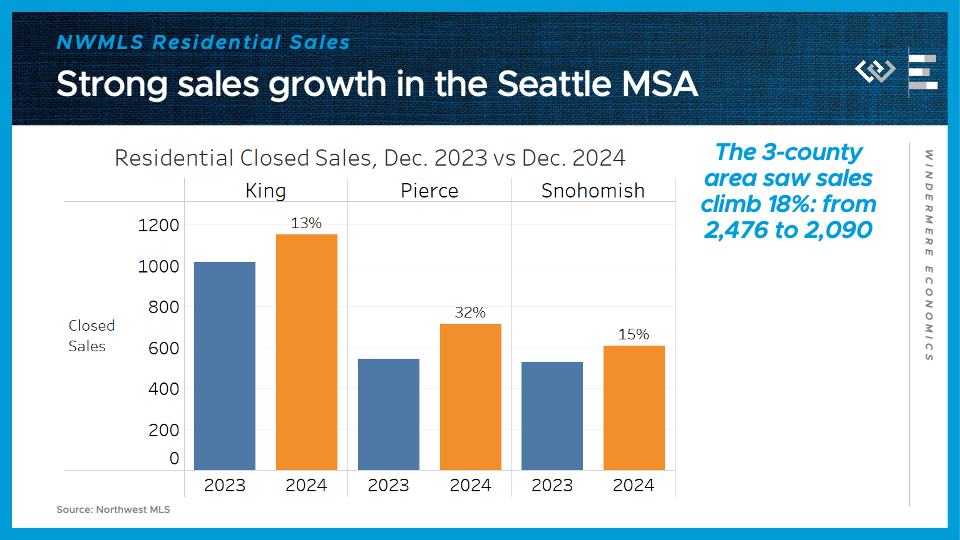

Now I’ll dig into the three counties that comprise the Seattle metropolitan area, where we saw similar trends play out.

Residential closed sales climbed 13 percent year over year here in King County, which includes Seattle and Bellevue; a whopping 32% down in Pierce County, including Tacoma, and 15% up in Snohomish County, including Everett. So for the 3-county metropolitan area as a whole, that’s a gain of 18% from the same month last year. November, by comparison, saw a 30% increase for the whole MSA, so the sales gains are clearly decelerating.

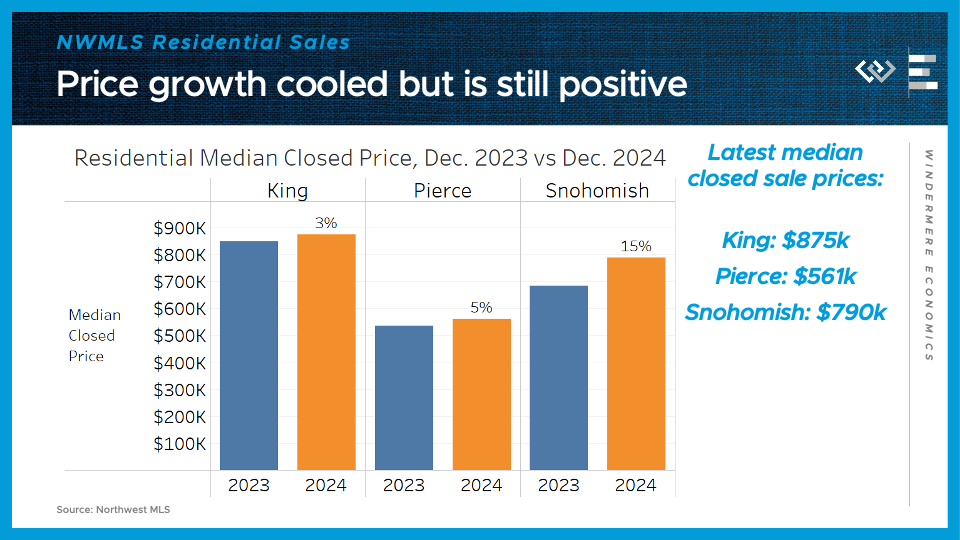

The median sale price climbed modestly: just 3% from last year in King County and 5% in Pierce County, but a whopping 15% in Snohomish. This statistic can get noisy when the sample size is small, like in December, so I think we won’t have a clear view of Snohomish price trends for another couple of months.

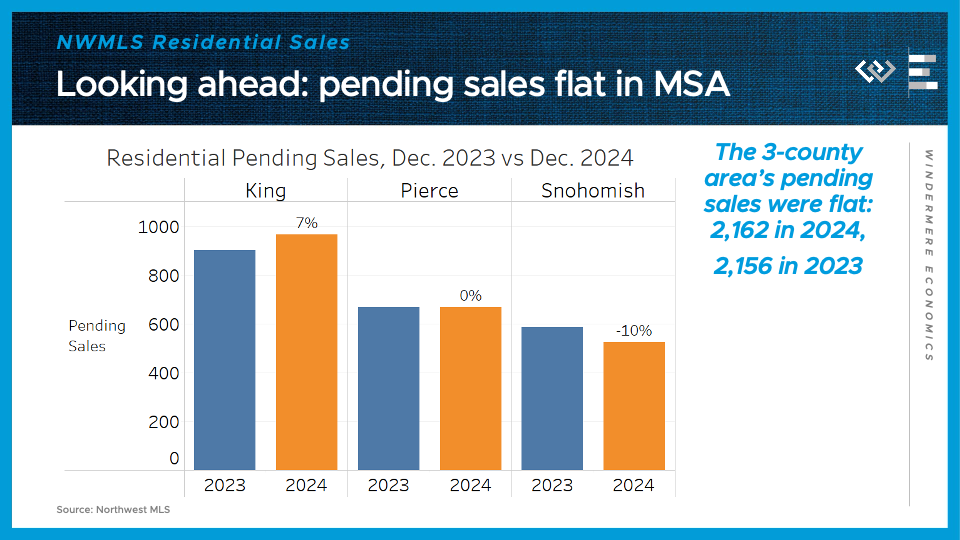

Looking ahead, there was a pretty different picture for pending sales in each of these counties: up 7% in King, flat year-over-year in Pierce, and down 10% in Snohomish. Again, sales in December are so thin that random noise can look like big changes, so I wouldn’t read too much into that data point for Snohomish County, but the broad picture for the 3-county area is that pending sales were essentially flat year-over-year in December.

On the supply side, the 3-county metro area had about 22% more active listings to end the year than there were at the end of 2023. That could give buyers more options as they start their house hunt in Q1, and could help keep price growth in check. But the biggest factor behind supply and demand this spring will be the number of new listings that come out of the woodwork, which will only start to come into focus in the months ahead.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link