The following analysis of the greater Las Vegas, Nevada real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

ECONOMIC OVERVIEW

Job growth in the Las Vegas metropolitan area continues at a very brisk pace. A total of 32,300 new jobs were added over the past 12 months, representing a very strong annual growth rate of 3.3%. For perspective, the U.S. as a whole is growing at around 1.6%, or half the rate of Las Vegas.

Even as jobs are added to the local economy, the unemployment rate is still higher than one would expect to see. The seasonally adjusted rate is 4.9%, which is down from 5.25% a year ago but still well above the national rate. This can be attributed to a rapidly rising labor force that has grown by over 34,000 in the past year as people who had been on the sidelines start to look for employment.

HOME SALES ACTIVITY

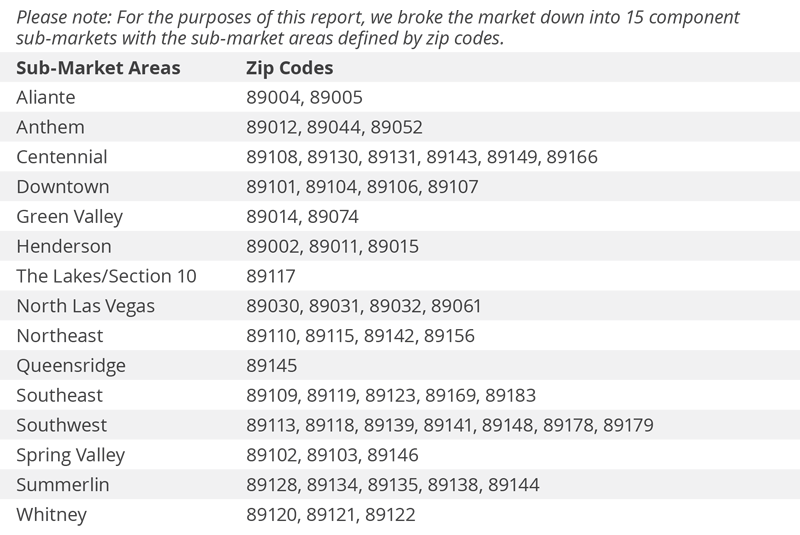

- A total of 9,146 homes were sold in the third quarter of 2018 — a drop of 4.8% over the same period a year ago. The drop in sales since the start of the year had been attributed to a lack of inventory, but we are now experiencing a substantial increase in homes for sale. This has given buyers more choice and less urgency.

- Pending sales dropped by 5% versus the same period a year ago and were down by 16% when compared to the second quarter of this year. This suggests that closings in the fourth quarter will not be very robust.

- Sales rose in three sub-markets compared to a year ago, with the Aliante market seeing solid growth (but bear in mind that this is a very small area and subject to volatility in sales). There was also a slight increase in sales in Whitney and a smaller rise in Northeast Las Vegas. All other markets saw sales decline, the most substantial of which was in the Southeast sub-market.

- In a nutshell, Las Vegas is experiencing the same increase in listing activity as a majority of U.S. markets. There is no cause for panic, but more choice does lead to a temporary slowing in sales as buyers take their time choosing a new home.

HOME PRICES

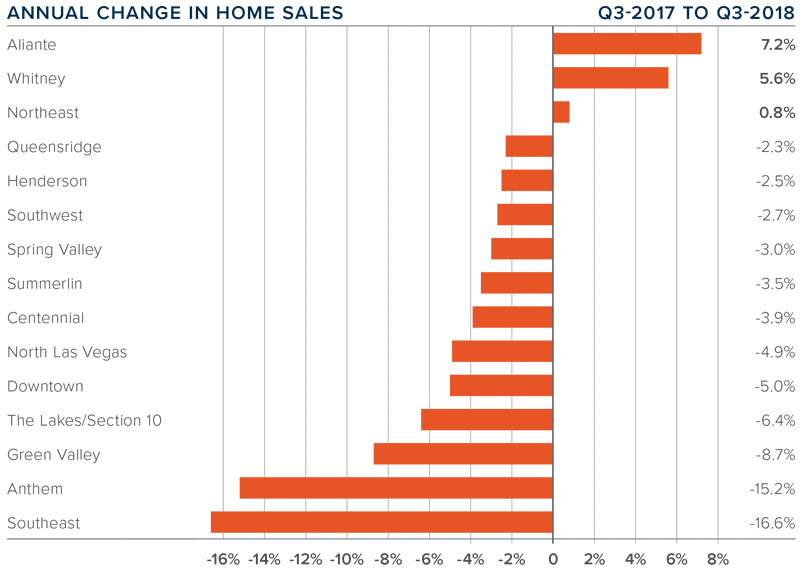

- Home prices in the area rose by 11.8% compared to the third quarter of 2017 — to an average of $304,182 — and were a modest 0.6% higher than in the second quarter of this year.

- The Las Vegas market continues to see home prices rise but I believe we will start to see a slowdown as affordability issues start to appear.

- Prices in all sub-markets rose compared to the same quarter last year. The strongest growth was in the Northeast Las Vegas sub-market, where prices were up 22.5%. Eleven sub-markets saw double-digit price growth.

- The takeaway is that home values are likely to continue to increase, but more choice — in concert with affordability constraints — will lead to a slowdown in the rate of price growth.

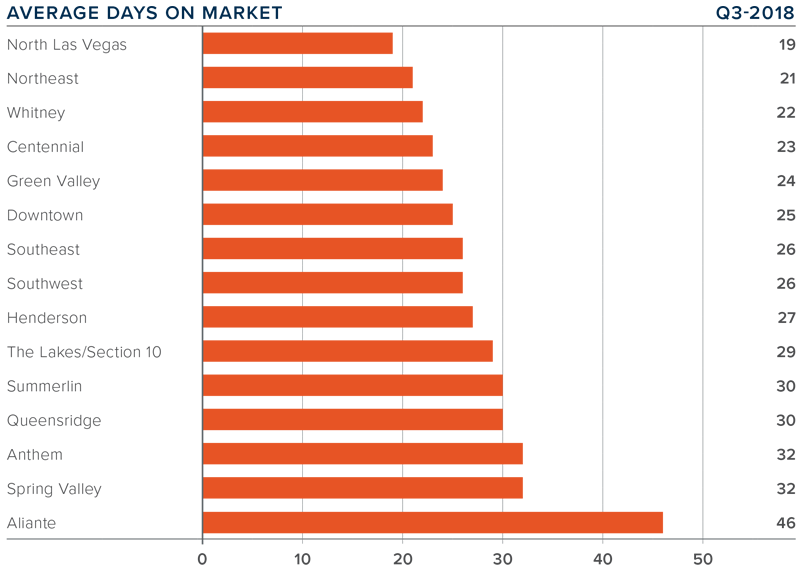

DAYS ON MARKET

- The average time it took to sell a home in the region dropped five days compared to the third quarter of 2017.

- Region-wide it took an average of only 27 days to sell a home in the third quarter of this year.

- Days on market fell in all but two of the sub-markets compared to a year ago. The exceptions were in the Queens Ridge area (+4 days) and in Green Valley (+1 day).

- The greatest drop in days on market was in Northeast Las Vegas, which took 10 fewer days than in the same quarter of 2017.

CONCLUSIONS

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Though employment growth in Clark County continues to be very robust, this has yet to be reflected in any major growth in earnings. Home prices have been growing at some of the fastest rates in the U.S., which is affecting affordability. With the lack of real wage growth, and in concert with rising inventory levels, I believe that the market will start to trend toward more balance, but we have a ways to go. Because of this, I have moved the speedometer a little more toward buyers.

Mr. Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link