ECONOMIC OVERVIEW

Employment in the Las Vegas market saw quite a nice bump during the summer after having taken a bit of a pause earlier in the year. August data showed that there were just shy of 950,000 non-agricultural employees in the area, up by 5,300 from the prior month, and 26,400 higher than seen a year ago. The local unemployment rate dropped from 6.9% at the end of June to 6.0% in August. This is, in part, a result of the data not being seasonally adjusted, but also because we saw the workforce drop by 6,600 people. Employment sectors were a mixed bag, with sizable improvement seen in casinos and related hotel industries, but a decline in professional services, finance, insurance, and the information technology sectors.

HOME SALES ACTIVITY

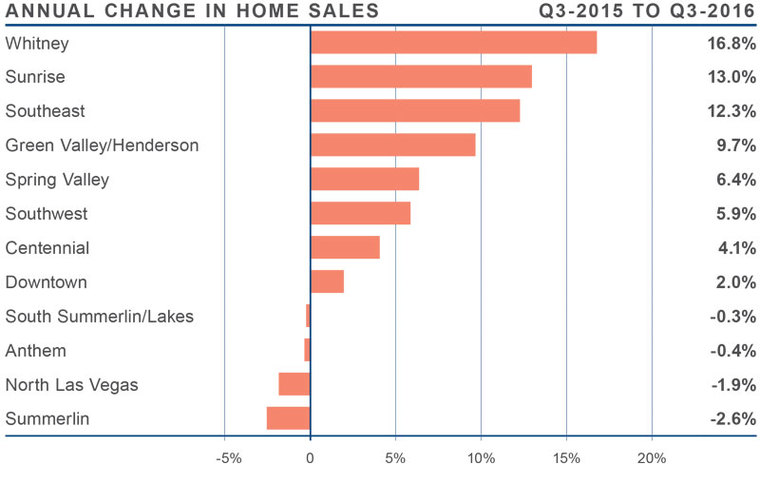

- There were a total of 10,126 home sales, which was an increase of 4.5% when compared to the third quarter of 2015. This was also 4.2% higher than seen during the second quarter of this year.

- Sub-markets where sales activity was either slow or negative were limited to South Summerlin/Lakes, Anthem, North Las Vegas and Summerlin sub-markets; however the drop in sales was modest.

- The fastest rate of growth in sales came in the Whitney sub-market, which saw a 16.8% increase compared to a year ago. There were also sizable increases in sales in the Sunrise and Southeast sub-markets.

- Inventory levels are still well below where I would like them to be, with 10.9% fewer listings than seen a year ago. That said, overall listing activity in the quarter was up by 21.9% from the second quarter of this year. The fastest pace of growth in listings was seen in the Southwest and South Summerlin/ Lakes sub-markets, where listings were 7.0% and 5.8% higher, respectively.

HOME PRICES

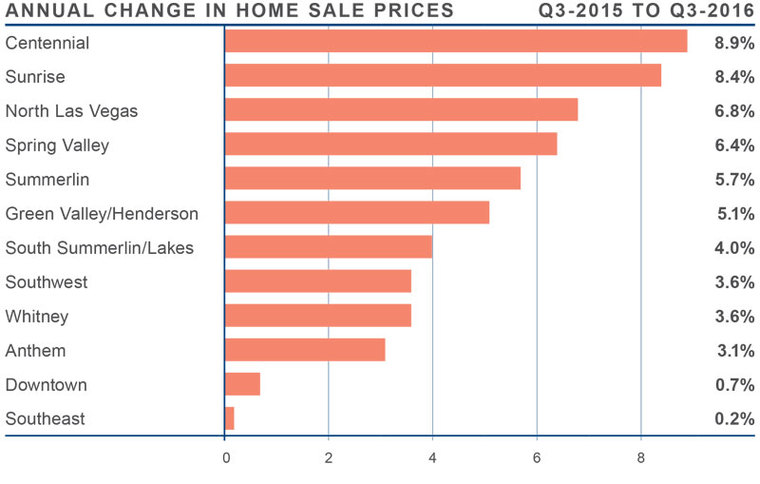

- Average prices in the region rose by 4.6% year-over-year to $232,750. This is also 1.0% higher than seen in the second quarter of this year.

- The Centennial sub-market saw the strongest annual growth, with average home prices rising by 8.9% to $240,300. We also saw notable gains in the Sunrise neighborhood, where sale prices were up by 8.4% to $151,000.

- All sub-markets saw prices rise compared to the third quarter of 2015, with several above the region-wide average.

- As mentioned earlier, prices were higher across the board, but the Southeast and Downtown areas were essentially at the same level as seen a year ago.

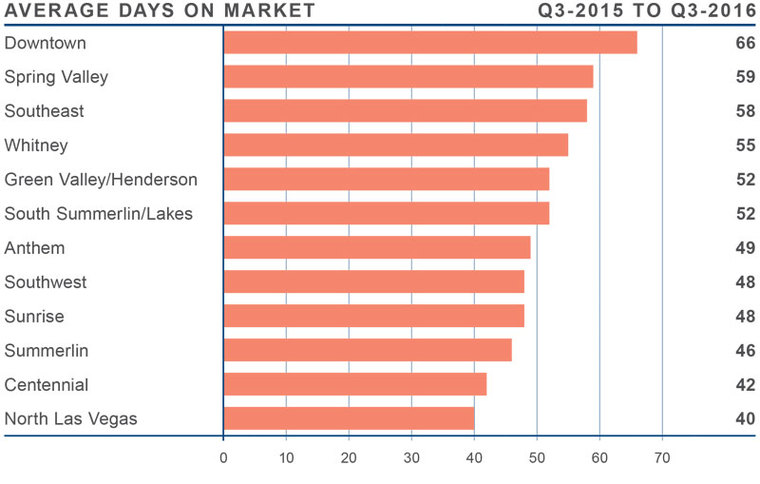

DAYS ON MARKET

- The average number of days it takes to sell a home in the region dropped by eleven when compared to the third quarter of 2015.

- The average time it took to sell a home in the region was 52 days—one day less than seen in the second quarter of this year.

- All component sub-markets saw the length of time it took to sell a home drop when compared to a year ago.

- The greatest drop in days-on-market was again seen in the Sunrise sub-market, which dropped by 23 days to 48.

CONCLUSIONS

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. Employment growth in Clark County has resumed and I believe that it is this growth that is continuing to drive home sales. Inventory levels have risen substantially over the past six months and, while they are below the levels of a balanced market, they are headed in the right direction. Home prices are increasing at a reasonable pace but there are some sub-markets that are over-performing at the present time. This is not a concern, as I think buyers will start to be more selective regarding the neighborhoods that they want to move to. This process will allow some markets to appreciate at levels higher than the regional averages. I have moved the speedometer a little more in favor of sellers, as price growth is higher across the board and, even with the rise in listing activity, sellers still have the upper hand.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. Employment growth in Clark County has resumed and I believe that it is this growth that is continuing to drive home sales. Inventory levels have risen substantially over the past six months and, while they are below the levels of a balanced market, they are headed in the right direction. Home prices are increasing at a reasonable pace but there are some sub-markets that are over-performing at the present time. This is not a concern, as I think buyers will start to be more selective regarding the neighborhoods that they want to move to. This process will allow some markets to appreciate at levels higher than the regional averages. I have moved the speedometer a little more in favor of sellers, as price growth is higher across the board and, even with the rise in listing activity, sellers still have the upper hand.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link