ECONOMIC OVERVIEW

Employment growth in the Las Vegas metropolitan area slowed down—albeit very modestly—as the market entered the summer, with an annual employment growth of 2.9%. That said, the market has added 27,300 new jobs over the past 12 months. With this growth in employment, the unemployment rate remained at 4.8%, which is marginally above the statewide level of 4.7%. Las Vegas continues to approach full employment but the market, like many others across the country, has yet to see robust wage growth. However, I do believe wages will start to rise as the labor market continues to tighten through the rest of the year.

Employment growth in the Las Vegas metropolitan area slowed down—albeit very modestly—as the market entered the summer, with an annual employment growth of 2.9%. That said, the market has added 27,300 new jobs over the past 12 months. With this growth in employment, the unemployment rate remained at 4.8%, which is marginally above the statewide level of 4.7%. Las Vegas continues to approach full employment but the market, like many others across the country, has yet to see robust wage growth. However, I do believe wages will start to rise as the labor market continues to tighten through the rest of the year.

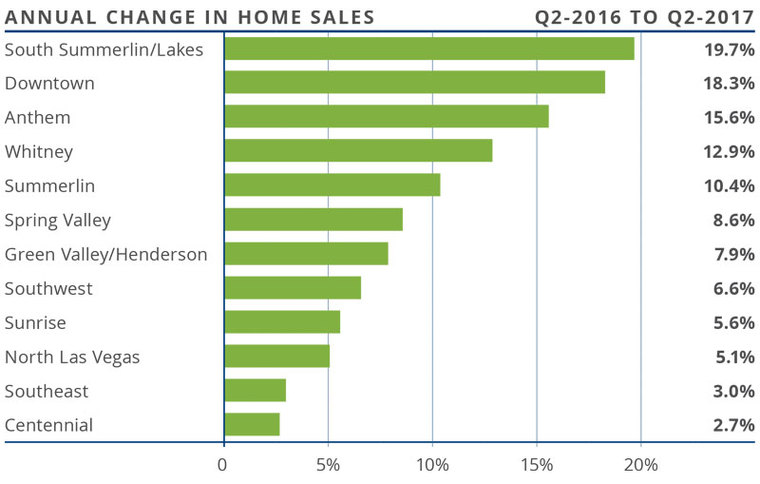

HOME SALES ACTIVITY

- A total of 11,256 homes sold in the second quarter, which was an increase of 8.9% over the same period a year ago. Sales were a substantial 30.5% higher than last quarter.

- Home sales were not as strong in the Centennial and Southeast Las Vegas sub-markets, but this is due to low inventory levels rather than a decrease in demand.

- There were substantial increases in home sales in a majority of the submarkets within this report, but the fastest rate was in the South Summerlin/ Lakes area, which saw an annual increase of 19.7%.

- Inventory levels remain remarkably low with 35.1% fewer homes for sale than the same period in 2016 and 11.5% below the level seen in the first quarter. Unfortunately, we failed to see any rise in listings in the spring.

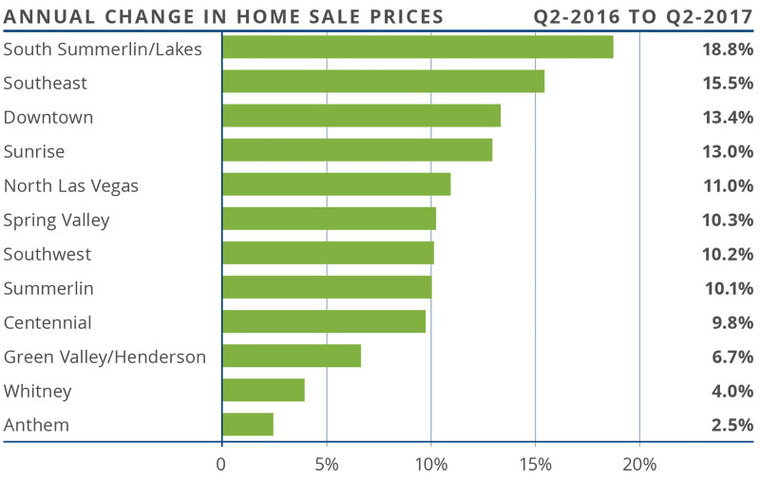

HOME PRICES

- Home prices in the area have risen by 10.4% year-over-year, to an average of $260,535, and are 6.3% higher than first quarter.

- The relatively affordable downtown sub-market saw a substantial price increase of 13.4% to $164,000. Double-digit gains were also seen in the Sunrise, North Las Vegas, Spring Valley, Southwest Las Vegas, and Summerlin neighborhoods.

- Prices rose in all sub-markets when compared to the second quarter of 2016, with the strongest growth seen in the South Summerlin/Lakes and Southeast Las Vegas sub-markets, which saw prices up by 18.8% and 15.5% respectively.

- I anticipate that we will continue to see above-average price growth in the greater Las Vegas market, as job growth continues and inventory levels remain constrained.

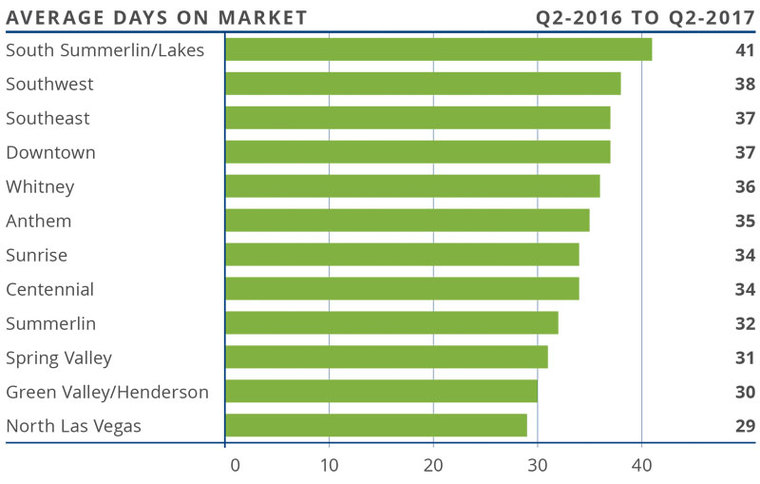

DAYS ON MARKET

- The average time it took to sell a home in the region dropped by 18 days when compared to the second quarter of 2016.

- It took an average of just 35 days to sell a home in the second quarter—a substantial 12 fewer days than in the first quarter.

- The length of time it took to sell a home dropped in all the Las Vegas sub-markets when compared to a year ago.

- The greatest drop in days-on-market was in the downtown sub-market, which dropped by 27 days when compared to the same quarter in 2016.

CONCLUSIONS

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Employment growth in Clark County, although slightly less robust than seen in the first quarter, is still gaining ground. This, in concert with low inventory levels and still-competitive mortgage rates, will lead to continued above-average price growth.

Given these factors, I have moved the speedometer a little farther in favor of sellers.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

If you are in the market to buy or sell, we can connect you with an experienced agent here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link