ECONOMIC OVERVIEW

As a whole, Oregon’s labor market remains stronger than it has been in decades. Job growth in the second quarter was somewhat muted, but this is nothing to be concerned about. Businesses have expanded to pre-recession levels, so at this point hiring tends to be cyclical rather than expansionary.

The state has essentially reached what is defined as “full employment”, at which point growth rates tend to naturally slow. This explains why the state’s unemployment rate has remained steady at 4.5% for the past three months—a level that has not been seen in over 40 years.

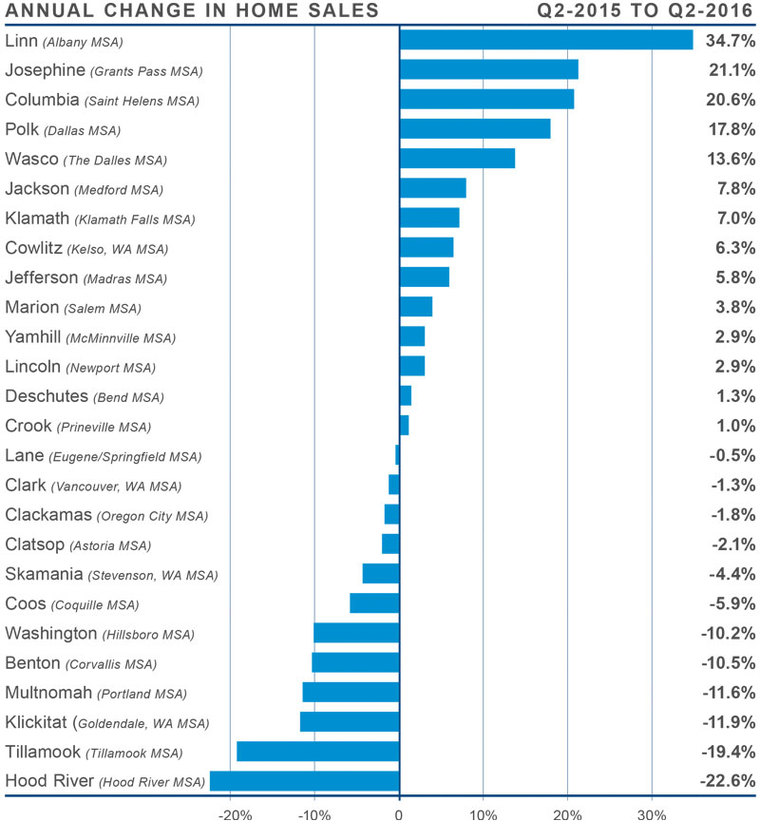

HOME SALES ACTIVITY

- Home sales fell by 2.3% when compared to the second quarter of 2015, with a total of 17,509 transactions.

- Sales rose at the fastest rate in Linn, Josephine, Columbia, Polk, and Wasco Counties. The greatest declines were seen in Hood River, Tillamook, Klickitat, Multnomah, and Benton Counties.

- Although overall sales activity was somewhat slower, there were still 14 out of 26 counties that saw home sales increase over the same period in 2015. However, a majority of these counties are small, which means a few sales can result in major swings. As such, I believe the major reason for the slowing in sales is the lack of inventory rather than lack of demand.

- Home sales are a product of supply, and that is what’s missing from the equation. When we start to see more listing activity—which I hope will be later on this year—an increase in sales will surely follow.

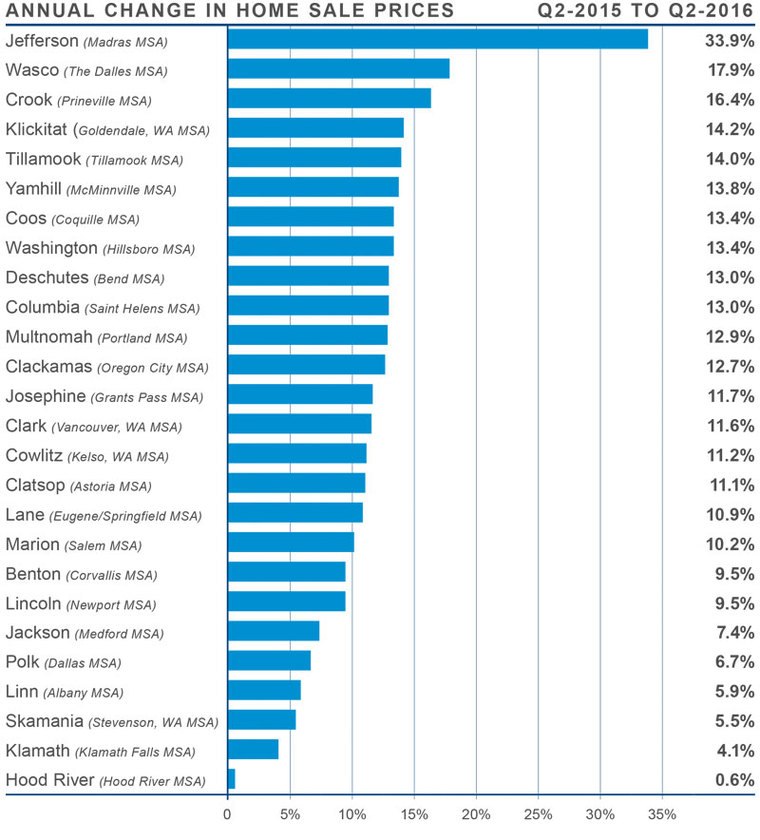

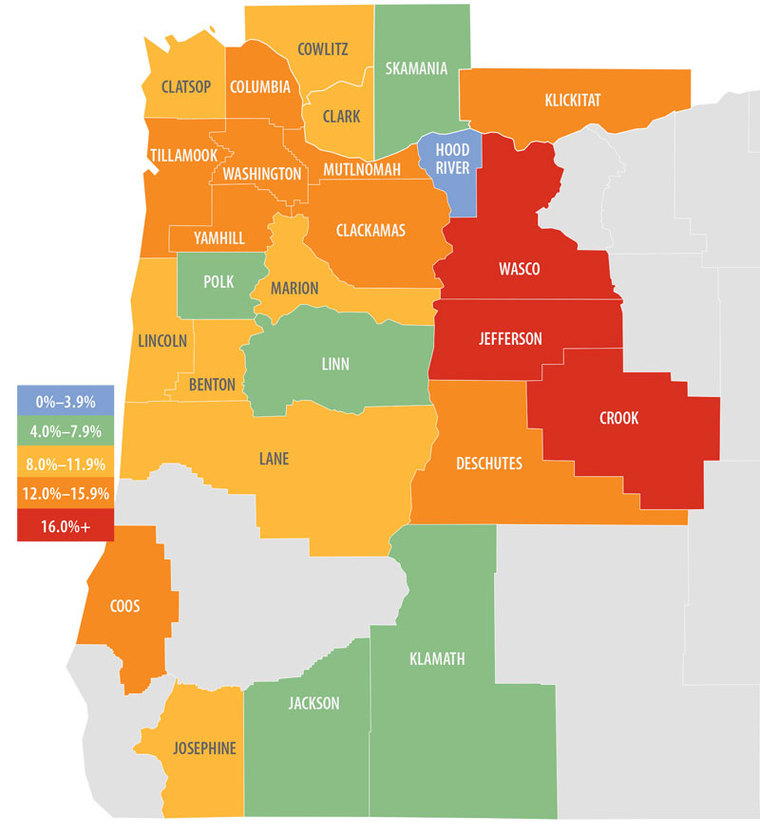

HOME PRICES

- Average prices in the region rose by 10.5% year-over-year to $336,882. This is up from the annual rate of 9.1% seen in the first quarter of the year. It is clear that supply constraints continue to push prices higher, and this rate of appreciation is one of the highest in the nation.

- When compared to the second quarter of 2015, Jefferson County took over as the market with the greatest price growth, with homes selling for 34% above that seen a year ago.

- All counties saw prices rise compared to the second quarter of 2015, and all but eight saw double-digit percentage gains. The only “underperformer”—if it can be termed as such—was the very small Hood River County where prices rose by 0.6%.

- The rapid price growth that is being seen in the region so far this year cannot be sustained. That said, I see little reason to believe that any slowdown will occur in the near-term.

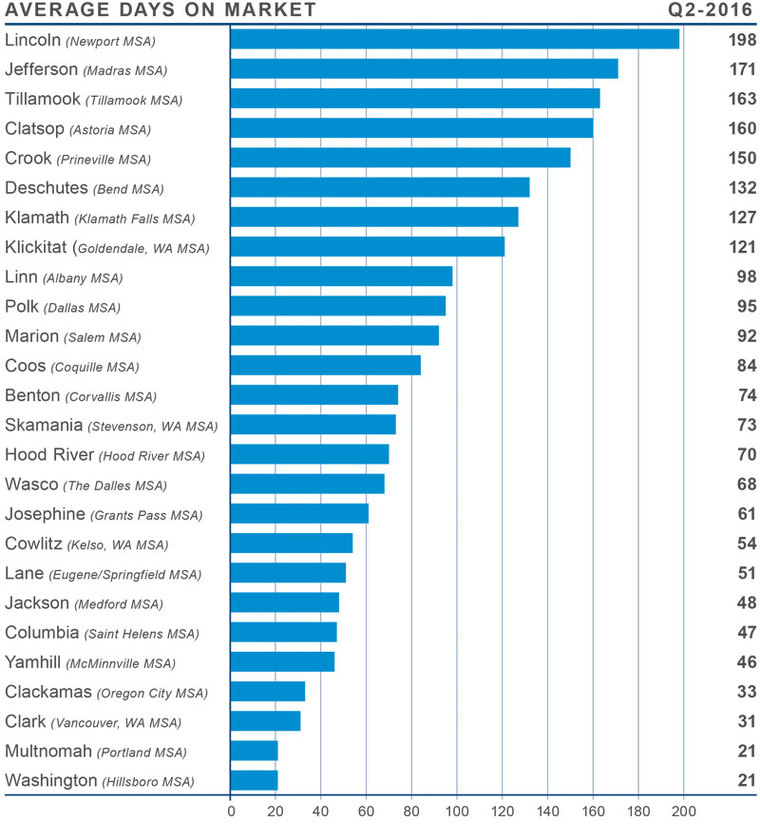

DAYS ON MARKET

- The average time it took to sell a home last quarter was 88 days.

- The average number of days it took to sell a home dropped by 16 days when compared to a year ago.

- Crook County was the only area where the average time it took to sell a home rose, but given the fact that it is a small market (104 sales this quarter), the increase is clearly nominal.

- The fastest sales pace was again seen in Washington and Multnomah Counties, which reported an average of just 21 days to sell homes.

CONCLUSIONS

CONCLUSIONS

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. Growth in the Oregon economy remains well above average and is unlikely to slow down in the foreseeable future. As real estate relies heavily on economic growth, this continues to bode well for the Oregon housing market.

Listing activity is still well below levels that I would like to see, and this continues to push up home prices. Interest rates remain at near historically low levels and are not likely to increase to any great degree in the near-term. This allows buyers to borrow more, and adds additional upward pressure on home prices.

As such, I have moved the needle even more in favor of sellers.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link