The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The very significant COVID-19-induced contraction in employment Oregon experienced — along with the rest of the nation — looks as if it is behind us (at least for now).

Employment growth across the state turned negative in March, but April was the real shocker: total employment dropped by 252,800 jobs, a decline of 13%. However, this turned around remarkably quickly with 22,500 jobs added in May. The Southwest Washington region saw a drop in total employment of almost 30,000 jobs, but also turned around in May with 1,650 jobs returning. In May, the unemployment rate was 14.2% in Oregon and 14.4% in Southwest Washington.

As the rate of COVID-19 infections slow, we should see more jobs return.

HOME SALES

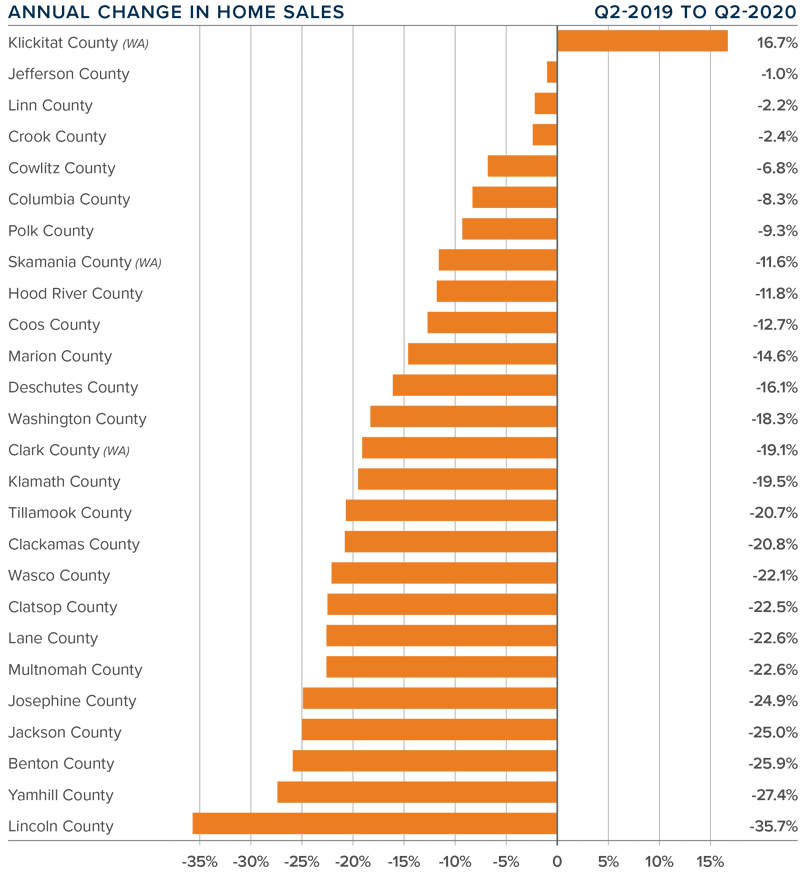

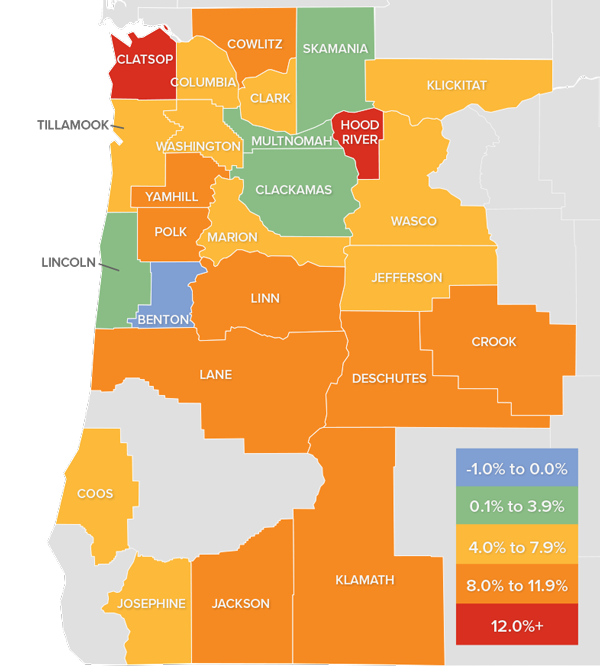

- Second quarter home sales dropped 19.3% compared to the same period last year. A total of 14,342 transactions closed.

- Sales dropped in every county except Klickitat, but it is a very small market and is subject to massive swings. Home sales fell most in Lincoln County.

- Although significantly lower than what we saw a year ago, closings were 20% higher than in the first quarter of 2020. Housing appears to be recovering faster than the overall economy.

- These numbers are not surprising given the onslaught of COVID-19. However, there are “green shoots” as pending sales have started to rise significantly. I expect to see decent growth in the third quarter.

HOME PRICES

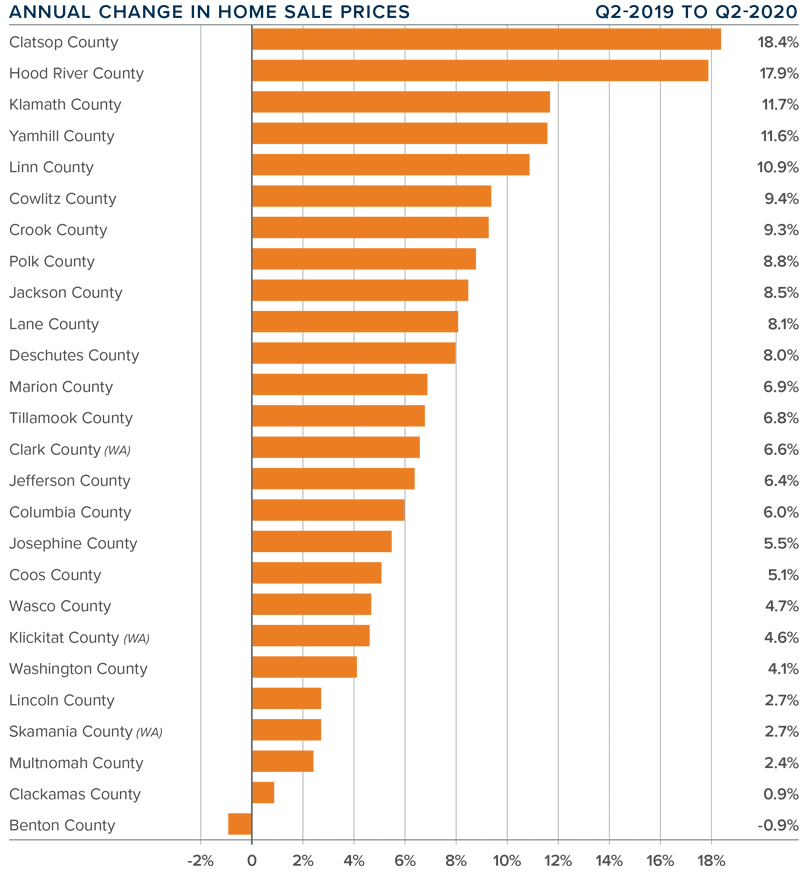

- The average home price in the region rose 5% year-over-year to $421,068. Home prices were 5.3% higher than in the first quarter of 2020.

- Clatsop County led the market with the strongest annual price growth. Homes there sold for 18.4% more than a year ago. Prices were lower in Benton County, but the decline was very modest.

- All but one of the counties contained in this report experienced price growth over the second quarter of 2019. Annual price growth continues to outperform historic averages.

- The takeaway from this report is that home prices appear to have been somewhat immune to COVID-19 (no pun intended). This is likely a function of extremely low levels of inventory across the region.

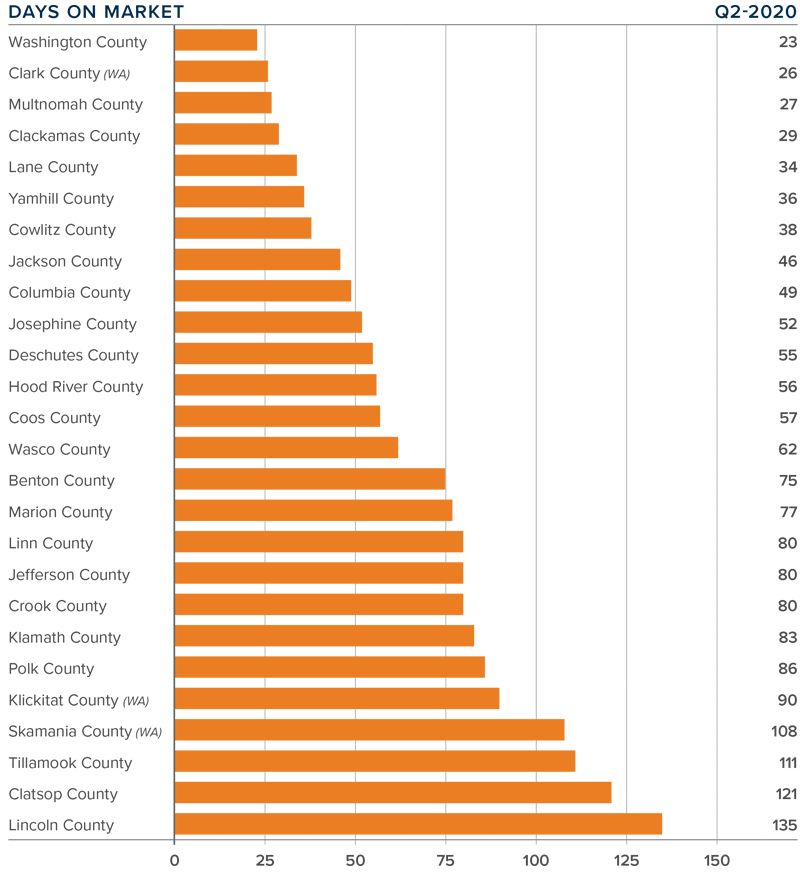

DAYS ON MARKET

- The average number of days it took to sell a home in the region dropped one day compared to the second quarter of 2019. It took 19 fewer days to sell a home than in the first quarter of 2020.

- The average time it took to sell a home in the second quarter was 66 days.

- Fourteen counties saw the length of time it took to sell a home drop compared to a year ago. Twelve counties saw market time rise.

- Homes again sold the fastest in Washington County where it only took 23 days to sell.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Given the current economic environment, I have decided to freeze the needle in place until we see a restart in the economy. Once we have resumed “normal” economic activity, there will be a period of adjustment with regard to housing. Therefore, it is appropriate to wait until later in the year to offer my opinions about any quantitative impact the pandemic will have on the housing market.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link