The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

I am pleased to report that Idaho has not only recovered all the jobs that were lost following the onset of the pandemic, but total employment is now 10,400 jobs higher than the previous peak we saw in February of last year. Utah is the only other state in the U.S. that can make this claim. Having recovered all the jobs lost, and with new positions being added, the unemployment rate continues to trend lower and now stands at a very solid 3.2%—almost half the national rate of 6%. New COVID-19 cases did rise in the first quarter, but not to such an extent that is likely to negatively impact the economy. In all, Idaho is positioned very well to continue to grow.

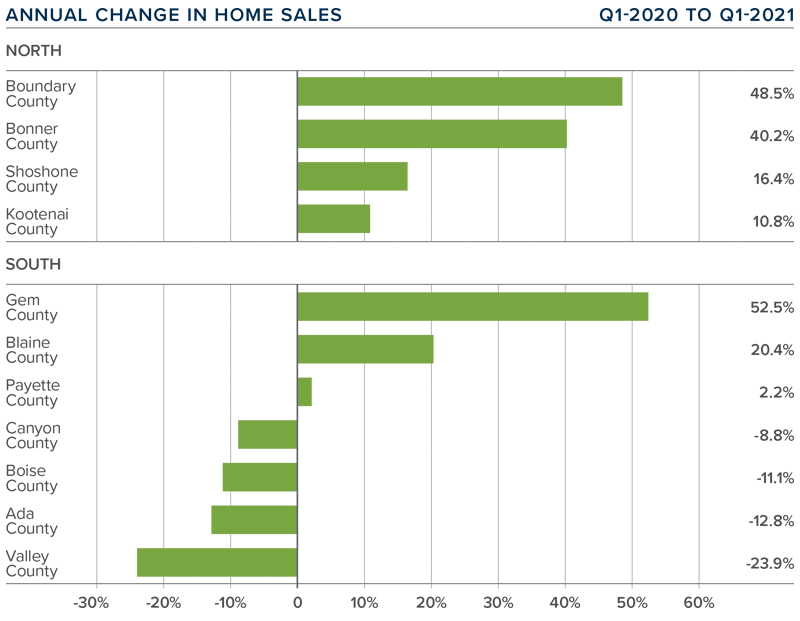

idaho Home Sales

❱ In the first quarter of 2021, 4,949 homes sold, representing a drop of 4.5% year over year. Total home sales were down 32% from the final quarter of 2020.

❱ Interestingly, sales did rise in all the northern markets compared to the same time a year ago, with impressive increases across the board. However, sales were down 32% compared to the fourth quarter of 2020.

❱ Year-over-year sales growth was positive in three of the seven Southern Idaho counties, but the areas that saw growth are all relatively small.

❱ Pending sales rose 1.4% compared to the final quarter of last year, suggesting that the second quarter is likely to show improvement. The biggest issue, however, is the lack of homes for sale: inventory levels are 48.6% lower than a year ago, and 8.7% lower than in the fourth quarter.

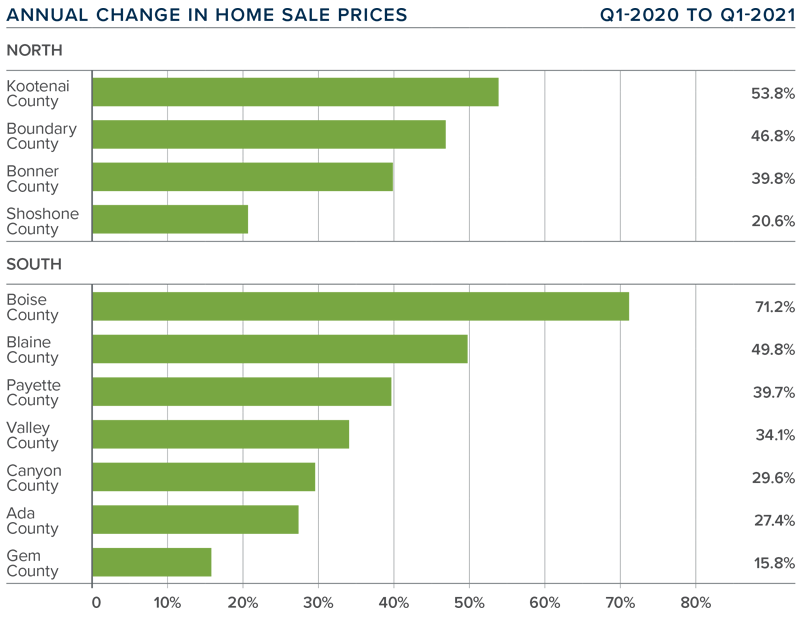

idaho Home Prices

❱ The average home price in the region rose by a remarkable 35.4% year over year to $516,725. Sale prices were also up 4% compared to the prior quarter.

❱ Southern Idaho saw significant gains, with Boise County jumping more than 70%. That said, this is a very small area and subject to extreme swings. Prices in Southern Idaho were 10.7% higher than in the prior quarter.

❱ Prices rose in all Northern Idaho counties covered by this report, with significant gains across the board. Prices were 6.6% higher than in the final quarter of 2020.

❱ Buyers significantly outnumber sellers, which is causing prices to rise at a frenetic pace. I would like to see inventory rise to meet demand, but I doubt this will be the case in the near term.

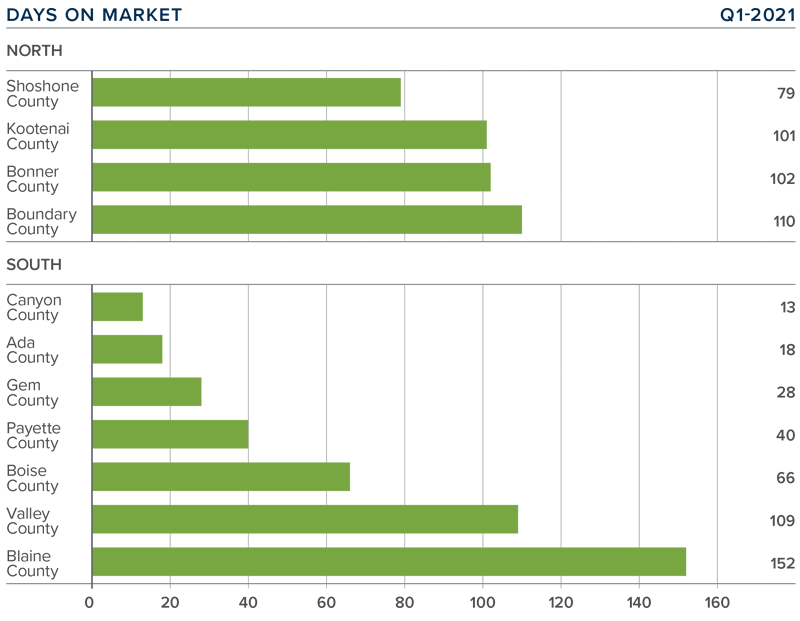

Days on Market

❱ It took an average of 98 days to sell a home in Northern Idaho and 61 days in the southern part of the state covered by this report.

❱ The average number of days it took to sell a home in the region rose nine days compared to the first quarter of last year.

❱ In Northern Idaho, days-on-market dropped in all counties other than Boundary, where market time rose by 2 days. In Southern Idaho, market time dropped in all counties other than Boise, where it took 26 more days to sell a home than in the first quarter of 2020.

❱ Homes sold the fastest in Canyon and Ada counties in the southern part of the state and in Shoshone County in the northern part of the state.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

With employment levels now higher than before the pandemic, buyers are clearly comfortable and, perhaps motivated by modestly rising mortgage rates, they are out in force. Unfortunately, the choice of available homes is very limited, which continues to cause prices to rise at well-above-average rates. As such, sellers still have a significant advantage. Since I do not expect to see listings rise enough to meet this demand, I am moving the needle more in favor of sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link