The following analysis of the greater Las Vegas real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Needless to say, the Las Vegas job market was hit hard by COVID-19. Fortunately, the recovery continues, with more than 142,000 jobs returning. That said, total employment is still 138,000 below the pre-pandemic peak of 1.054 million jobs. With jobs returning, it is natural to see the unemployment rate improve. It has now fallen below 10%, standing at 9.3% in February. There is still a long way to go before the area gets back to full employment, but things are heading in the right direction. New COVID-19 infection rates were fairly stable in the first quarter but increased in April. That said, they are significantly lower than last winter. Moreover, the rapid increase in vaccinations is likely to lead to more travel, and that can significantly impact the Las Vegas job market. I hope this trend continues.

nevada Home Sales

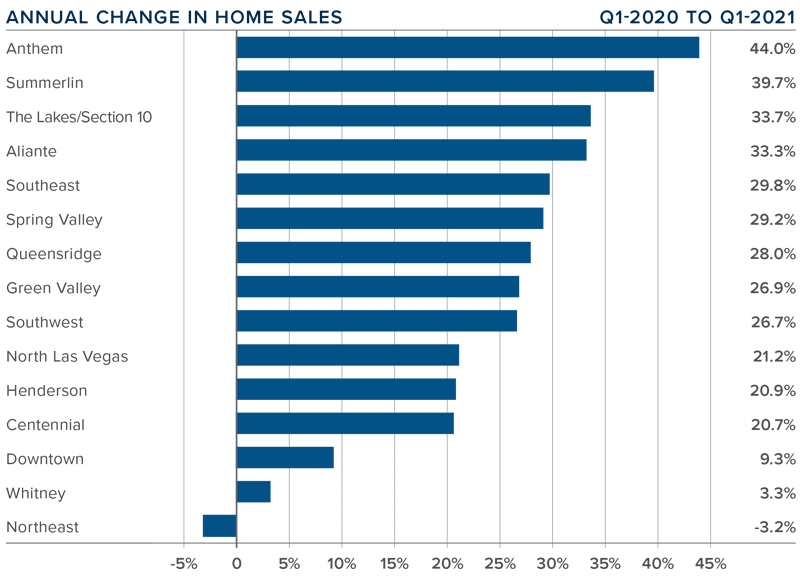

❱ A total of 9,709 homes sold in the first quarter of 2021, an increase of 23.3% compared to the same period a year ago but down 3% from the fourth quarter of 2020.

❱ Pending sales, which are an indicator of future closings, rose 16.8% compared to the fourth quarter of last year, suggesting that closings in the second quarter of 2021 will likely be positive. Pending sales were also 40.2% higher than they were a year ago.

❱ Sales rose in every market other than Northeast Las Vegas, which had a very modest drop. The Anthem area saw significant growth in sales, but it is worth noting that all but two markets saw double-digit growth in sales.

❱ Listing activity is still very low, with the average number of homes for sale down 52.2% compared to a year ago and 43.9% lower than in the fourth quarter of 2020.

nevada Home Prices

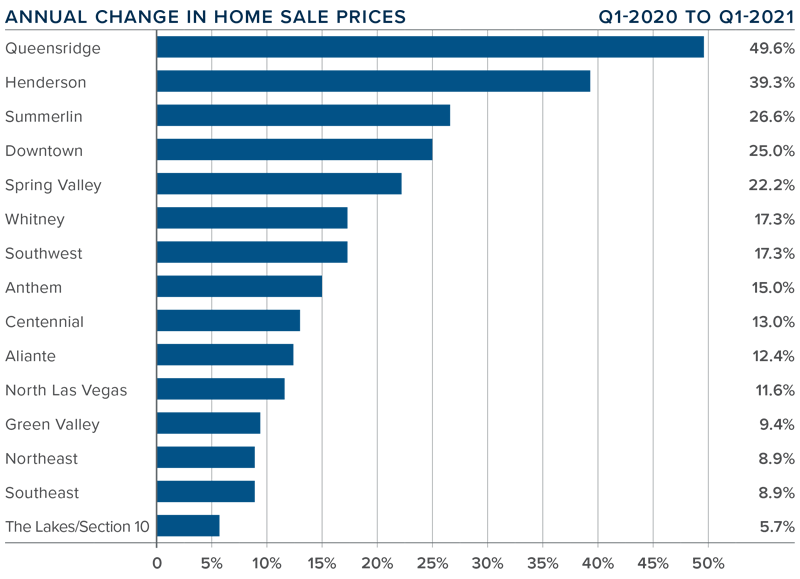

❱ With sales rising and so few homes for sale, it’s not surprising that home prices continue to rise. The average sale price in the first quarter rose 21.1% year over year to $396,020. Prices were also up by 3.3% compared to the final quarter of 2020.

❱ Despite rising mortgage rates, price growth continues at well above average levels. It’s unclear at the moment when this might change.

❱ Prices rose in every sub-market compared to the same quarter last year. All but four neighborhoods experienced double-digit gains.

❱ The takeaway is that demand still exceeds supply, and this is causing prices to continue to rise rapidly.

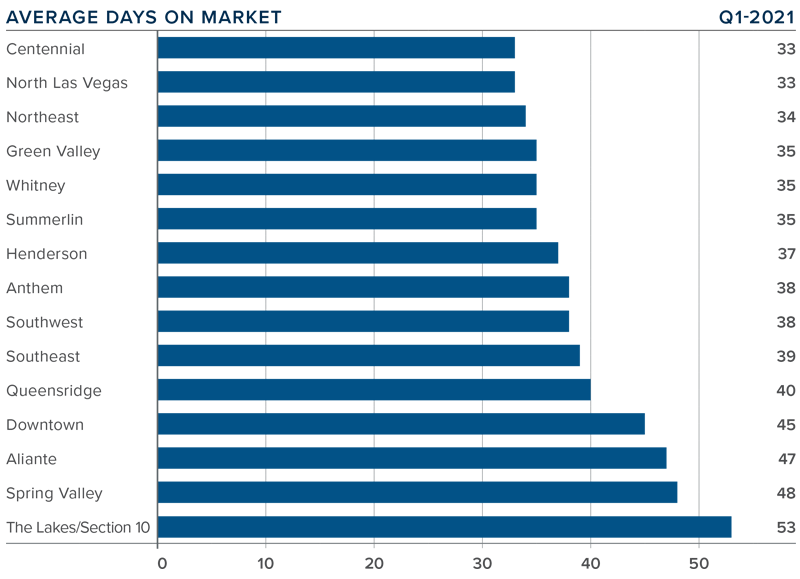

Days on Market

❱ The average time it took to sell a home in the region dropped ten days compared to the first quarter of 2020.

❱ It took an average of 39 days to sell a home in the first quarter of 2021, which was two more days than in the prior quarter.

❱ Days on market dropped in all but two neighborhoods contained in this report compared to a year ago. The exceptions were Queens Ridge (+1 day) and The Lakes/Section 10 (+3 days).

❱ The greatest drop in market time was in the Summerlin market, where the length of time it took to sell a home dropped 18 days compared to a year ago.

Conclusions

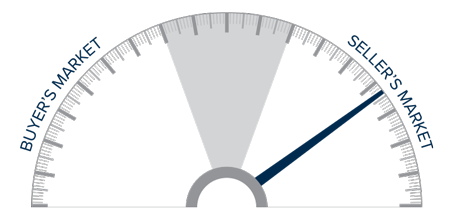

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The Las Vegas economy continues to improve from the impact of COVID-19, and demand for housing remains very strong. Even in the face of rising mortgage rates and limited options of homes for sale, buyers remain engaged. Naturally, these conditions favor home sellers, so I am moving the needle a little more in their favor.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link