The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The post-COVID job recovery continues at an impressive rate. As discussed in last quarter’s Gardner Report, the state has not only recovered all of the 79,600 jobs that were shed during the pandemic but has added 16,300 new positions. Utah remains the only other state that can make this claim. With such a strong recovery, and additional new hiring, it is no surprise to see the unemployment rate continuing to trend lower. It currently stands at only 3%—almost half the national rate of 5.9%. New COVID-19 cases have risen in recent weeks, but not to a level that is likely to slow down the state’s robust rate of economic growth. That said, if there are significant increases in infections, it may take some of the momentum away. I remain hopeful this will not be the case.

idaho Home Sales

❱ In the second quarter, 6,023 existing homes sold, representing a drop of 4.7% year over year. However, because the pandemic was in full swing a year ago, I think it’s more meaningful to consider the second quarter sales increase of 21.7% relative to the first quarter of this year.

❱ Due to the pandemic, comparing the current quarter to a year ago does not give an accurate picture, but compared to first-quarter data, home sales showed solid growth in all counties. Bonner and Kootenai led the way in the north, and Boise and Blaine in the south.

❱ Year-over-year sales showed significant growth in all of the Northern Idaho counties contained in this report. In the southern part of the state, sales soared in Blaine County, were modestly higher in Boise and Gem counties, but were lower in all other markets.

❱ Pending sales rose 3.4% from the first quarter of this year, suggesting that the third quarter will be positive. This may also be aided by higher levels of inventory, which were up almost 55% compared to the first quarter.

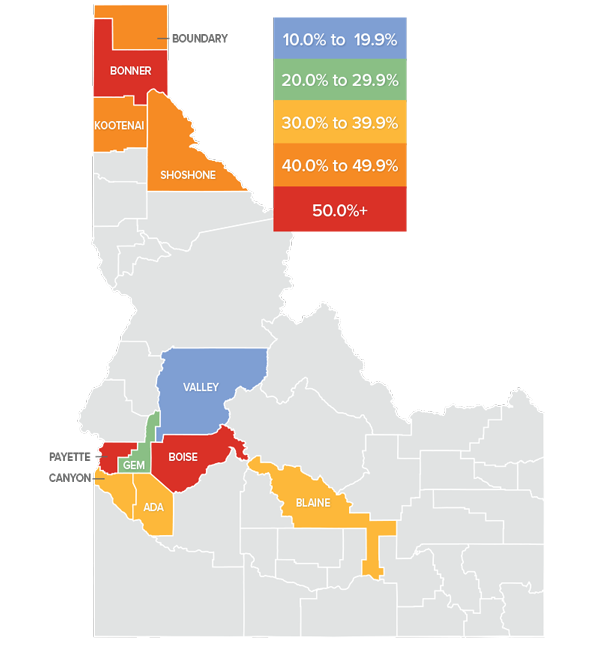

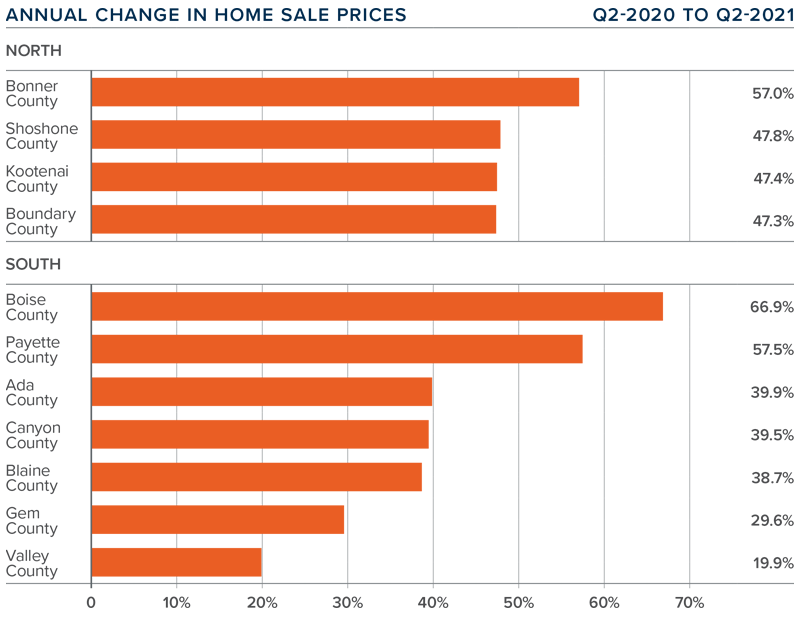

idaho Home Prices

❱ Compared to a year ago, the average home price in the region rose 44.4% to $558,161. Prices were also up 8% compared to the prior quarter.

❱ Southern Idaho also saw significant year-over-year gains. Boise County jumped almost 67%. Of additional note was that prices were only .6% higher in Southern Idaho compared to the prior quarter.

❱ Prices rose year over year by at least 47% in all Northern Idaho counties covered by this report, and they were 9% higher than in the first quarter of this year. Some suspect that prices are being driven up by an increase in buyers from nearby Spokane, Washington moving to Northern Idaho where prices and supply are better, and it’s close enough to commute to Spokane for work.

❱ Buyers still outnumber sellers, which resulted in steep price increases. This may also be a function of mortgage rates rising in the first quarter, which nudged more buyers off the fence even as inventory levels remained very weak.

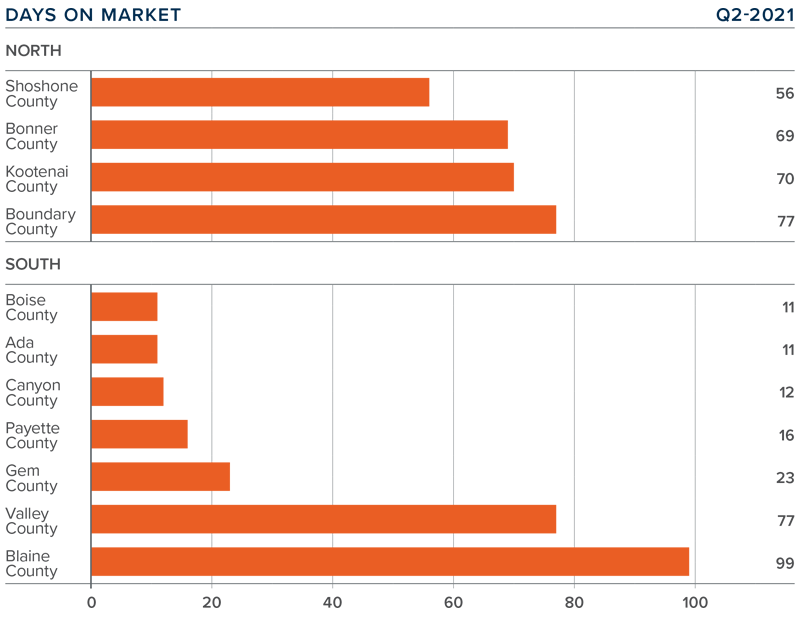

Days on Market

❱ It took an average of 68 days to sell a home in Northern Idaho, and 36 days in the southern part of the state covered by this report.

❱ The average number of days it took to sell a home in the region dropped 29 days compared to the second quarter of 2020 and was down 27 days compared to the first quarter of this year.

❱ In Northern Idaho, days-on-market dropped in all counties compared to a year ago, and market time was also lower than in the previous quarter. In Southern Idaho, market time dropped in all counties other than Valley, where it took five more days to sell a home than in the second quarter of 2020. Market time was down across the state compared to the first quarter of this year.

❱ Homes sold fastest in Boise and Ada counties in the southern part of the state, and in Shoshone County in the northern part of the state.

Conclusions

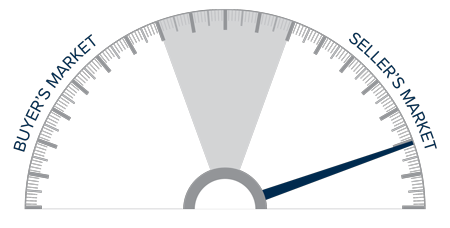

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The economy continues to perform very admirably, and this is allowing buyers to become even more confident in their decision to buy a home. Mortgage rates have pulled back, and while I expect them to tick higher as we move through the year, they will still be remarkably low from a historic standpoint. Inventory levels have risen, but demand is still outpacing supply. Therefore, I have moved the needle more in favor of home sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link