The following analysis of select counties of the Northwest Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Oregon counties contained in this report continue to recover, but employment levels are still down more than 61,000 from the pre-pandemic peak. This is mainly due to the Portland market as Multnomah County accounts for over half of the missing jobs. Even with employment not having fully recovered, the region’s unemployment rate was a healthy 3.5%, which is down from the pandemic peak of 12.8%. The Southwest Washington market has recouped all the jobs lost and added 6,600 more. During second quarter, the unemployment rate was 4.4%, which is down from 14% at the start of the pandemic.

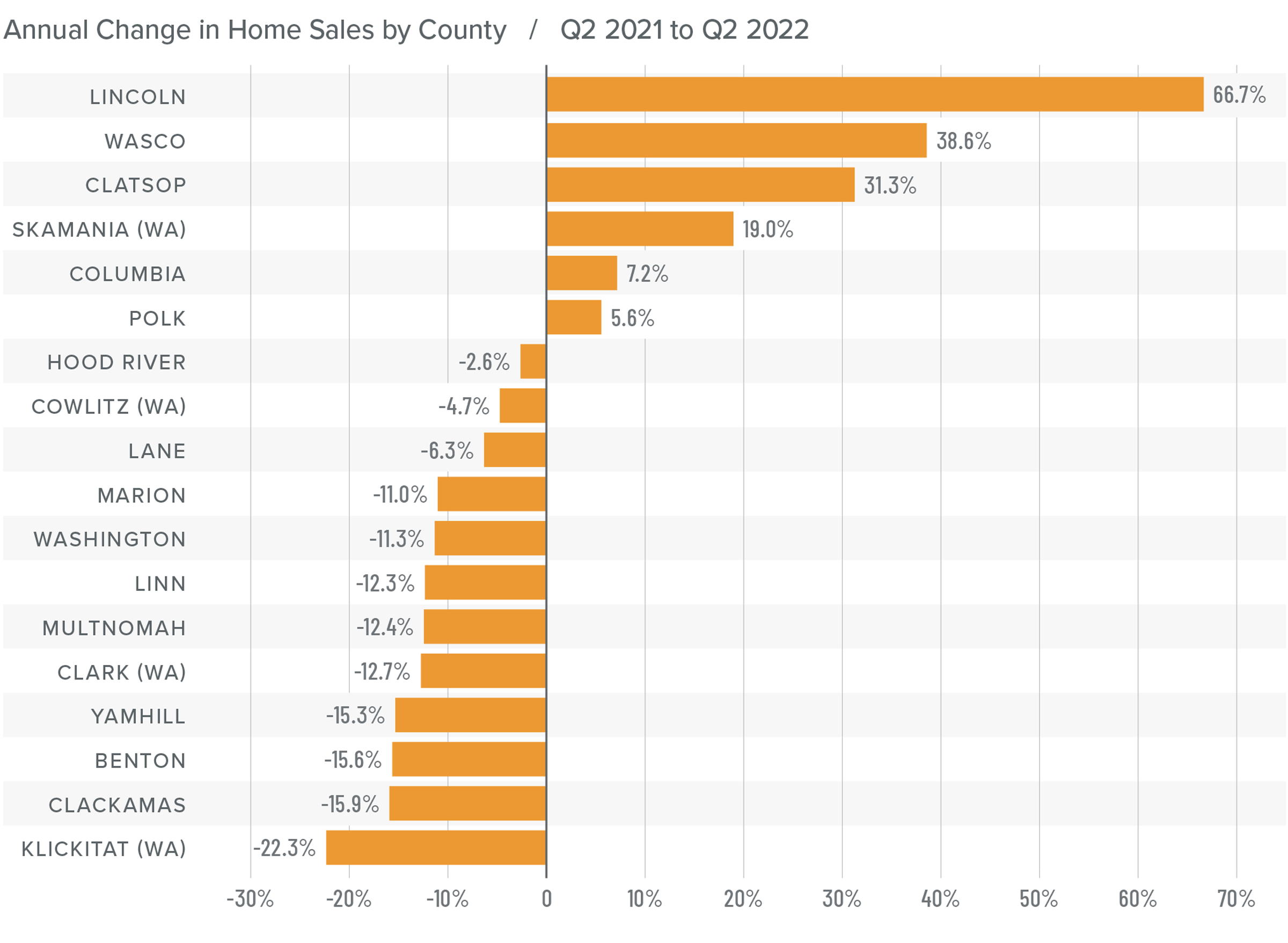

Northwest Oregon and Southwest Washington Home Sales

❱ In the second quarter, 14,558 homes sold, which is a drop of 10% compared to a year ago. Sales rose more than 33% compared to the first quarter of the year.

❱ Compared to the first quarter of this year, sales rose across the board, with double-digit increases in every county other than Clatsop.

❱ Although year-over-year sales fell overall, several markets saw transactions increase. Lincoln, Wasco, Clatsop, and Skamania counties had solid gains.

❱ The tangible growth in sales comes at a time when inventory levels have also grown significantly. This suggests that demand remains strong.

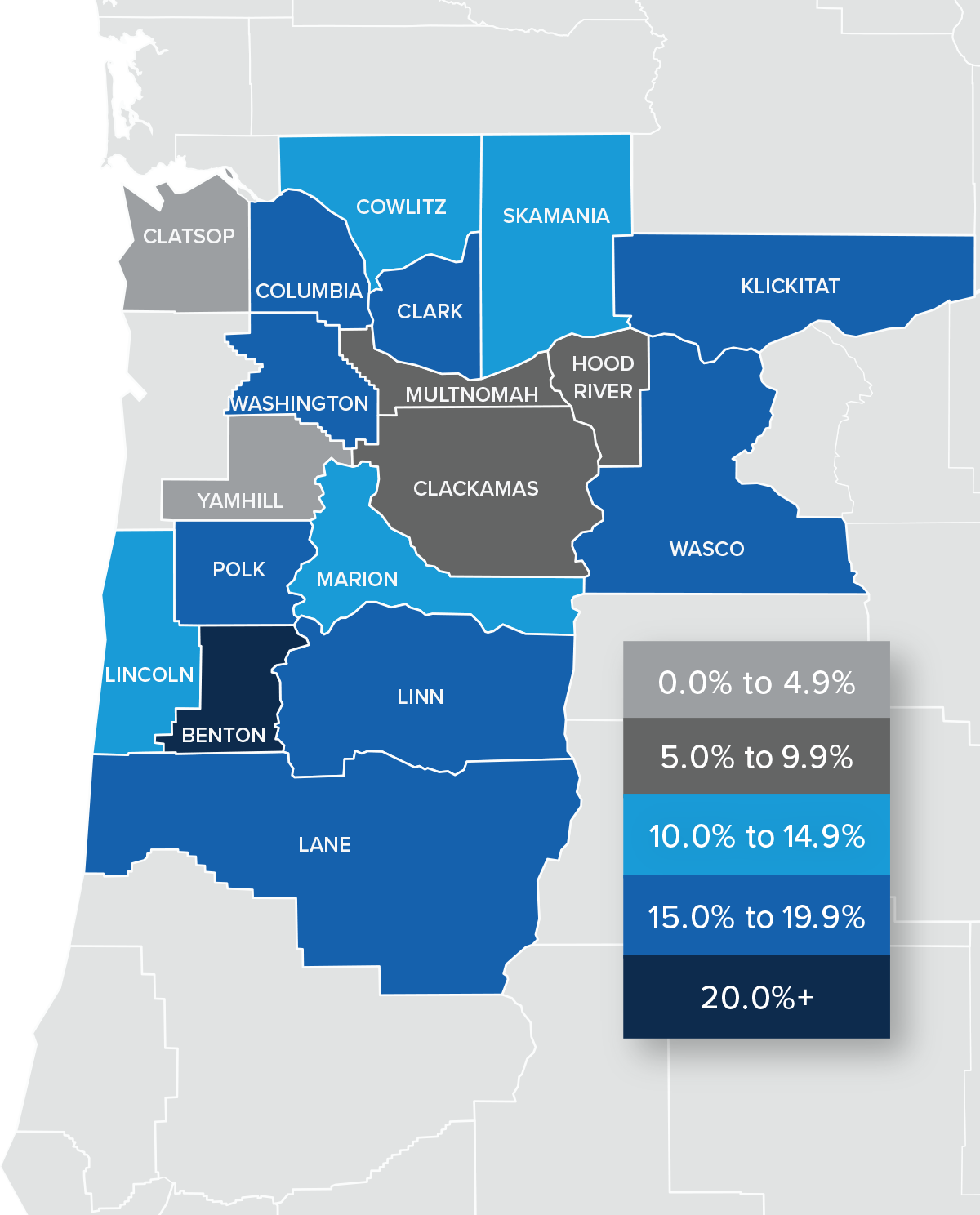

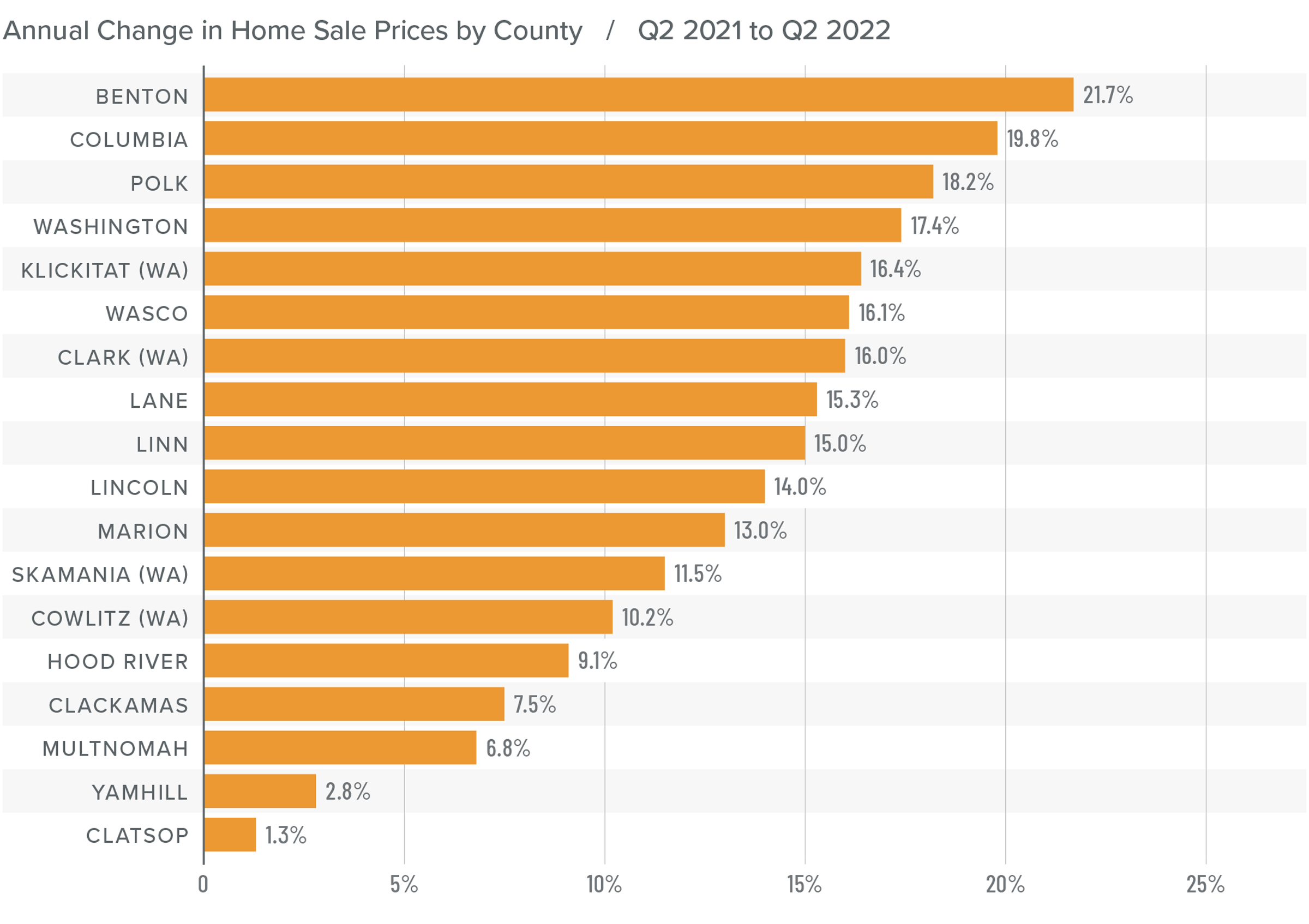

Northwest Oregon and Southwest Washington Home Prices

❱ The average home sale price in the region rose 11.2% year over year to $589,526. Prices were 7.8% higher than in the first quarter of 2022.

❱ Relative to the first quarter of 2022, average prices rose in all counties other than Clatsop and Columbia. Home prices were up by more than 20% in Hood River and Klickitat counties.

❱ All but five counties saw average sale prices rise more than 10% compared to a year ago.

❱ Rising mortgage rates have yet to impact home prices. Median list prices are still rising in most markets, which suggests that home sellers remain confident. I will be closely monitoring list prices going forward, as they will be the first indicator that the market may be cooling; I currently see no real signs of this.

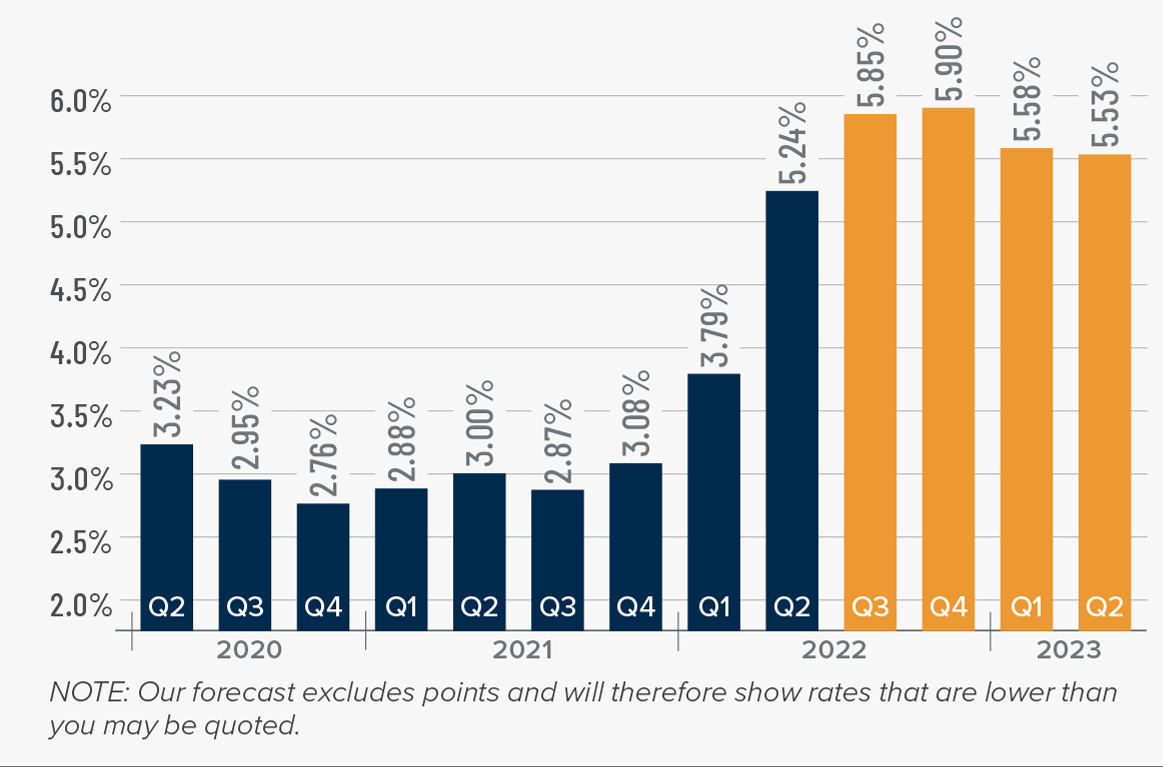

Mortgage Rates

Although mortgage rates did drop in June, the quarterly trend was still moving higher. Inflation—the bane of bonds and, therefore, mortgage rates—has yet to slow, which is putting upward pressure on financing costs.

That said, there are some signs that inflation is starting to soften and if this starts to show in upcoming Consumer Price Index numbers then rates will likely find a ceiling. I am hopeful this will be the case at some point in the third quarter, which is reflected in my forecast.

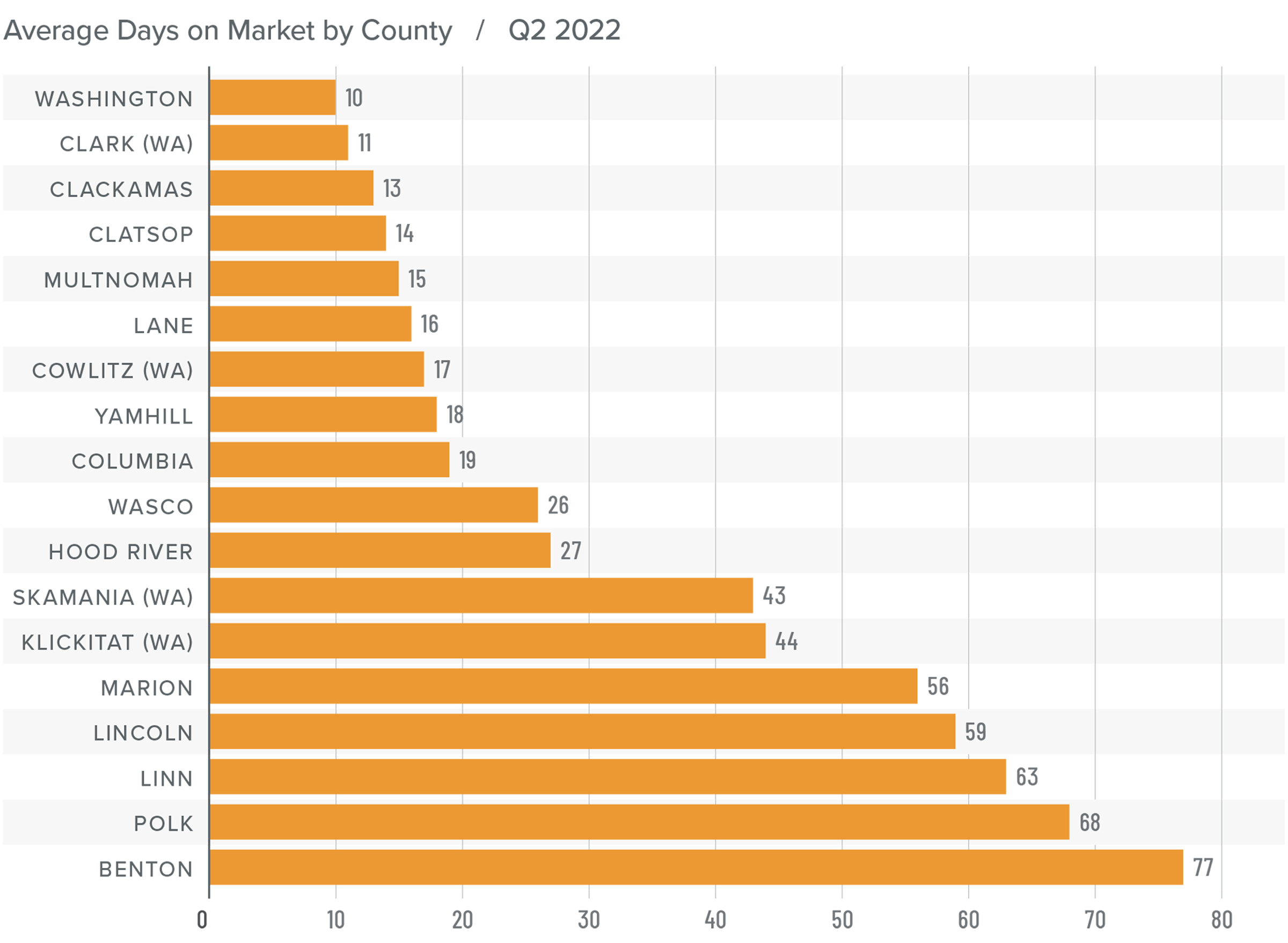

Northwest Oregon and Southwest Washington Days on Market

❱ The average time it took to sell a home in the region fell 2 days compared to the same period a year ago. It took 11 fewer days for homes to sell compared to the first quarter of 2022.

❱ The average time it took to sell a home in the second quarter of 2022 was 33 days.

❱ Skamania, Polk, Marion, Lane, and Cowlitz counties saw market time rise, while market time dropped or remained static in the rest of the region compared to a year ago. Compared to the first quarter, market time fell in all markets other than Hood River, where it rose by a modest two days.

❱ Interestingly, the average days on market in the second quarter of 2019 (pre-pandemic) was 62 days, which tells me that the current market remains bullish.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Though the job market is recovering more slowly than I would like, the housing market is still performing strongly. As we move through the year, some may believe that the market is underperforming, but this is not the case. Along with much of the rest of the country, the Northwest Oregon and Southwest Washington housing markets have been overperforming since the onset of the pandemic. As I expect the market to start trending back to its pre-pandemic pace of sales and price growth, the slowdown might feel exaggerated, but there is no cause for concern.

Despite dramatically rising financing costs, buyers still appear to be motivated. List prices have yet to “roll over,” suggesting that sellers are still confident. This, combined with the other data presented here, tells me that they are still in the driver’s seat.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link