The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Regional Economic Overview

Although it is encouraging to see jobs return to the region following the massive contraction caused by COVID-19, it is clear the recovery is losing steam. Oregon lost 285,200 jobs when the economy essentially closed last spring, but the state has now recovered 131,700 of them. This is certainly good news, but it must be acknowledged that statewide employment is still 153,500 jobs short of the levels we saw in February. In Southwest Washington, 11,000 of the jobs lost have returned but, like Oregon, the pace of recovery has stalled.

The unemployment rate in Oregon is improving as jobs return, with the rate dropping from a peak of 14.9% in April to 6% at the end of the year. The unemployment rate in Southwest Washington dropped from 14.6% to 7%. The recovery has slowed, which is not surprising given the increase in new COVID-19 infections. I still anticipate that more jobs will be added as we move through 2021, but I am expecting that the pace of growth won’t improve significantly until vaccines become readily available.

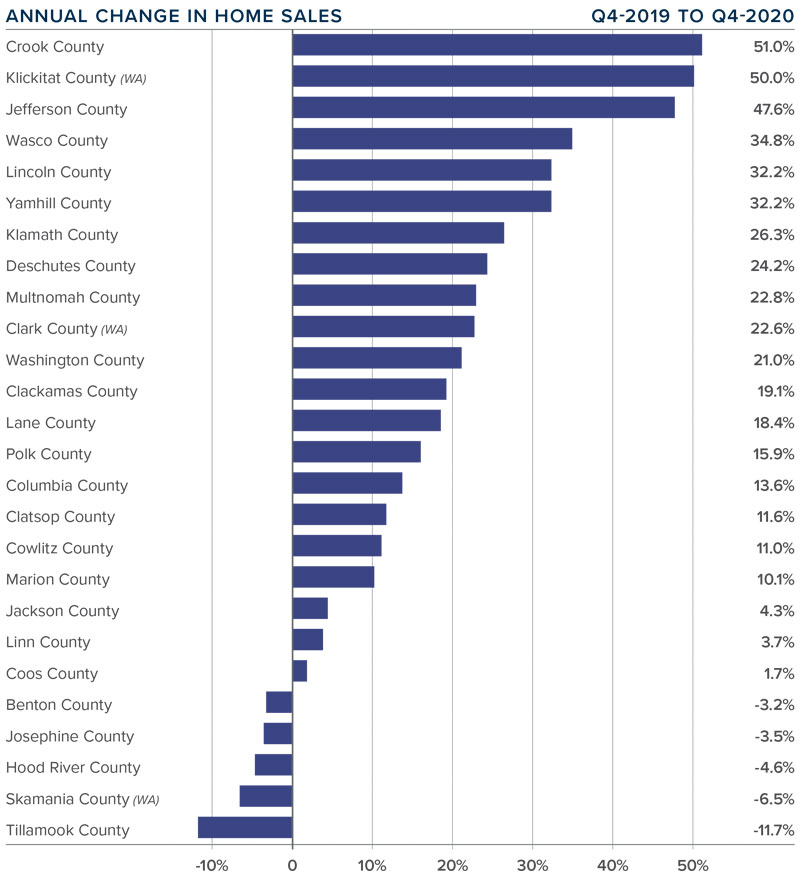

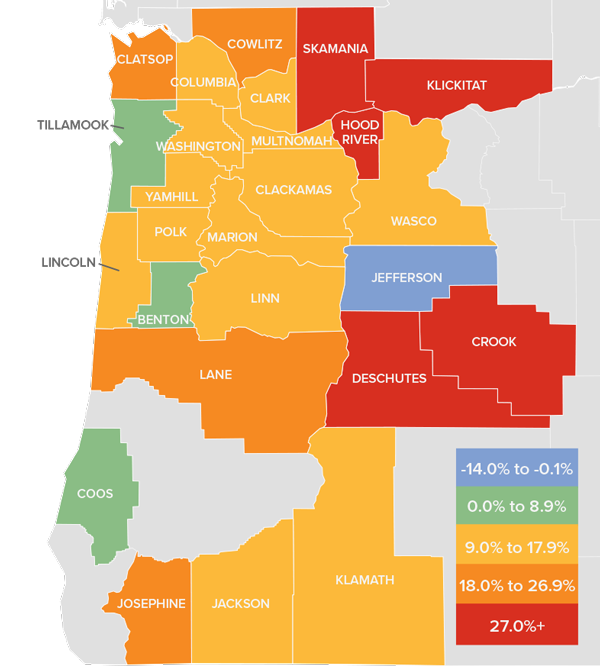

oregon and southwest washington Home Sales

❱ The final quarter of 2020 was a good one for home sales. Total transactions were up 18.1% compared to the same period a year ago, with a total of 18,216 sales closing.

❱ Sales rose in a majority of counties, but five counties saw modest declines. However, these are small markets that can be subject to significant swings.

❱ Sales were lower than in the third quarter, but this can be attributed to seasonality and a significant lack of inventory.

❱ The housing market continues to impress, and I expect we will see more transactions as we move through 2021. Demand will come from owners who no longer need to live close to their offices as they move away from the more expensive counties to areas where they see more value.

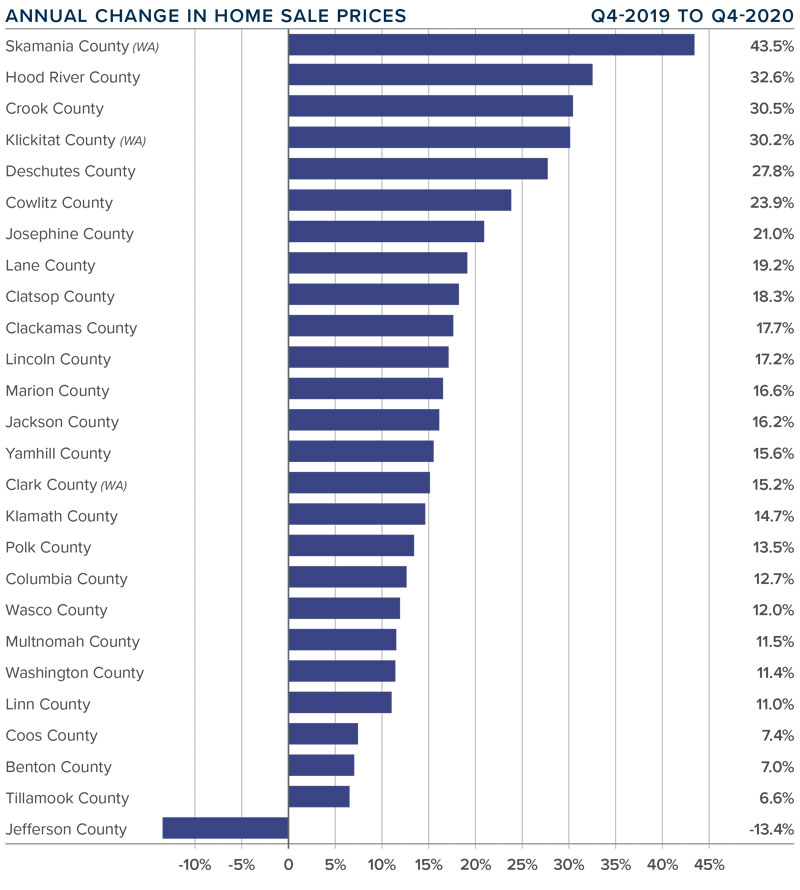

oregon and southwest washington Home Prices

❱ The average home price in the region rose a very significant 16.5% year-over-year to $476,051. Home prices were 3.4% higher than in the third quarter of 2020.

❱ Skamania County led the market with the strongest annual price growth, but this is a very small market prone to significant swings. Prices were lower in Jefferson County but, again, this is a very small market.

❱ All but one of the counties contained in this report experienced price growth compared to the final quarter of 2019. All but four counties experienced double-digit appreciation.

❱ Home prices are rising at a very significant pace, but mortgage rates are unlikely to drop much further and income growth remains muted. As such, I expect to see price growth start to slow this year.

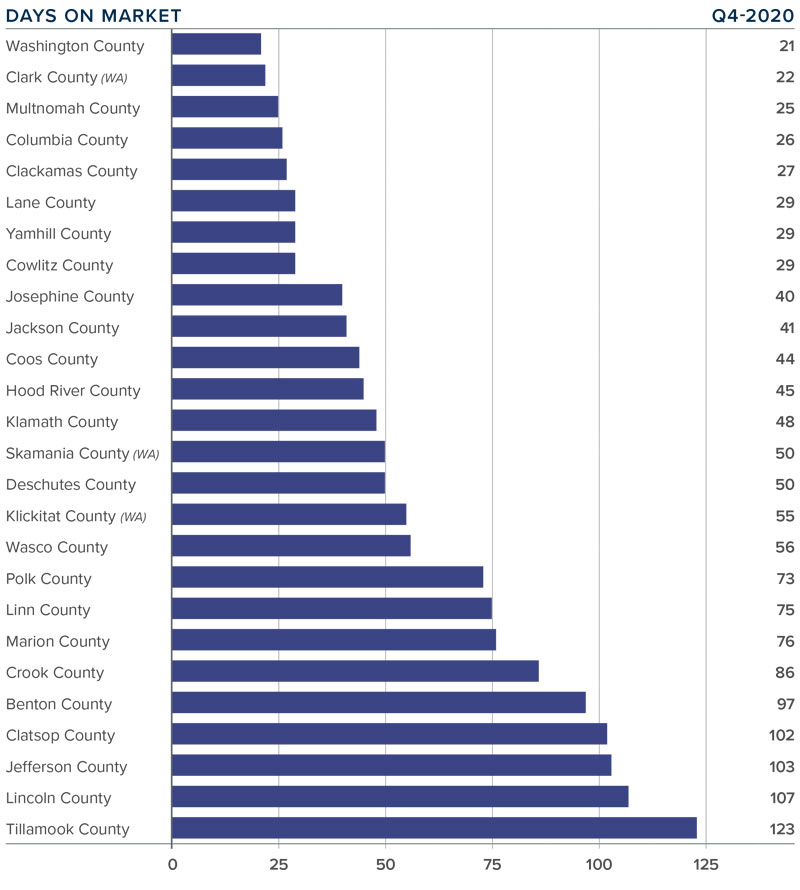

Days on Market

❱ The average number of days it took to sell a home in the region dropped 19 days compared to the fourth quarter of 2019. It took 4 fewer days to sell a home compared to the third quarter of 2020.

❱ The average time it took to sell a home in the fourth quarter was 57 days.

❱ All but one county (Benton, +7 days) saw the length of time it took to sell a home drop compared to a year ago.

❱ Homes again sold fastest in Washington County, where it took only 21 days to sell.

Conclusions

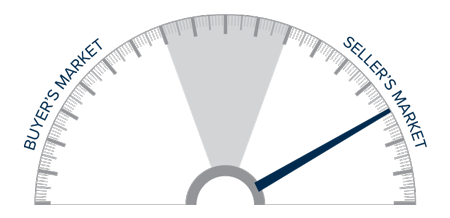

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Sales and prices are significantly higher, and demand for housing is very much in place. This favors home sellers who are still in control of the market. I do expect to see listing activity rise this year, which, in concert with modestly rising interest rates, will likely start to take some of the steam out of the market. However, any moderation in the market has yet to appear.

Given these factors, I have moved the needle further in the favor of sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link