The following analysis of select counties of the Eastern Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Year over year, total employment in Eastern Washington fell 2,909 jobs. Spokane and Grant counties collectively lost 3,253 jobs. There were minor job losses in Lincoln, Walla Walla, and Whitman counties, but employment rose in Benton and Franklin counties. Unadjusted for seasonality, the regional unemployment rate was 5%, up from 4.2% a year ago. Seasonally adjusted, the jobless rate was 5.3%, up from 4.4% a year ago. Businesses may be looking to consolidate in anticipation of a possible economic slowdown this year. Although I am not particularly worried now, I will be watching to see if job losses continue as we move through the spring, which would be a greater concern.

Eastern Washington Home Sales

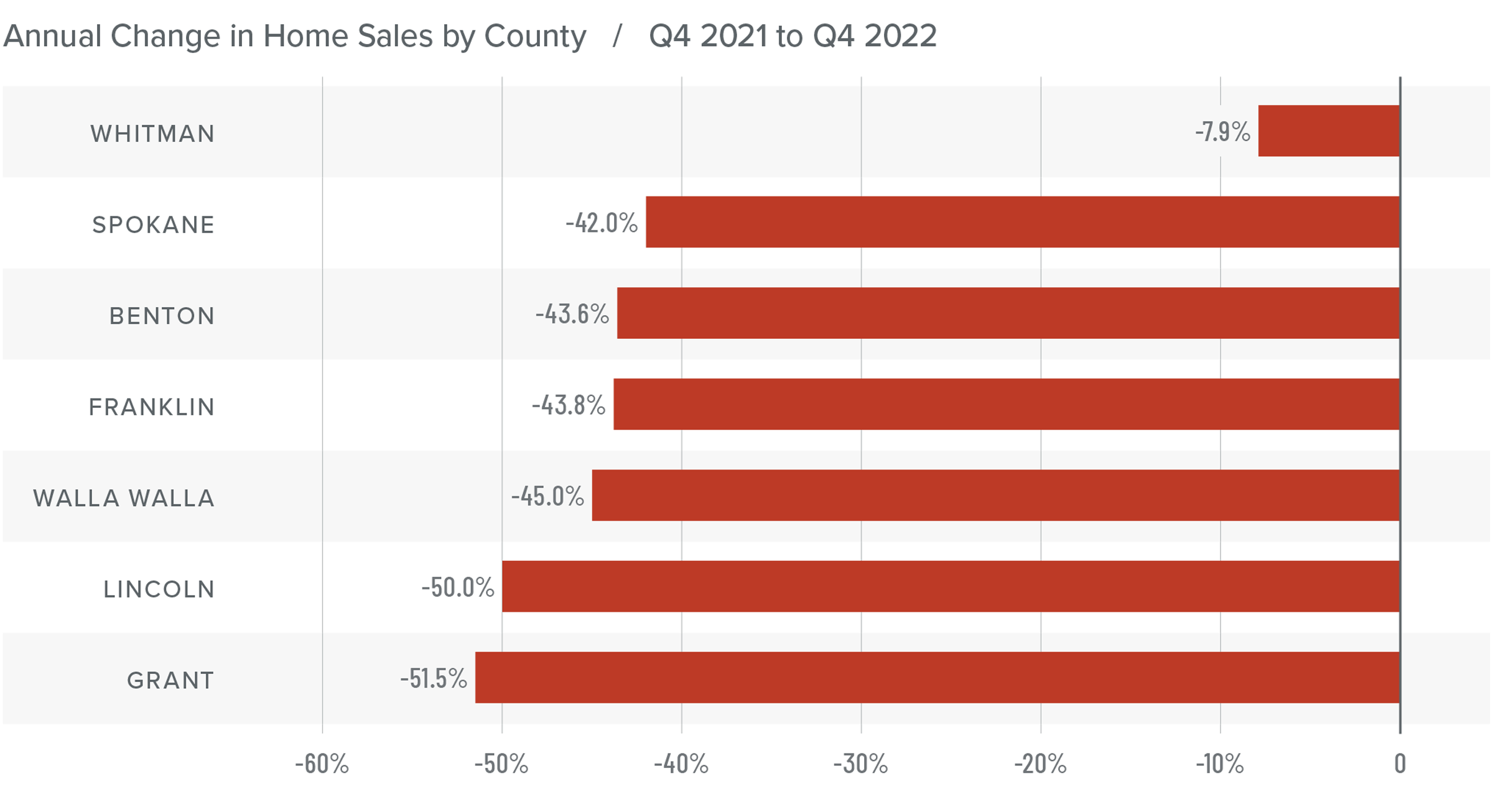

❱ In the fourth quarter of 2022, 2,167 homes sold, which was 42.8% lower than the same period the previous year and 34.4% lower than the third quarter of 2022.

❱ Listing activity rose 111% compared to the fourth quarter of 2021, but the average number of homes for sale was 12.5% lower than in the third quarter of 2022. This is expected given the slowdown that is traditional during the winter months.

❱ Year over year, sales fell across the region. Compared to the third quarter of 2022, sales were flat in Lincoln County but fell everywhere else.

❱ Pending sales fell 39.9% from the prior year, suggesting that the market will likely not see a buoyant early spring.

Eastern Washington Home Prices

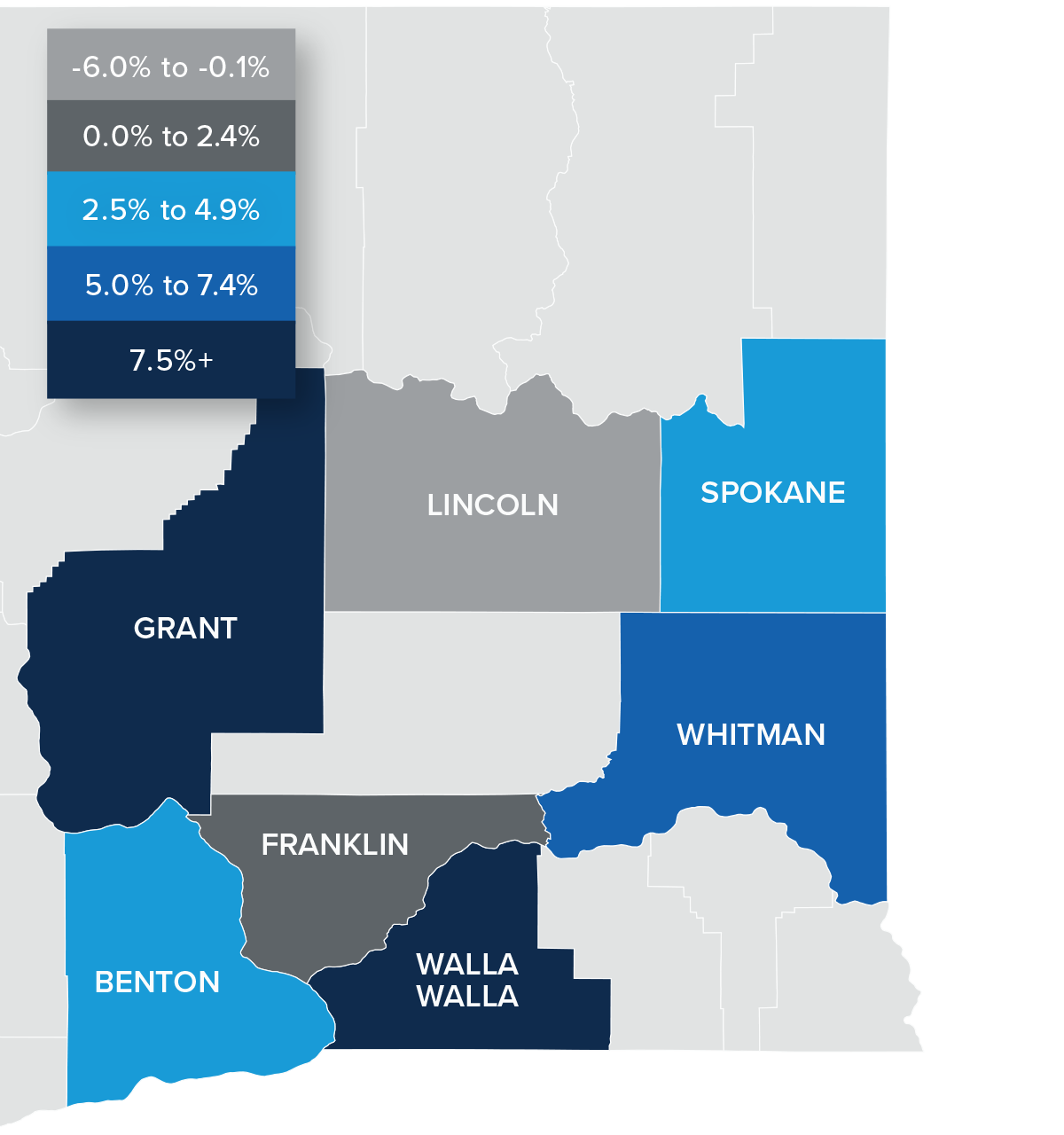

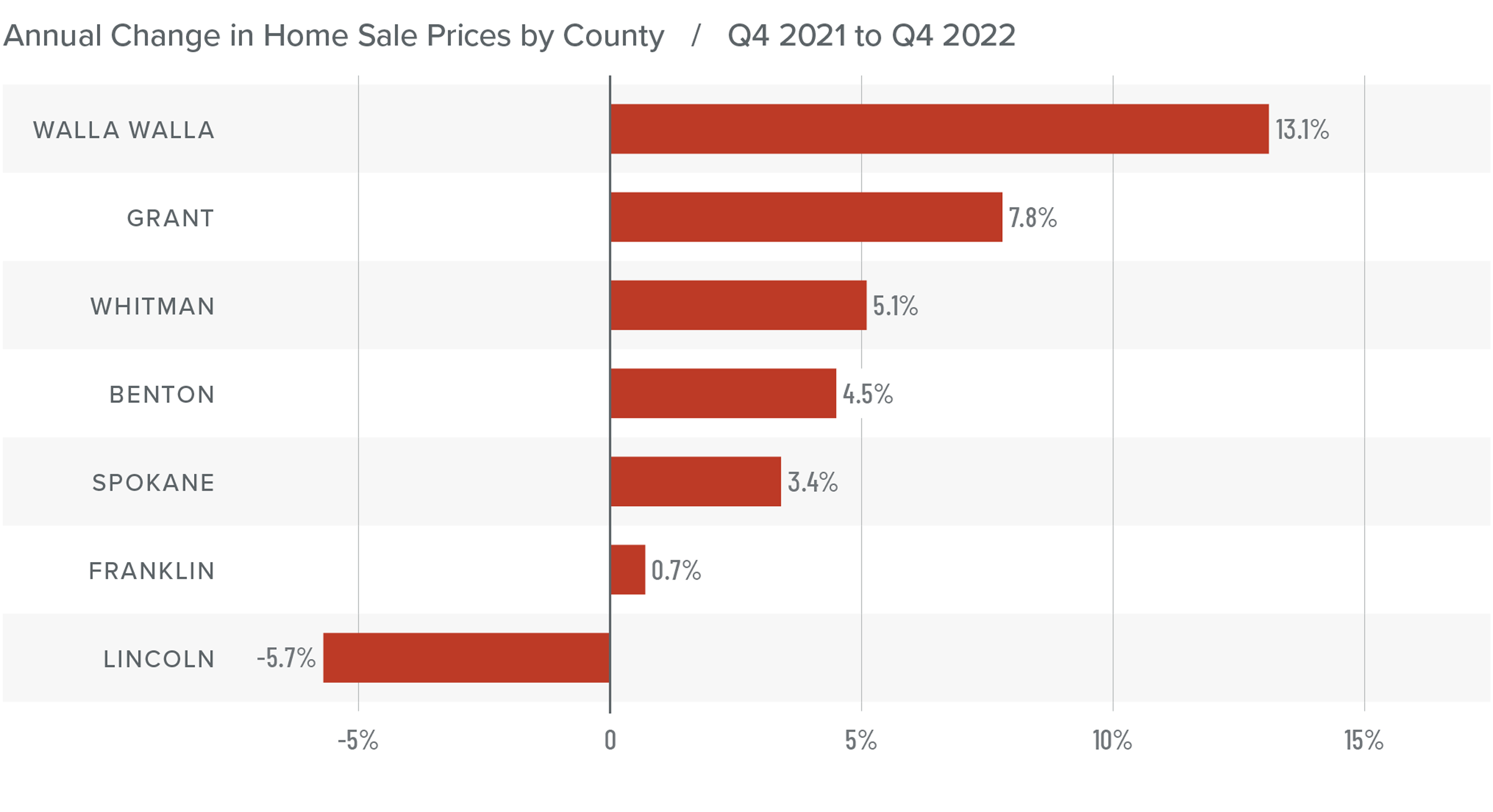

❱ Year over year, the average home price in Eastern Washington rose 4.3% to $442,603. Average prices were down 4.5% from the third quarter.

❱ Compared to the third quarter of 2022, prices fell in all counties with the exception of Franklin (+1.9%) and Walla Walla (+0.7%).

❱ Average sale prices increased year over year in every county but Lincoln. Walla Walla County experienced significant price increases.

❱ Mortgage rates peaked in the quarter, which undoubtedly impacted home prices. Additionally, median listing prices fell in all counties compared to the prior quarter, which also impacted the pace of price growth.

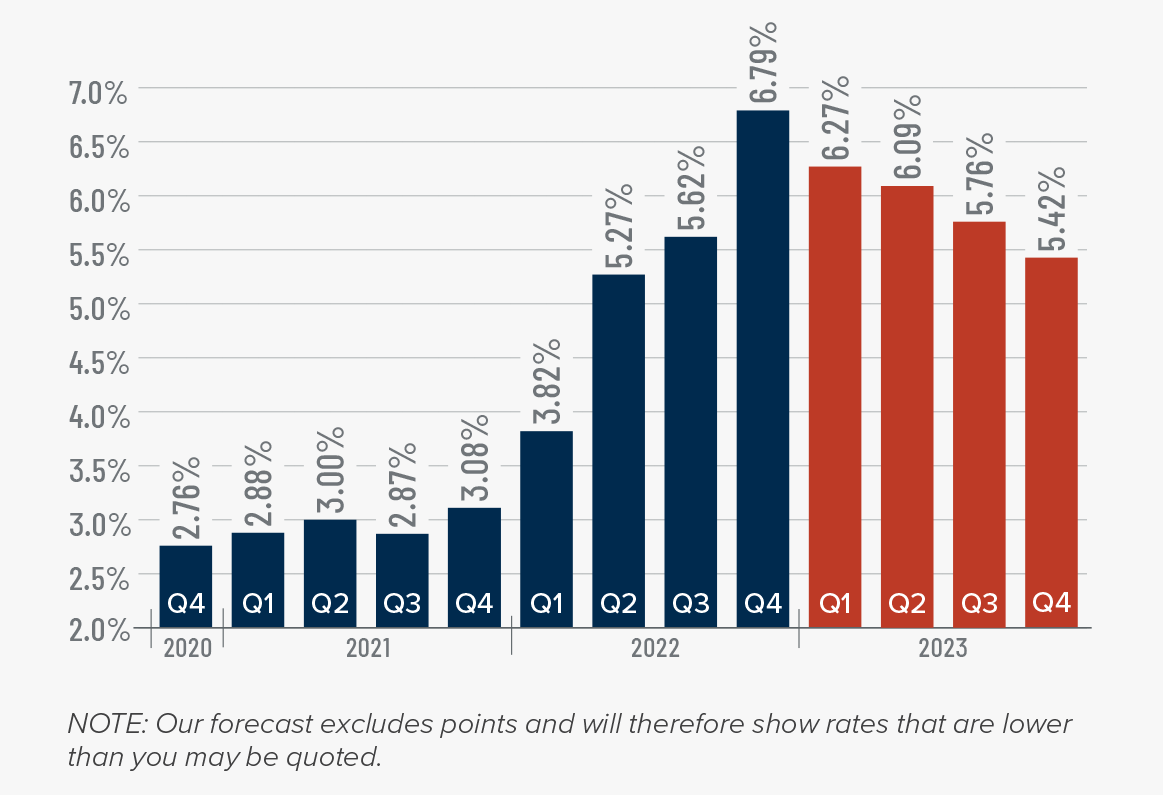

Mortgage Rates

Rates rose dramatically in 2022, but I believe that they have now peaked. Mortgage rates are primarily based on the prices and yields of bonds, and while bonds take cues from several places, they are always impacted by inflation and the economy at large. If inflation continues to fall, as I expect it will, rates will continue to drop.

My current forecast is that mortgage rates will trend lower as we move through the year. While this may be good news for home buyers, rates will still be higher than they have become accustomed to. Even as the cost of borrowing falls, home prices in expensive markets will probably fall a bit more to compensate for rates that will likely hold above 6% until early summer.

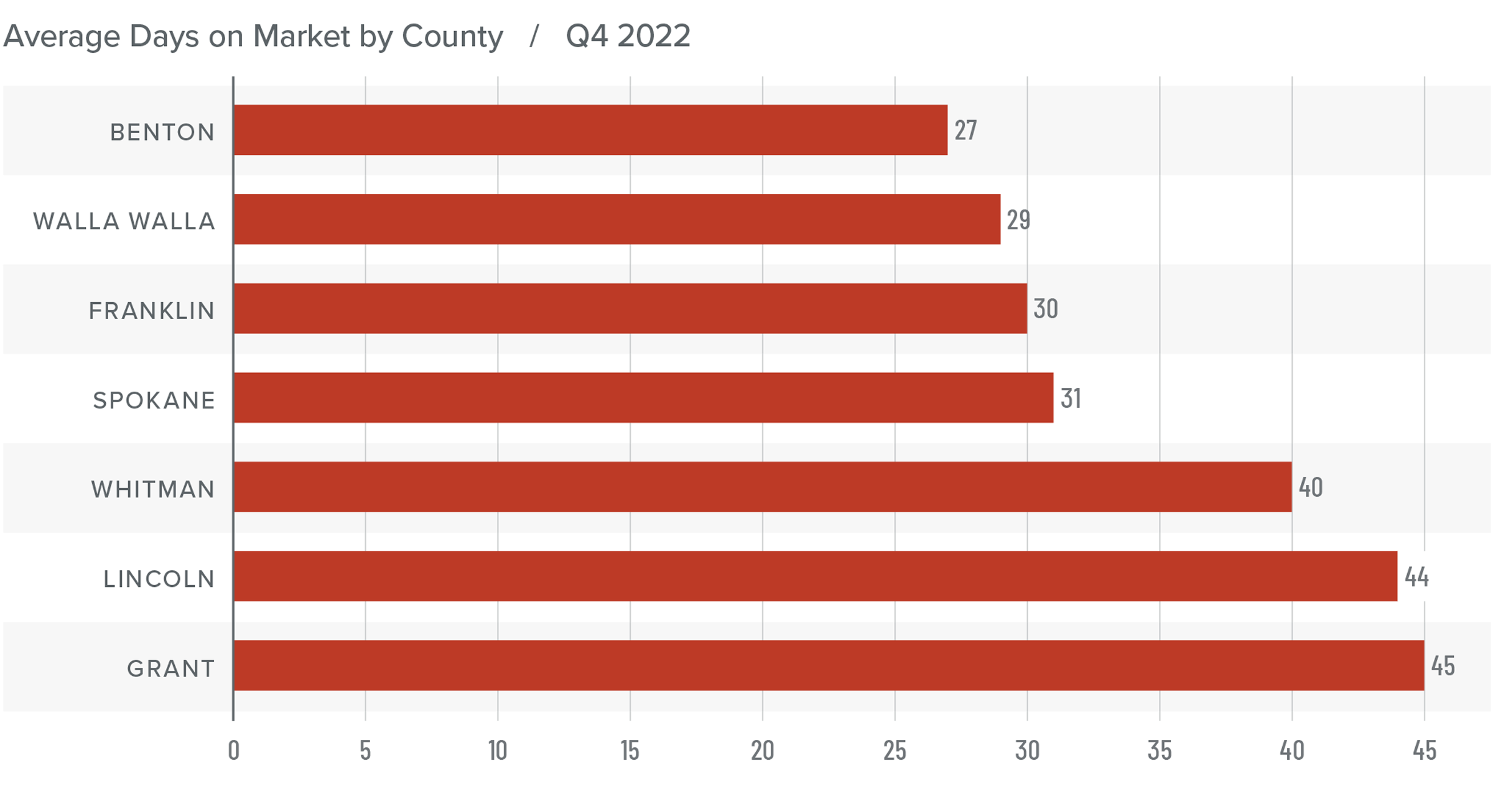

Eastern Washington Days on Market

❱ The average time it took to sell a home in Eastern Washington in the final quarter of 2022 was 35 days, which was 11 more days than the same period the previous year.

❱ Compared to the third quarter of 2022, average days on market in the region rose 11 days.

❱ All counties except Lincoln saw the average number of days it took for a house to sell rise compared to the same period the year prior.

❱ Higher financing costs and economic uncertainty have led market time to rise, but it’s possible that buyers are waiting for both mortgage rates and prices to fall further before starting their home search.

Conclusions

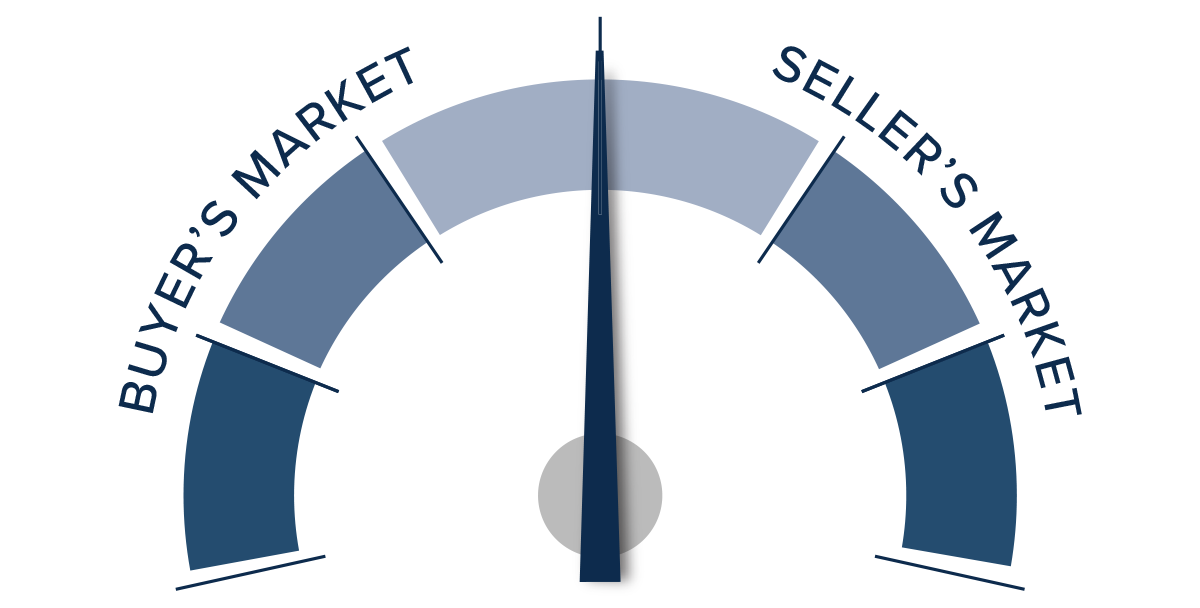

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

I suggested in the last Gardner Report that higher financing costs were starting to act as a significant headwind in the market, and I stand by this statement. That said, seasonality always skews the numbers, so I will see how the spring market performs before I consider the region to be firmly in the hands of home buyers.

I expect prices will fall a little further before stabilizing and then starting to rise again at a significantly slower pace. Because the current market favors neither buyers nor sellers, I have moved the needle to the center.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link