ECONOMIC OVERVIEW

Southern California continues to add jobs but the rate of increase has started to taper. Through the end of the first quarter of 2016, the counties that make up this report added 71,100 new jobs, and year-over-year, employment is up by 196,100 total jobs for a growth rate of 2.1%. Regional unemployment remains steady or is dropping modestly, and most counties are at or approaching full employment.

HOME SALES ACTIVITY

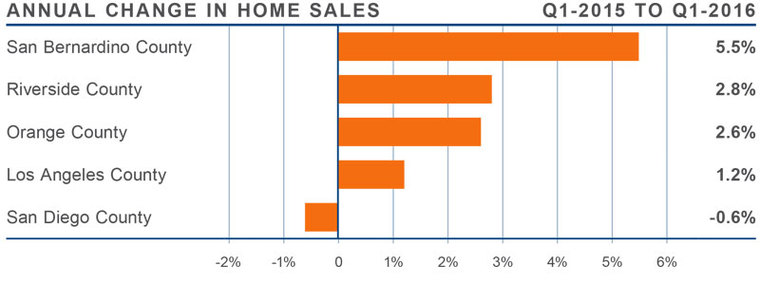

There were a total of 38,917 sales in first quarter, which is a modest increase of 1.9% compared to a year ago.

The modest increase in sales is primarily due to inventory constraints and price/affordability. Total listings were down by 5.5% in first quarter when compared to the first quarter of 2015.

Home sales grew fastest in San Bernardino County, at twice the rate of the other counties contained in this report.

San Diego County saw a modest decline in sales which is a direct result of a 9.1% decrease in active listings.

HOME PRICES

Compared to first quarter of last year, average prices in the region rose by 5.8% to $594,152. We are seeing a slowdown in price growth that can be attributed to affordability issues that are becoming prevalent in many markets.

Orange County saw the greatest appreciation in home values (+8.8%) to $767,667. This was closely followed by L.A. County where the average price rose to $747,300.

DAYS ON MARKET

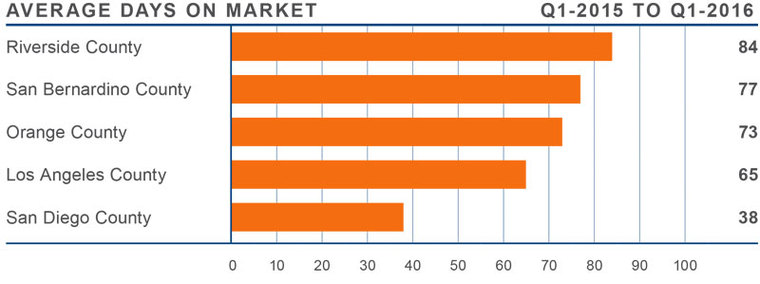

The average time it took to sell a home in the region was 56 days. This is a drop of five days when compared to the first quarter of 2015.

Homes in San Diego County sell at a faster rate than the other markets in the region. In the first quarter, it took an average of 38 days to sell a home, which is 10 days less than a year ago.

The drop in days on market can be blamed on a lack of available inventory. I am optimistic that we will see more homes for sale as we move through the year, but demand will certainly continue to outstrip supply during 2016.

All counties saw a drop in the amount of time it took to sell a home between the first quarter of 2015 and the first quarter of 2016.

CONCLUSIONS

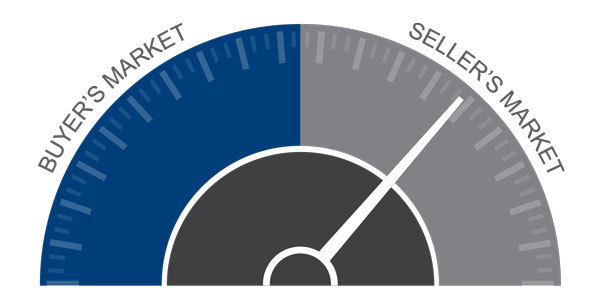

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. The regional economy continues to expand but the rate of growth has started to taper. Inventory constraints persist, which has been driving prices higher, but this has given rise to affordability issues which are becoming pervasive.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. The regional economy continues to expand but the rate of growth has started to taper. Inventory constraints persist, which has been driving prices higher, but this has given rise to affordability issues which are becoming pervasive.

In the coming months, the housing market will continue to favor sellers; however, for the time being, concerns about escalating home prices should be offset somewhat by the continuation of very competitive mortgage rates. We will still see strong demand for homes, but I believe we’re going to start moving towards a more balanced market through the duration of 2016.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link