The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The counties covered by this report — Los Angeles, San Diego, San Bernardino, Orange, and Riverside — saw total employment rise by 21,700 jobs (+0.2%) year-over-year, reversing the drop in total employment in the second quarter. Job growth was a mixed bag among the counties though. There was growth in San Diego, Riverside, and San Bernardino counties but modest drops in Los Angeles and Orange counties.

Over the past year, the unemployment rate in Southern California dropped from 4.4% to 4.2%, with total unemployment down year-over-year by 21,700 persons. In all, this was a pretty good report and demonstrates a return to normalized growth rates after the state re benchmarking, which led the second quarter numbers to appear worse than they really were.

HOME SALES

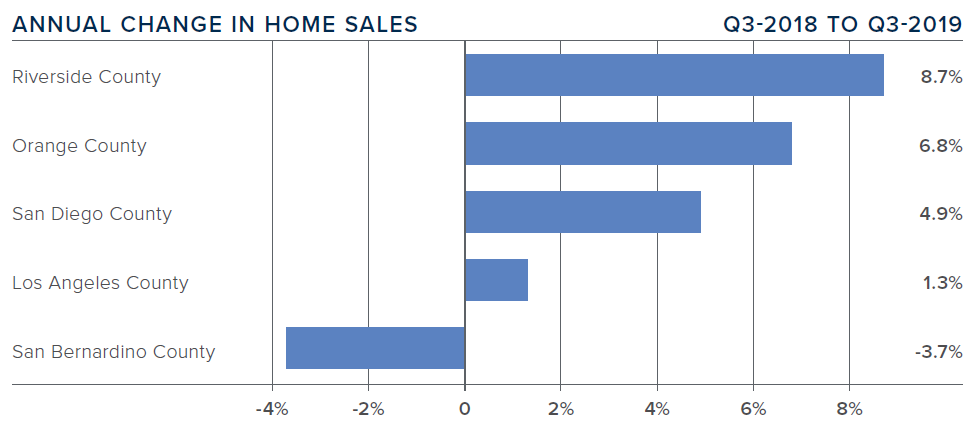

- There were 49,214 home sales in the third quarter. This was an increase of 3.5% from the same period in 2018 but 1.6% lower than in the second quarter of this year.

- Pending home sales (an indicator of future closings) rose 10.3% compared to a year ago, suggesting that total sales in the fourth quarter are likely to be an improvement over current levels.

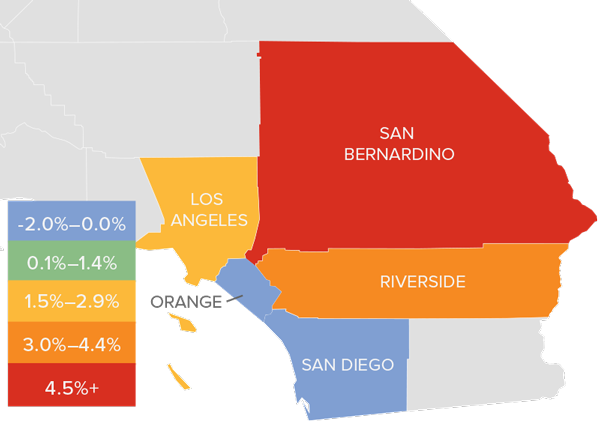

- Third-quarter home sales rose in all counties other than San Bernardino. There was also a significant growth in the relatively affordable Riverside County (+8.7%).

- There was an average of 39,208 active listings in the third quarter — down 5.9% from a year ago and 2.4% lower than in the second quarter of the year. The market is tighter than I would like but there is clearly demand from buyers.

HOME PRICES

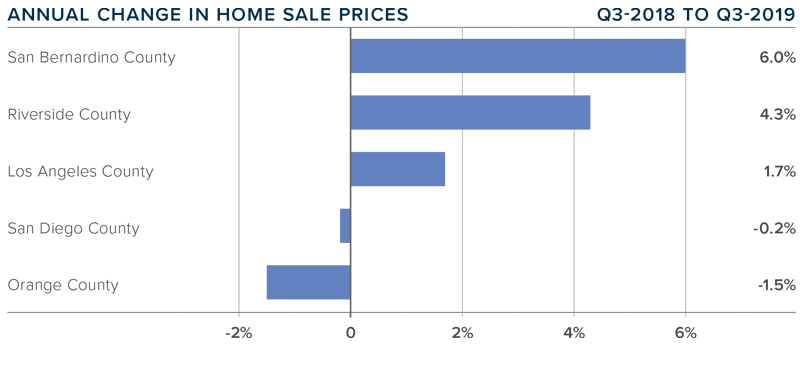

- Year-over-year, average home prices in the region were modestly higher (+1.2%). Compared to the second quarter of this year, they were a mere 0.5% higher.

- Affordability concerns, combined with slowing job growth, suggest that price growth is likely to continue to taper in many Southern California markets.

- Continuing the trend we saw in the second quarter of this year, price growth in the third quarter was mixed. Sale prices were higher in three counties but modestly lower in two. San Bernardino County took over the number one spot for price growth (+6%). Riverside County also saw significant price gains. Sale prices dropped in San Diego and Orange counties, but this is not of great concern at the present time.

- On a year-over-year basis, I still expect home prices to continue rising, but this is primarily due to very low mortgage rates.

DAYS ON MARKET

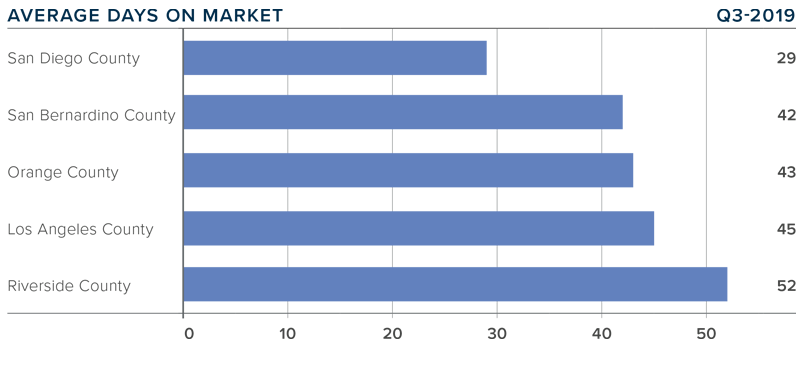

- The average time it took to sell a home in the region was 42 days, which is 4 days more than a year ago, but 2 days less than last quarter.

- All markets saw the time it took to sell a house increase compared to the third quarter of 2018.

- Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the second quarter, it took an average of 29 days to sell a home. This is only 2 more days than it took a year ago.

- Market time is increasing, which may concern some, but it is simply a move back to a more balanced market.

CONCLUSIONS

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Inventory levels and affordability concerns in many markets continue to have a slowing effect on price growth. However, pending sales are higher which suggests that the market is still buoyant, thanks in part to competitive mortgage rates.

Given the drop in the number of homes for sale, I have moved the needle a little more toward sellers.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link