The following analysis of select counties of the Utah real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

ECONOMIC OVERVIEW

According to the Labor Department, Utah added 46,200 non-agricultural jobs over the past 12 months, representing a very substantial growth rate of 3.1%. Although the area has experienced a slowing in employment gains, the economy is running at full employment, which limits how many new jobs can be created. In February, the unemployment rate was measured at 3.1%, down from 3.3% a year ago. I maintain my position that the regional economy will continue to outperform the country in terms of job growth and remain one of the most dynamic markets in the country.

HOME SALES ACTIVITY

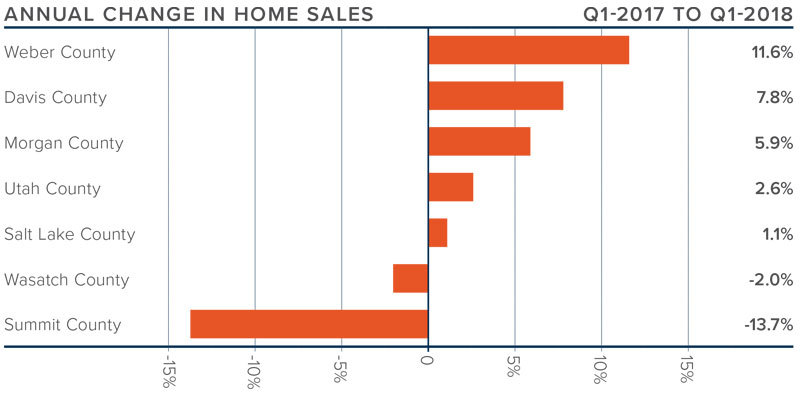

- There were 7,002 home sales during the first quarter of 2018, an increase of 3.2% from the same period in 2017.

- Total sales activity rose in five of the counties analyzed in this report, with a solid increase of 11.6% in Weber County. Sales fell the most in Summit County, but this is a relatively small market so the drop is not a concern.

- Listing activity continues to run at well below historic averages, with the average number of homes for sale in the first quarter down 39.8% from a year ago.

- The lack of supply continues to put downward pressure on home sales.

HOME PRICES

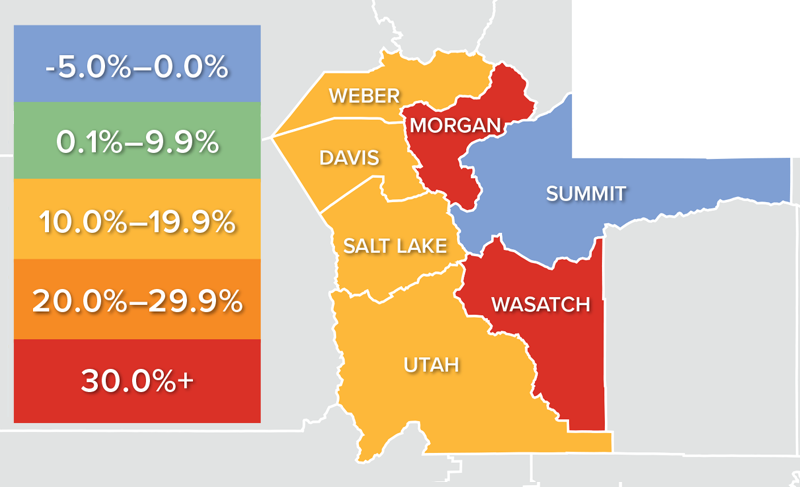

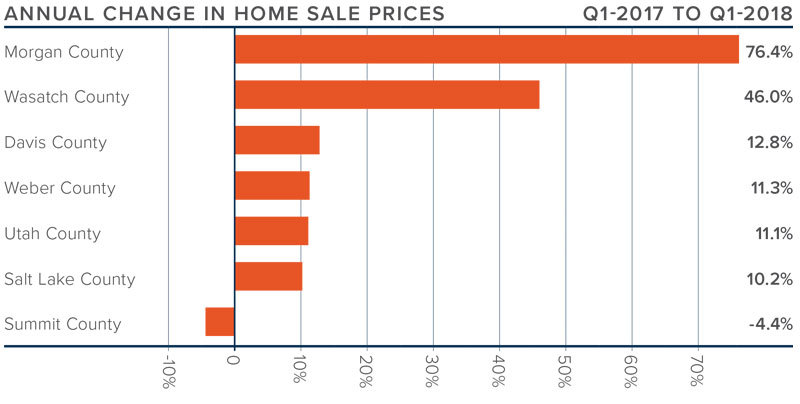

![]() The average home price in the region continues to rise with a year-over-year increase of 8.4% to $350,403.

The average home price in the region continues to rise with a year-over-year increase of 8.4% to $350,403.

- Wasatch County experienced solid price growth. Average sale prices there rose by 46%, which is largely a function of it being a relatively small county. Interestingly, average sale prices fell in Summit County—again, due to its small market size.

- Appreciation was strongest in Morgan County, where home prices rose by a substantial 76.4%. Although this may sound extreme, it is a very small market and subject to major swings. In this case, the average home price in January was $1 million which substantially skewed the numbers.

- In aggregate, home prices continue to appreciate at above-average rates due to supply limitations.

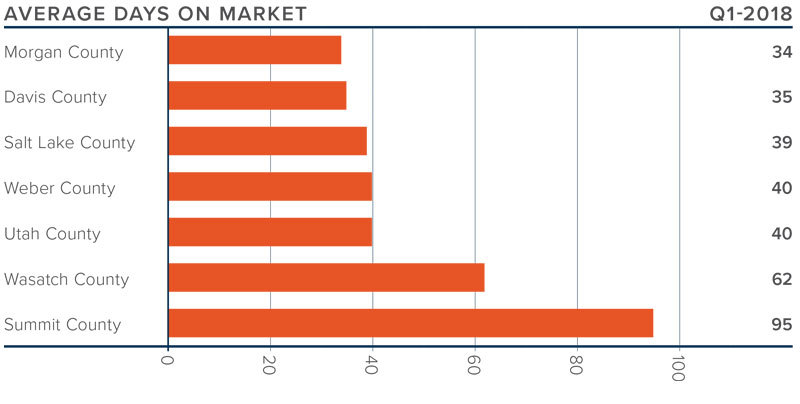

DAYS ON MARKET

- The average number of days it took to sell a home dropped by 20 days when compared to the first quarter of 2017.

- Sales occurred the fastest in Morgan and Davis Counties and slowest in Summit County, but all markets saw the length of time it took to sell a home either remain static or drop compared to the first quarter of 2017.

- During the first quarter of this year, it took an average of 49 days to sell a home in the region.

- The market remains robust, and well-priced homes are selling very quickly.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the first quarter of 2018, I moved the needle a little more in favor of sellers. Unfortunately, I don’t believe we’ll see much improvement in listing activity in the coming months, which means sellers will continue to remain firmly in the driver’s seat.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the first quarter of 2018, I moved the needle a little more in favor of sellers. Unfortunately, I don’t believe we’ll see much improvement in listing activity in the coming months, which means sellers will continue to remain firmly in the driver’s seat.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link