It’s springtime, which means spring cleaning for many households. It’s also a time to declutter and purge all those worn out, unwanted, outdated, unused and unneeded items from our closets, garages and other storage spaces.

But what do you do with all that stuff once you’ve decided to get rid of it? First, you’ll want to sort it all into various piles (sell, dump, or donate). For items that you can easily sell to get some extra cash, you can advertise on online sites such as eBay or craigslist, or take to a local consignment store. And many of your items can be donated to be reused by someone else. Your junk could be someone else’s treasure or be resold to provide funding for programs that help people in need. And some places will even take items that would normally go in the trash as long as it’s not wet, moldy or contains hazardous materials.

Thrift stores are probably the first places that come to mind, but there are a lot of other non-profit, charitable organizations in your area that would be more than willing to take your spring-cleaning discards. Here is a list of some organizations to give you an idea of the many possibilities.

NW Furniture Bank in Tacoma, Washington serves victims of domestic abuse, people suffering loss from fire and natural disasters, foster homes and especially families coming from transitional housing who are trying to rebuild their lives. NWFB relies on furniture donations from the community to help furnish the homes of families and individuals in need. They only accept new or gently-used items. View accepted donation items.

In King County, Washington, there is actually a place that accepts damaged clothes, shoes and linens for reuse or recycling. Even torn, badly worn or even stained items are now being taken by most large collectors in the area, as long as they’re not wet, mildewed, or contaminated with hazardous materials. Many other items, including stuffed animals, purses, belts, and other accessories can be donated in any condition—even single shoes, socks and gloves! Choose from several drop off or pick up organizations at www.kingcounty.gov/threadcycle.

Eastside Baby Corner in Issaquah, Washington gives to eastside families struggling with job loss, homelessness, medical crisis, and poverty. Bringing EBC the clothes, toys or furniture that your child has outgrown is an easy way to recycle and help a deserving child. When you donate new or gently-used goods, you can be confident that they will be in the hands of a local child—at no cost to the family or to one of their qualified partner agencies—almost immediately.

Bags of Love in Eugene, Oregon provides necessities and comfort items to children who are in crisis due to neglect, abuse, poverty or homelessness. They appreciate donations of new or gently used items for children ages birth through 17. Your donation will immediately be in the hands of a local child at no cost to the family or to our qualified partner agencies.

The Portland Police Bureau Sunshine Division in Portland, Oregon has been providing food and clothing relief to Portland families and individuals in need since 1923. They accept food donations, as well as donations of new and gently used clothing items. Most needed items in all sizes are: men’s clothes, women’s plus-sized clothes, adult and children’s shoes, and new children’s socks and underwear.

Habitat for Humanity has ReStores all over the U.S. and Canada where you can donate building materials, furniture, and/or appliances. Habitat for Humanity ReStores are nonprofit home improvement stores and donation centers that sell new and gently used furniture, home accessories, building materials, and appliances to the public at a fraction of the retail price. Habitat for Humanity ReStores are proudly owned and operated by local Habitat for Humanity affiliates, and proceeds are used to build homes, community, and hope locally and around the world.

There are Goodwill locations across the U.S. Donations to Goodwill has helped to create training and job opportunities for those in our communities. Plus, over the past few years, it has kept billions of pounds of clothing and household items out of landfills. They accept most clothing and household items, but don’t drop off items that have been recalled, banned or do not meet current safety standards. For specialty items such as computers, vehicles or mattresses, it’s best to give your local Goodwill agency a call first to find out any rules or restrictions around these items.

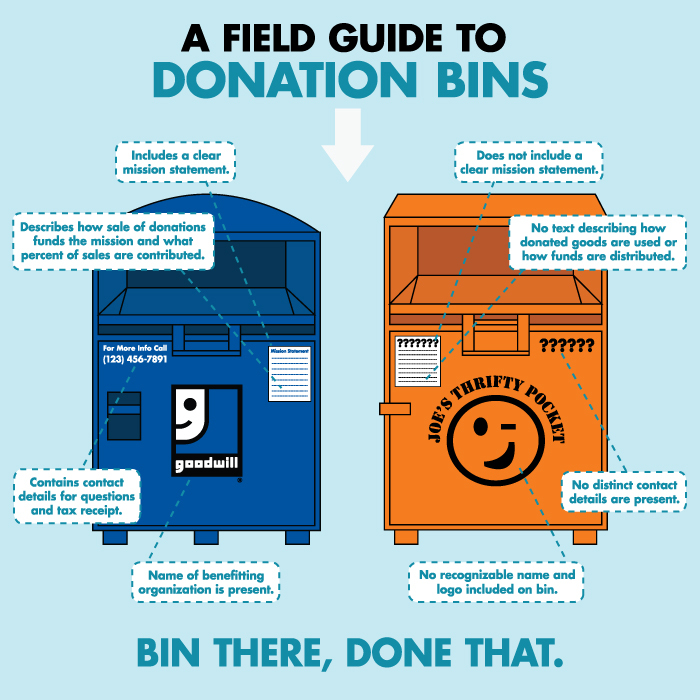

Donation Bins

Another option would be to just take your items to a donation bin. While it may be more convenient for you to drop off your items at a nearby donation bin, unfortunately, many goods that wind up in donation bins end up supporting for-profit groups, rather than aiding non-profit, charitable organizations. To help you make informed donation decisions, you can use this handy guide created by Goodwill.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Richard Eastern is a Windermere broker in Bellevue, WA and co-founder of

Richard Eastern is a Windermere broker in Bellevue, WA and co-founder of

Mr. Gardner is a land use economist and principal with Gardner Economics and is considered by many to be one of the foremost real estate analysts in the Pacific Northwest.

Mr. Gardner is a land use economist and principal with Gardner Economics and is considered by many to be one of the foremost real estate analysts in the Pacific Northwest.