The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Slow and steady is how I would describe Oregon’s job recovery following the massive COVID-19-related job losses that were seen in the spring of 2020. To date, more than 224,000 of the 285,000 jobs that were lost have returned. I’m not forecasting a full job recovery until early next year due to labor shortages and a gap between current job openings and the skills of the labor force. That said, I still expect jobs will be added in reasonable numbers as we move through 2022. Given that Southwest Washington is a far smaller market, I’m not surprised that it has already recovered all the pandemic-induced job losses, and subsequently grown by an additional 4,000 jobs. Even though the pace of the job recovery in Oregon has been relatively muted, the unemployment rate continues to trend lower and now stands at 4.2%. While this is a decent number, it is still well above the pre-pandemic low of 3.4%. The jobless rate in Southwest Washington was a solid 3.5%.

oregon and southwest washington Home Sales

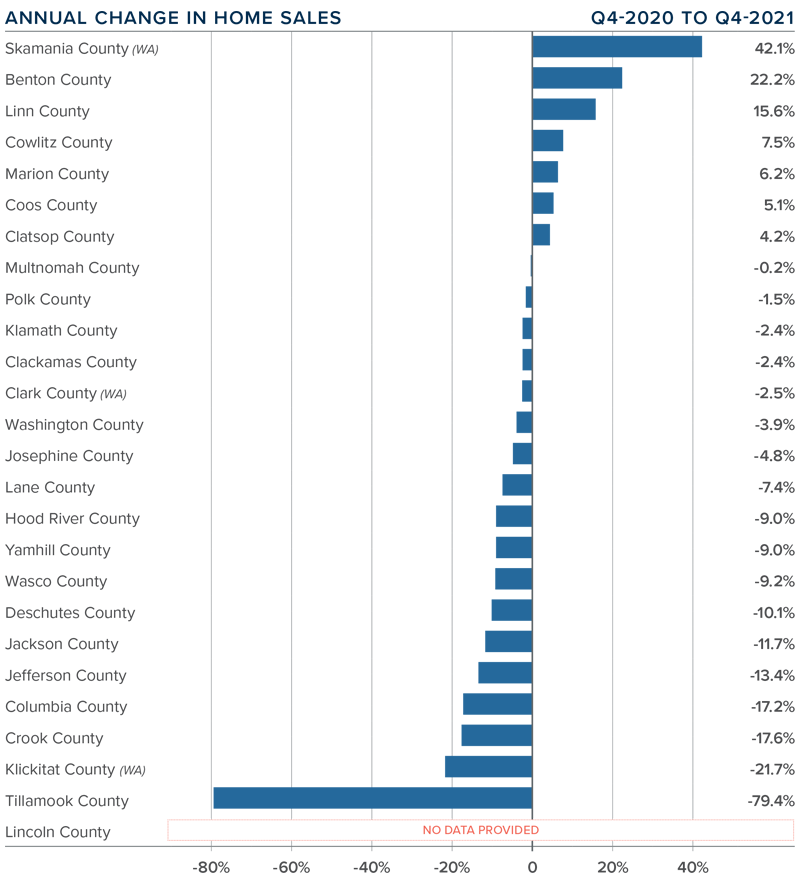

❱ During the final quarter of 2021, 17,862 homes sold, a drop of 3.6% compared to a year ago. This was mainly a result of a lack of homes for sale rather than an indication that the market is softening.

❱ Compared to the third quarter of 2021, all but four counties saw lower sales activity, which is likely due to seasonality changes in the market.

❱ Total sales were down from a year ago; however, several counties did report increases. Although most of these counties sold a relatively low number of homes, it was good to see that the drop was not across the entire region.

❱ Listing activity remains well below normal levels. Some of the drop in listings may be due to the rise of the Omicron variant of COVID-19.

oregon and southwest washington Home Prices

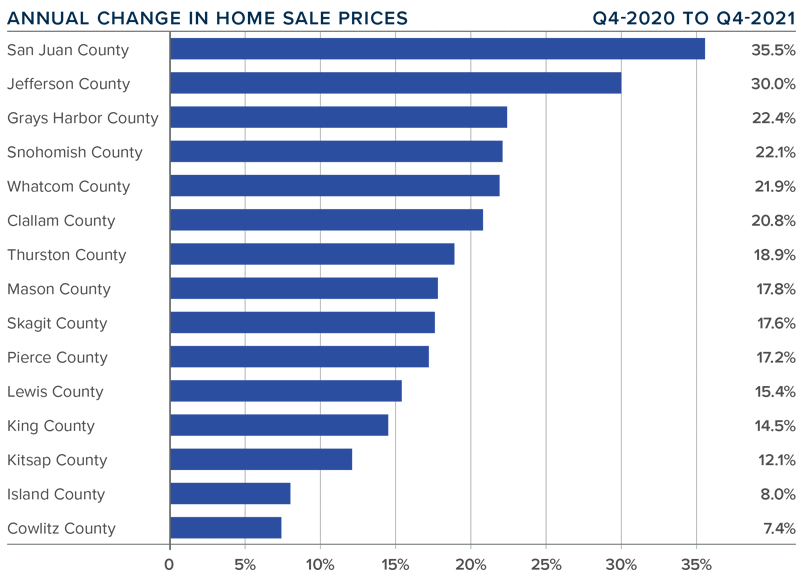

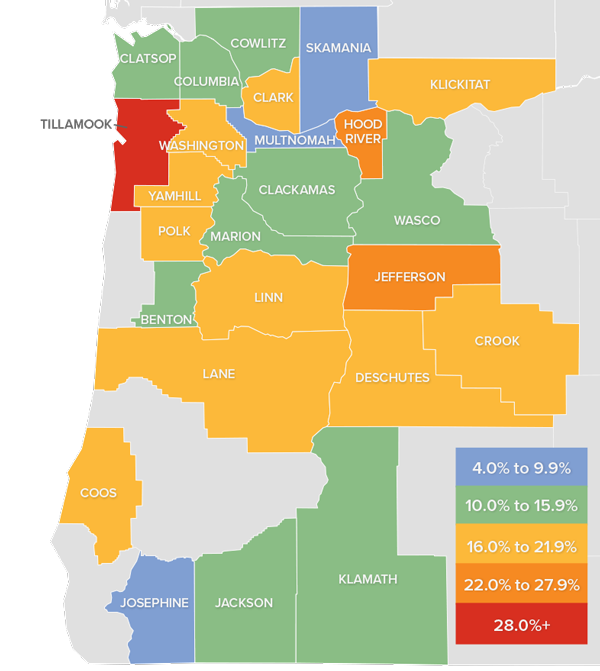

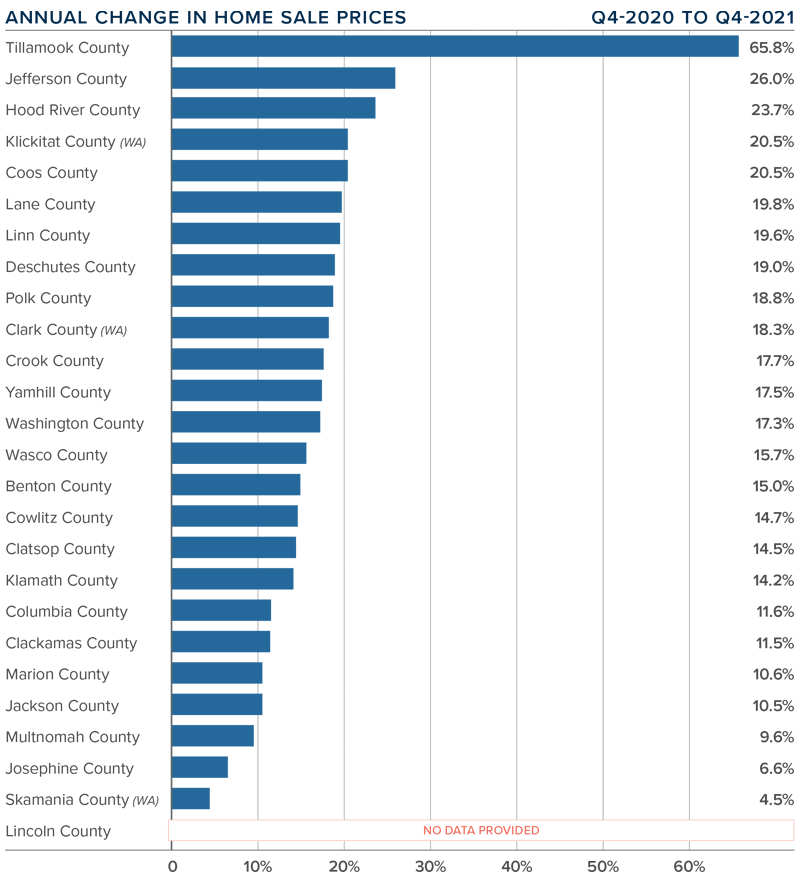

❱ Price growth continued the downward trend that started last summer but prices still rose by 14.6%, which is well above the long-term average.

❱ Compared to the third quarter of last year, 11 counties saw lower sale prices, which is likely due to seasonality changes in the market. The remaining 15 counties experienced price growth.

❱ All counties contained in this report had higher sale prices than a year ago, with very significant increases in Tillamook County. All but three counties showed double-digit appreciation.

❱ Mortgage rates in the quarter rose from 2.87% to 3.18%, which may also have contributed to the slowdown in the rapid pace of appreciation in the region.

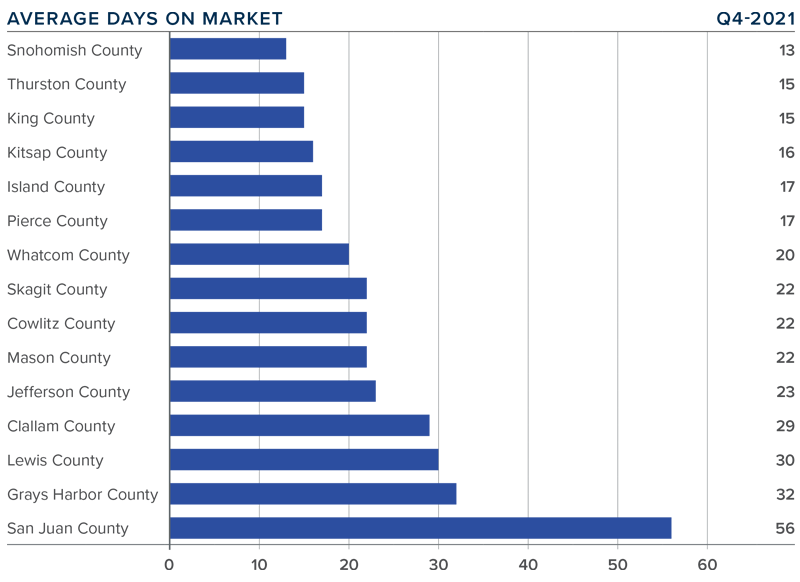

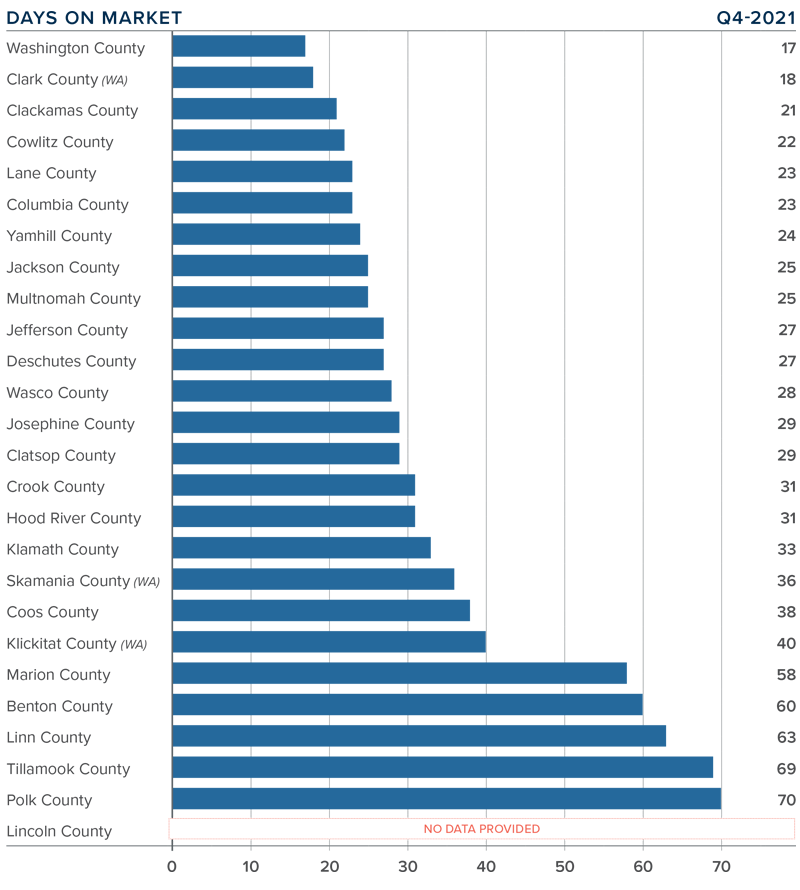

Days on Market

❱ The average number of days it took to sell a home in the region dropped 13 days compared to the final quarter of 2020. It took 2 more days for a home to sell compared to the third quarter of the year.

❱ The average time it took to sell a home in the final quarter of 2021 was 33 days.

❱ All counties except one (Polk) saw the length of time it took to sell a home drop compared to a year ago. Market time in all but four counties increased compared to the third quarter of 2021.

❱ Homes again sold the fastest in Washington County, where it took an average of only 17 days for a home to go under contract. An additional 13 counties saw the average market time drop to below a month.

Conclusions

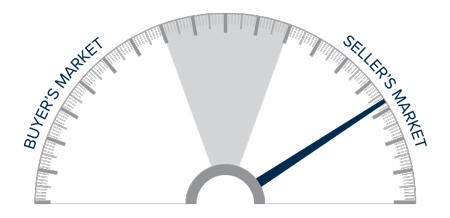

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although Oregon’s job recovery has not been as robust as many would like, its impact on the housing market really has been minimal as demand remains strong and buyers continue to take advantage of historically low mortgage rates.

Strong demand—in concert with low levels of supply and favorable financing rates—has caused prices to rise at well-above average rates. In the coming year, I believe the pace of growth will slow in the face of rising mortgage rates, which I have forecasted will reach 3.7% by fourth quarter. In addition to this, many markets are experiencing affordability constraints, which could also slow the pace of price increases.

As we move into 2022, I still believe prices will continue to rise, but the significant increases we’ve experienced over the past two year are likely behind us. While home sellers still have the upper hand, I am moving the needle a little more toward the center. The spring buying season will be a good test for buyers and sellers alike and should give me more clarity as to what the year will hold.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link