The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The annual pace of employment growth in the state continues to slow. However, the addition of 22,400 new jobs since the third quarter of 2022 represents an impressive 2.7% growth rate and is well above the national rate of 2.1%. While I expect the pace of job growth to continue to cool, jobs will still be added for the balance of the year. My current forecast calls for statewide employment to increase 2.5% in 2023 and 1.3% in 2024.

With the exception of Lewiston, where employment levels were static, all of Idaho’s metro areas had solid year-over-year nonfarm job gains. Idaho Falls saw the greatest increase at 4.2%, followed by Pocatello (+3.3%), Coeur d’Alene (+3%), Boise (+2.7%), and Twin Falls (2.6%).

The state unemployment rate was a healthy 3%, which was marginally above 2.8% in the third quarter of 2022. Regionally, the lowest jobless rate was in Idaho Falls at 2.7%. Boise’s unemployment rate was 3.5%. The highest rate was in Coeur d’Alene, where 4.5% of the workforce was actively looking for work.

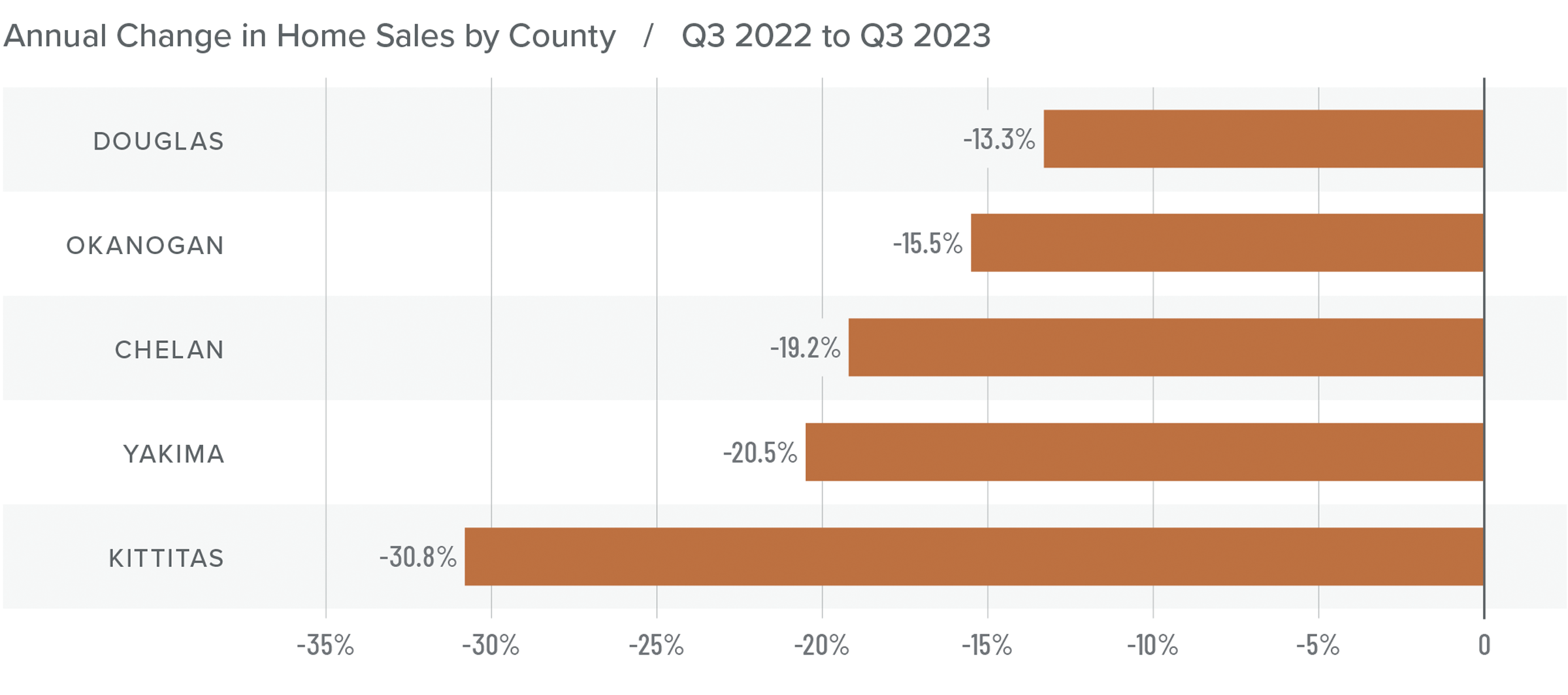

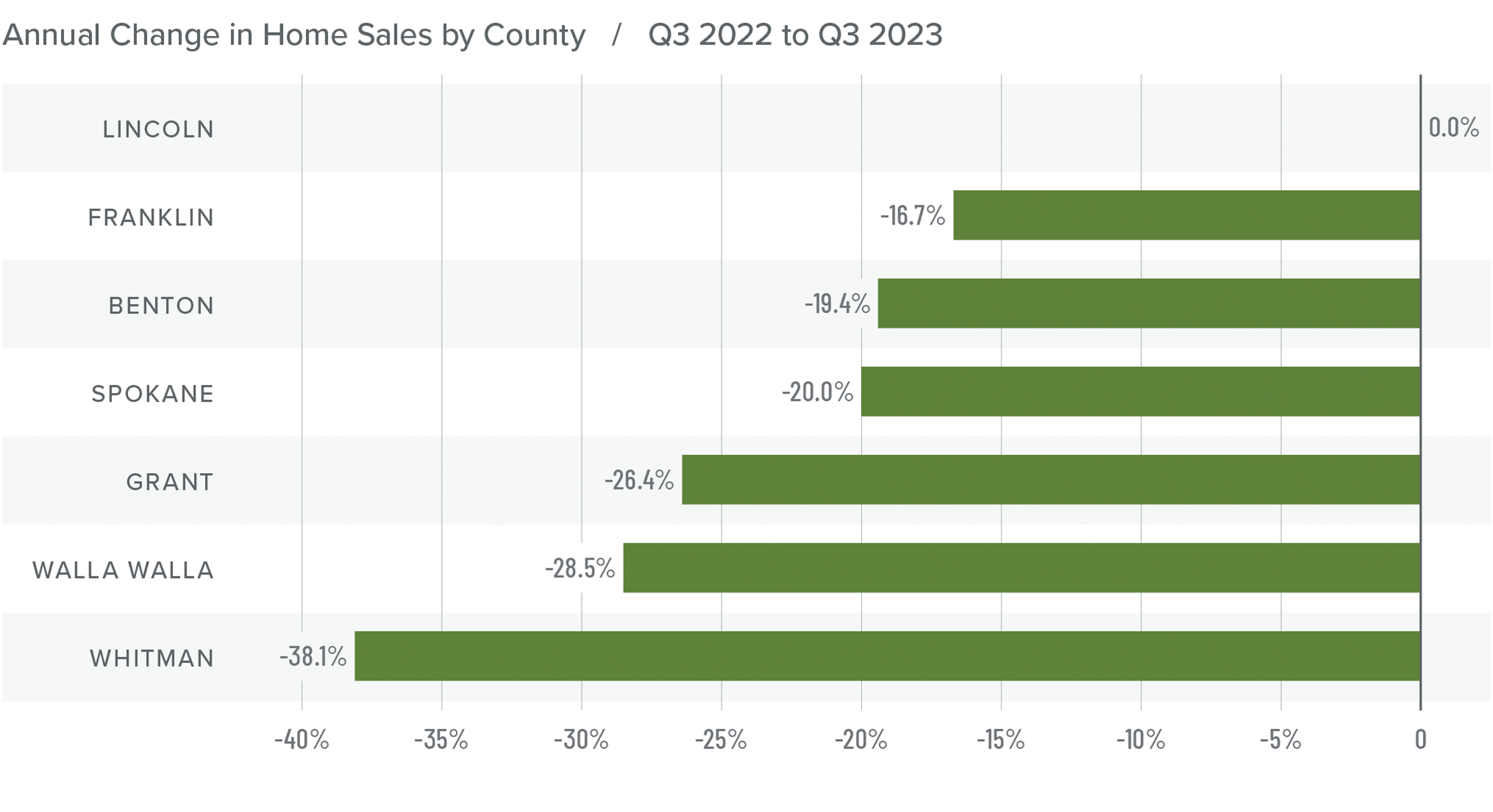

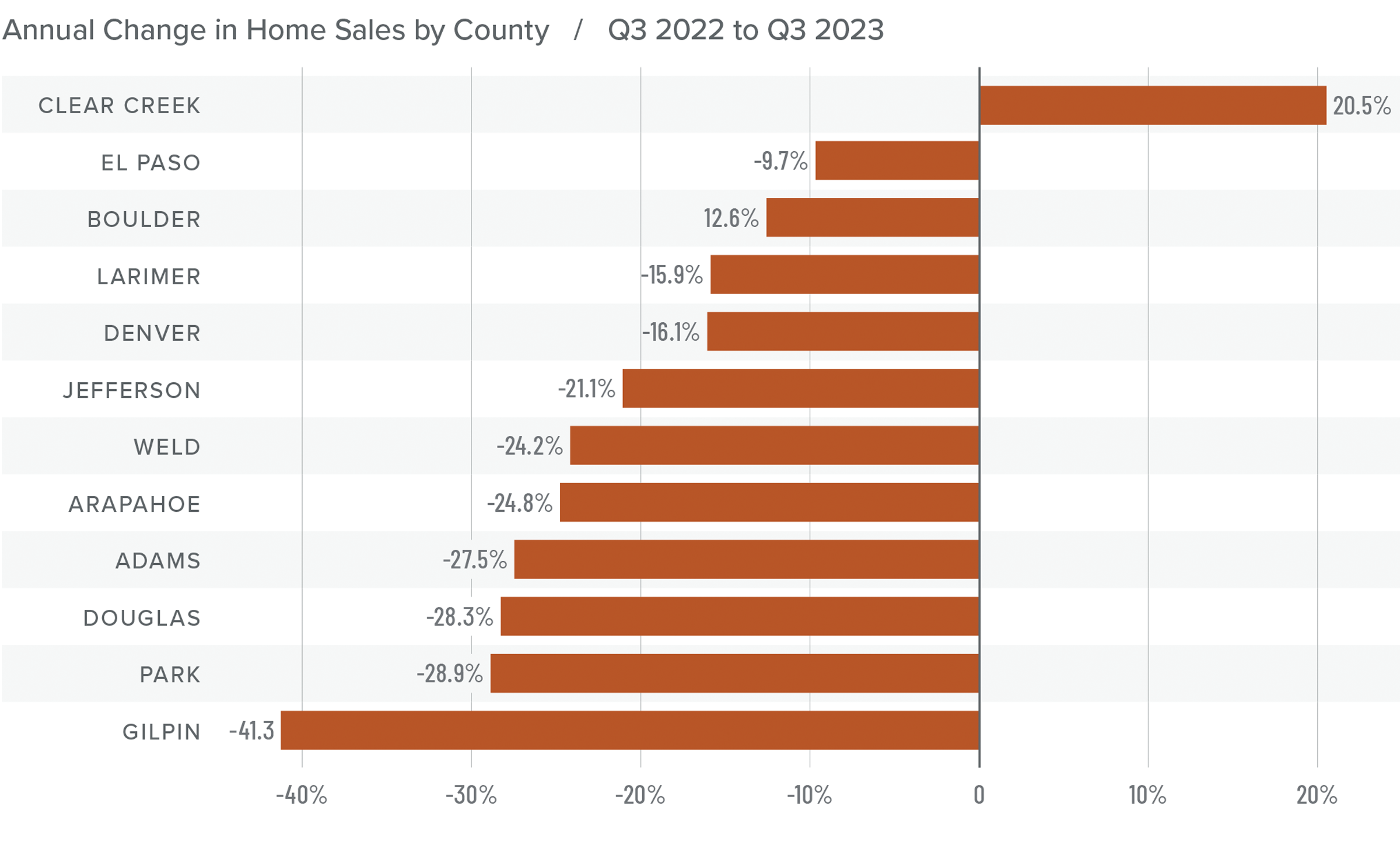

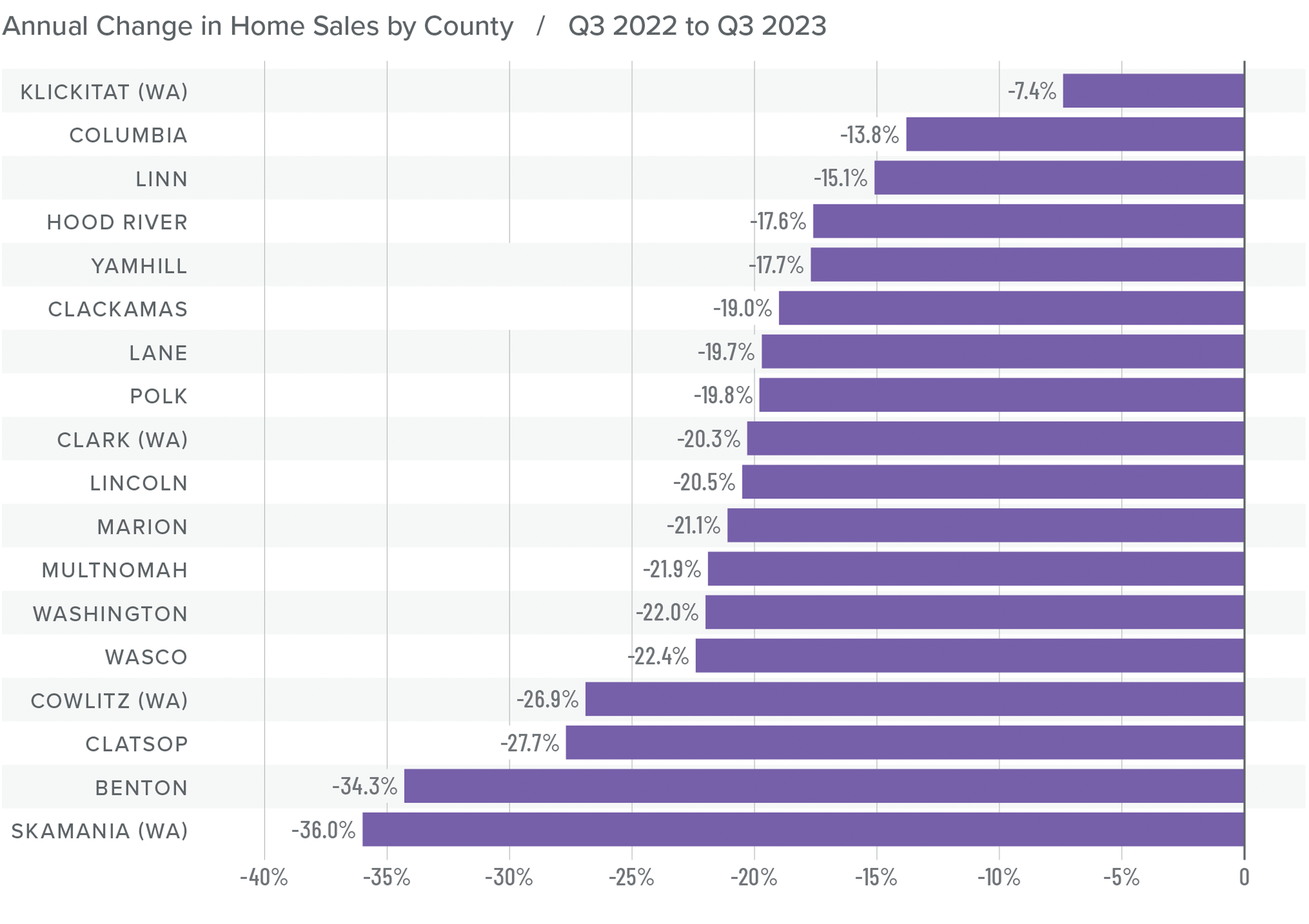

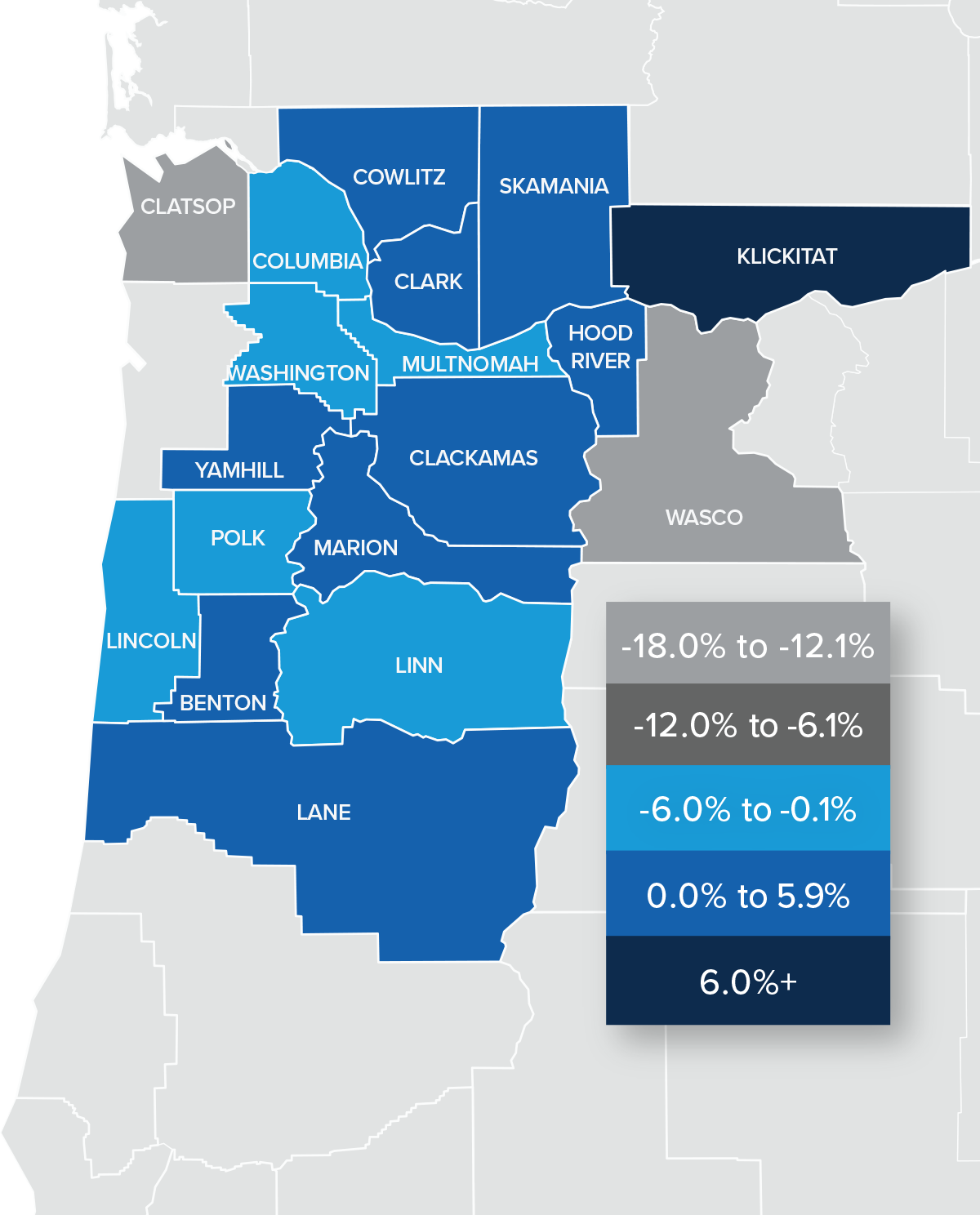

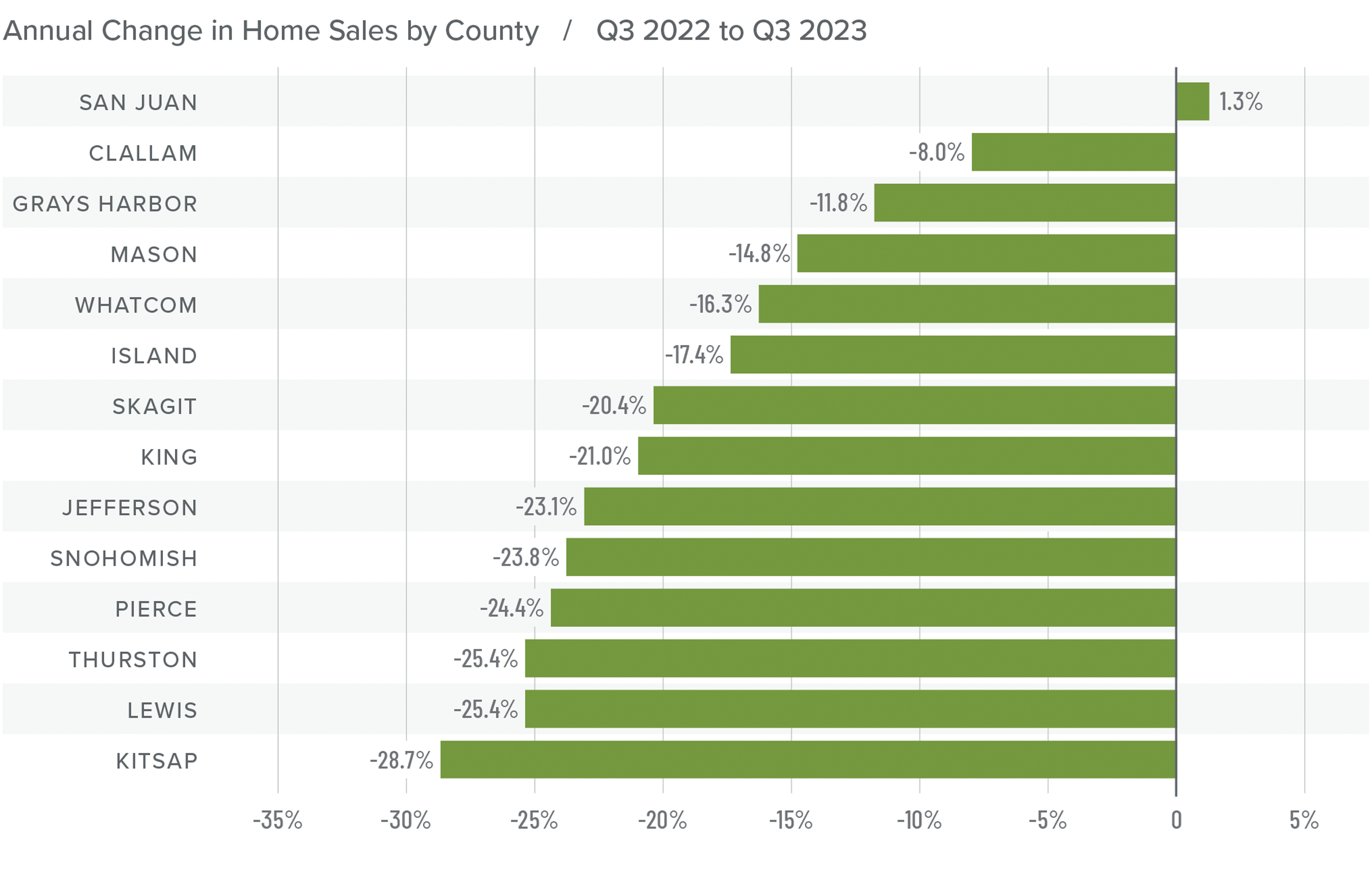

Idaho Home Sales

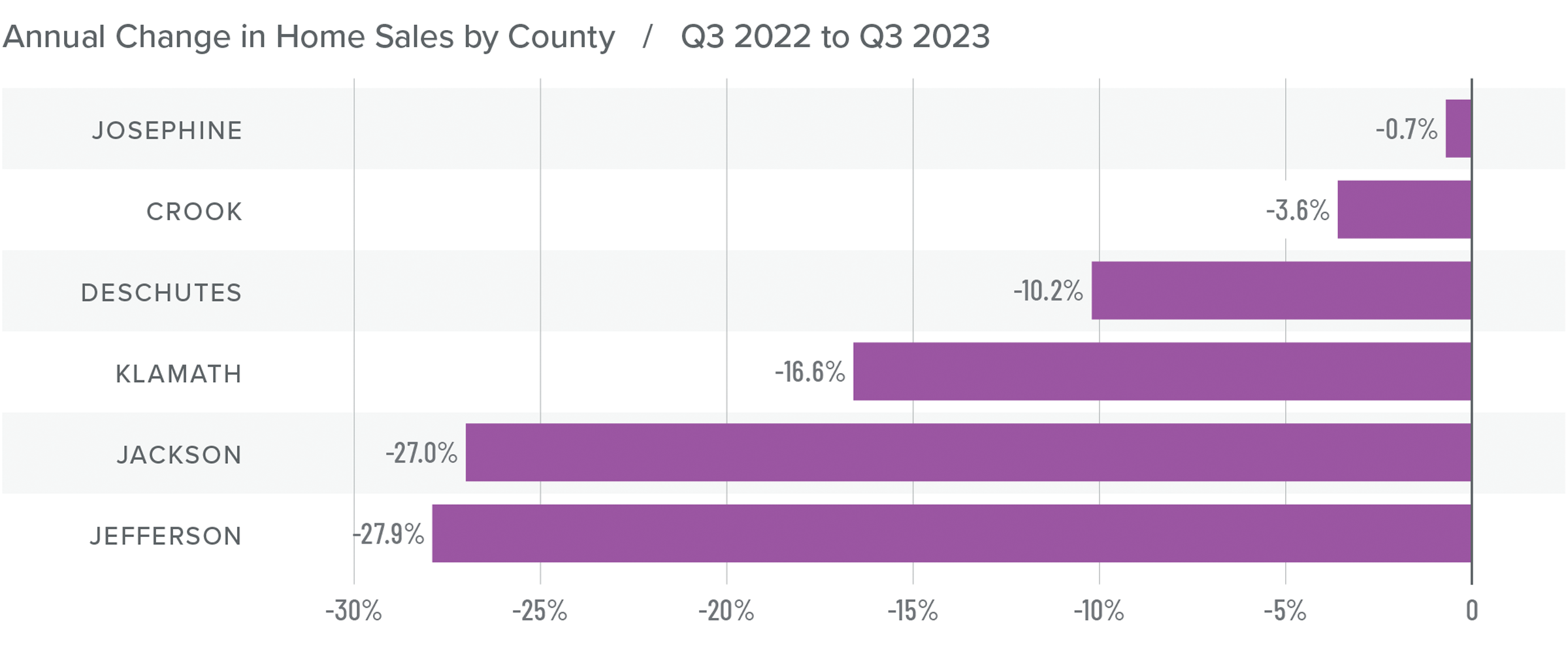

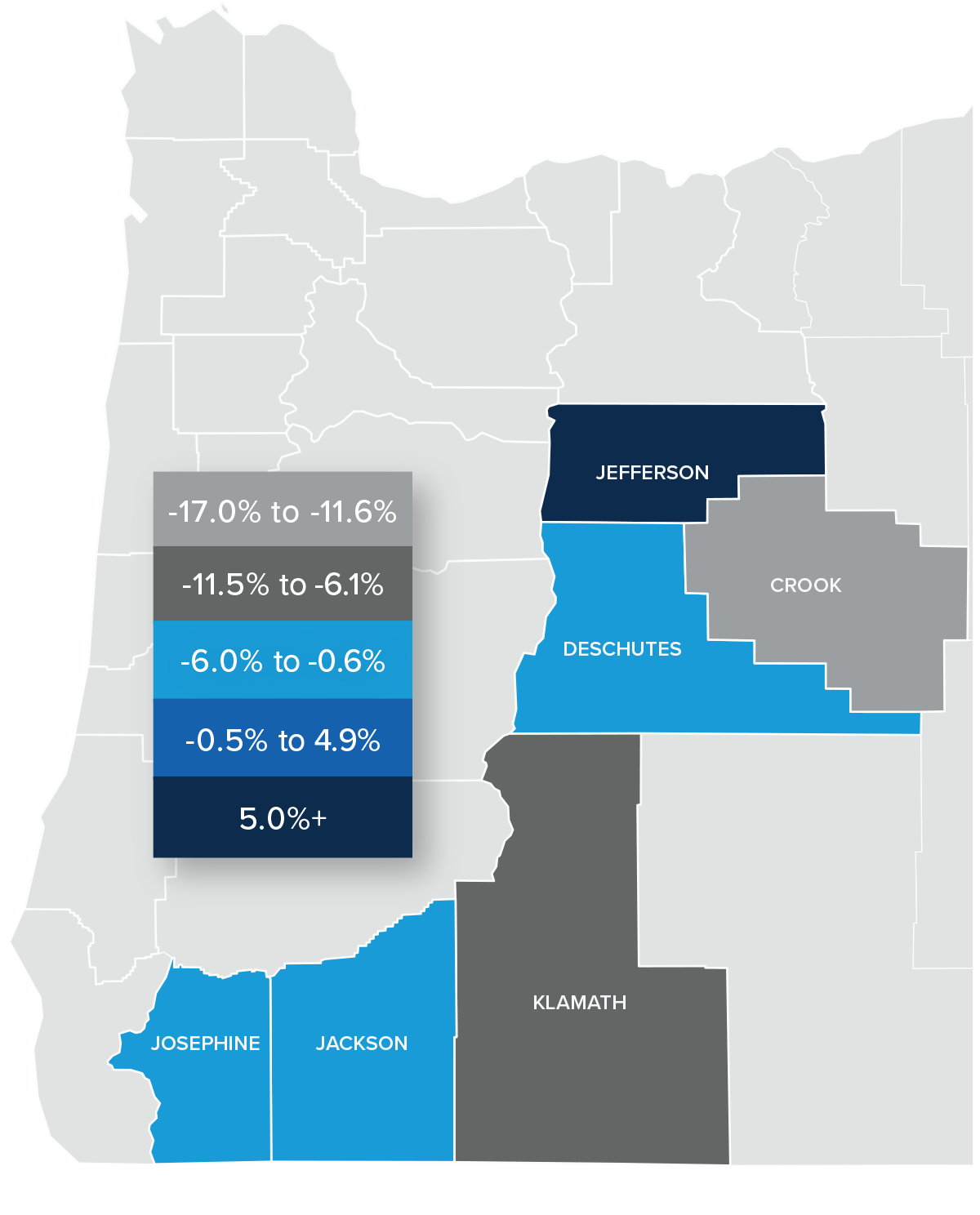

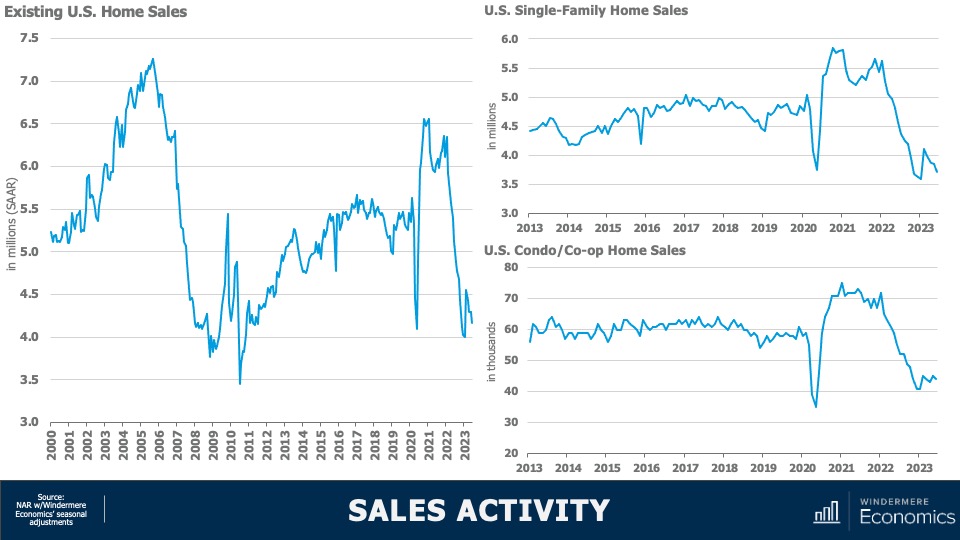

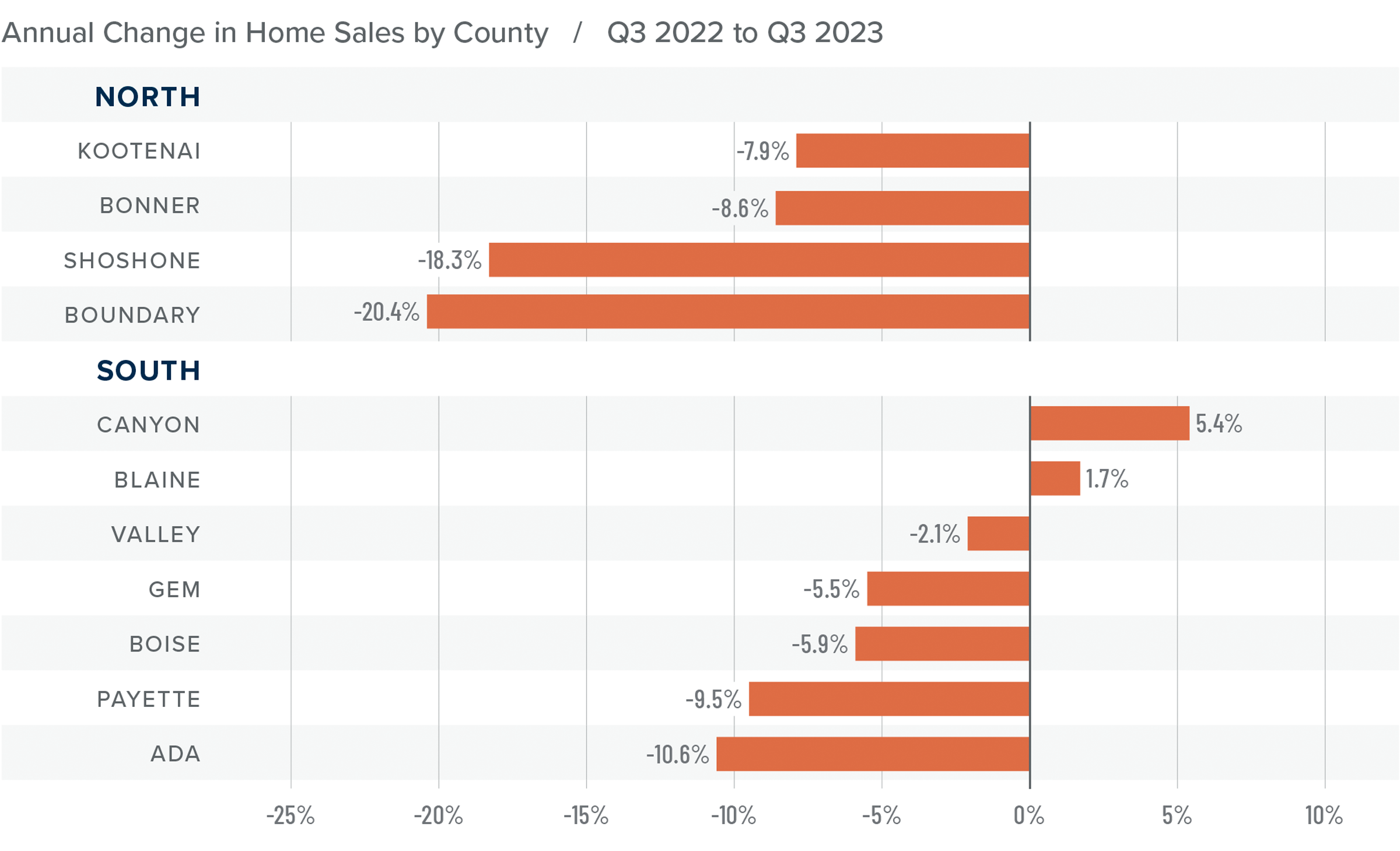

❱ In the third quarter of 2023, 4,945 homes sold, which was a drop of 6.2% from the third quarter of 2022 and 2.7% lower than in the second quarter of this year.

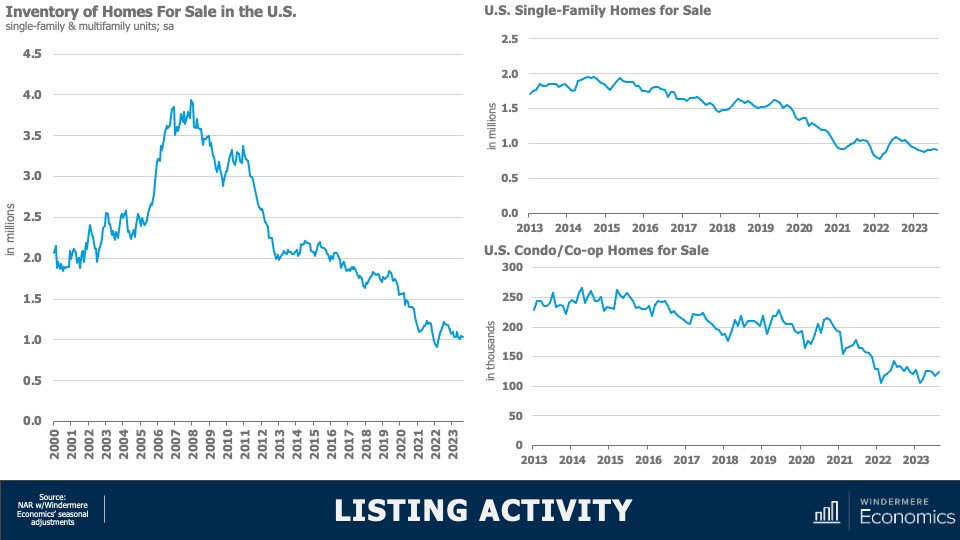

❱ Listing activity was up 11.3% from the second quarter of the year, which appears to have resulted in rising sales in most market areas.

❱ Relative to the same quarter in 2022, sales fell in all the northern counties covered by this report and in every county other than Canyon and Blaine in the Southern Idaho markets. However, compared to the second quarter of this year, sales rose in all markets other than Boundary County in Northern Idaho and Canyon, Gem, and Ada counties in the southern part of the state.

❱ Pending sales in the third quarter were lower than in the second quarter of 2023, suggesting that sales may slow in the final quarter of the year.

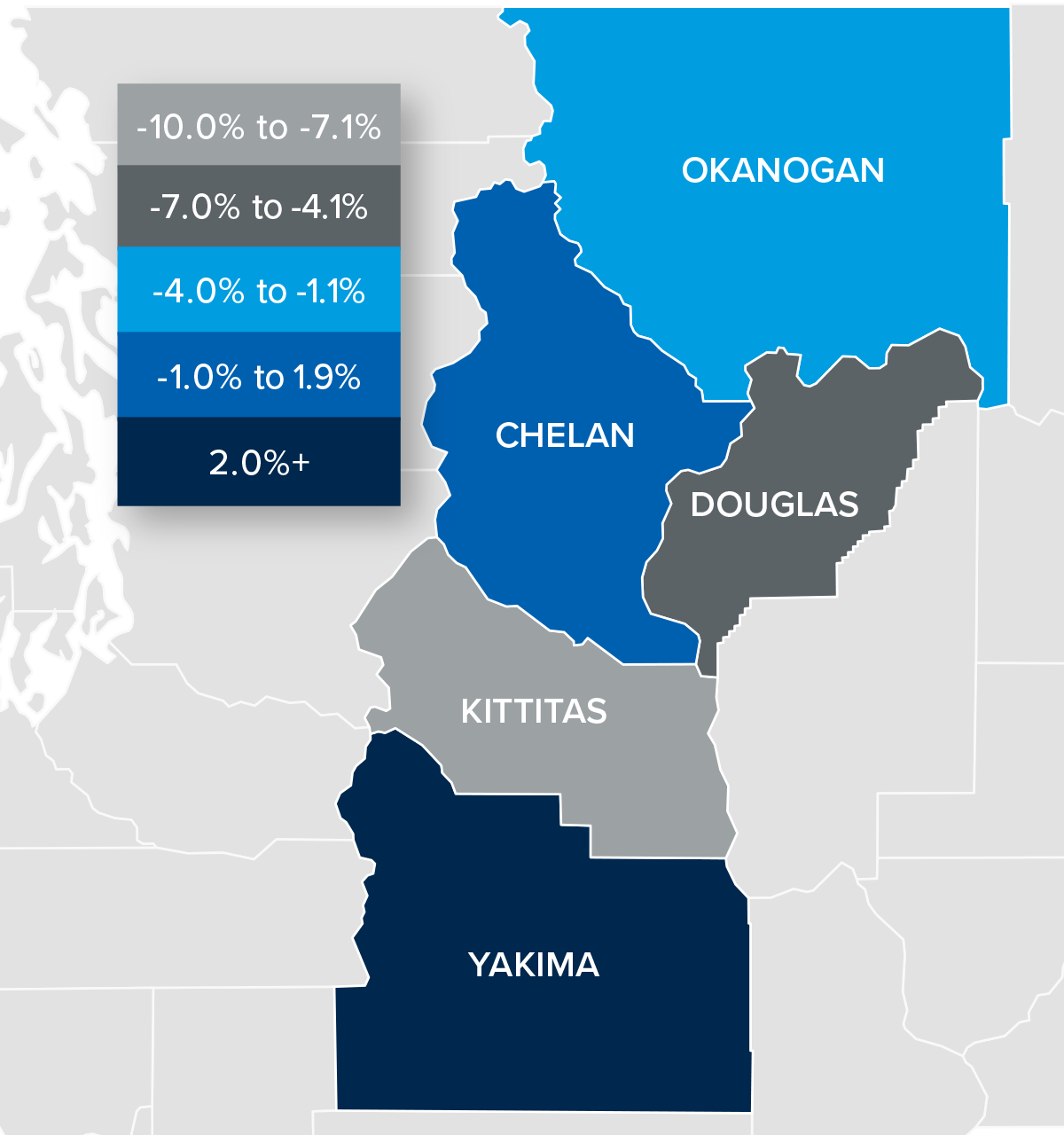

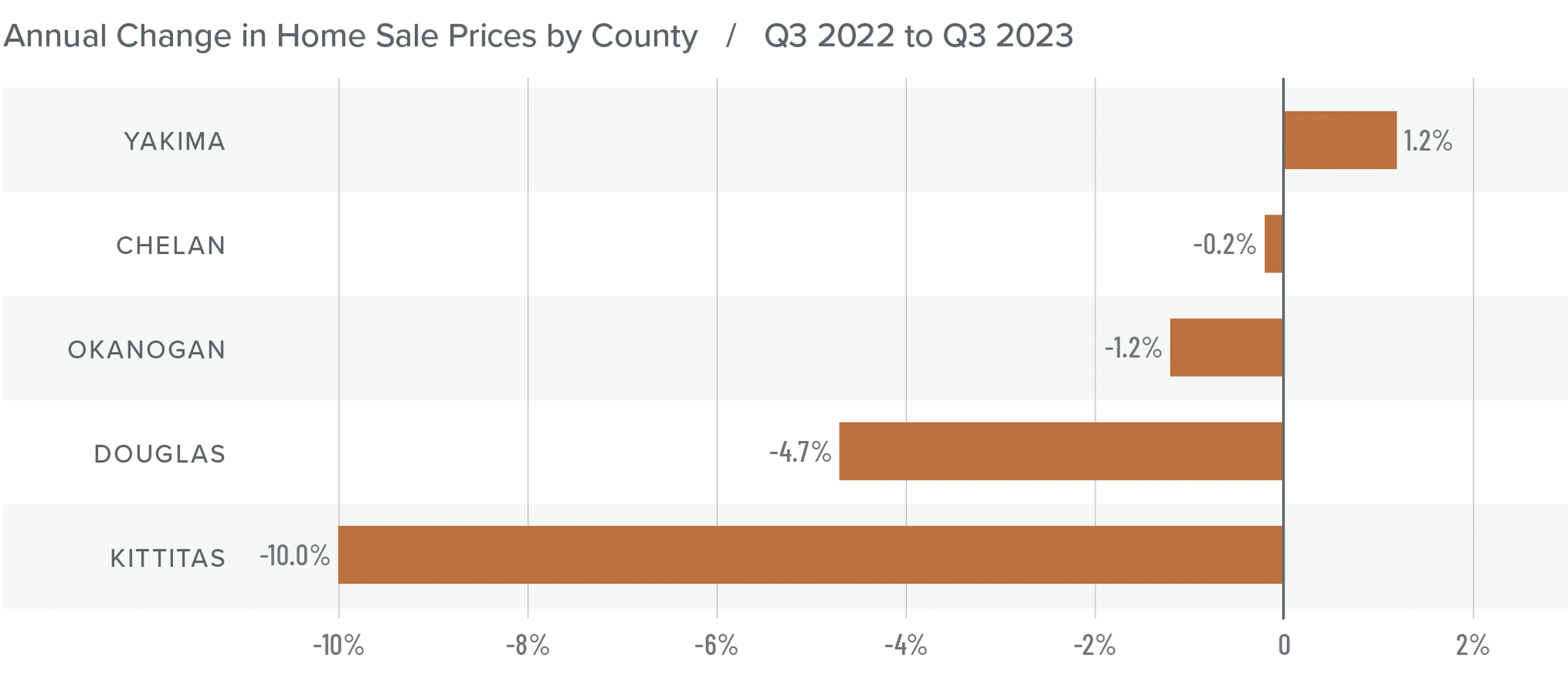

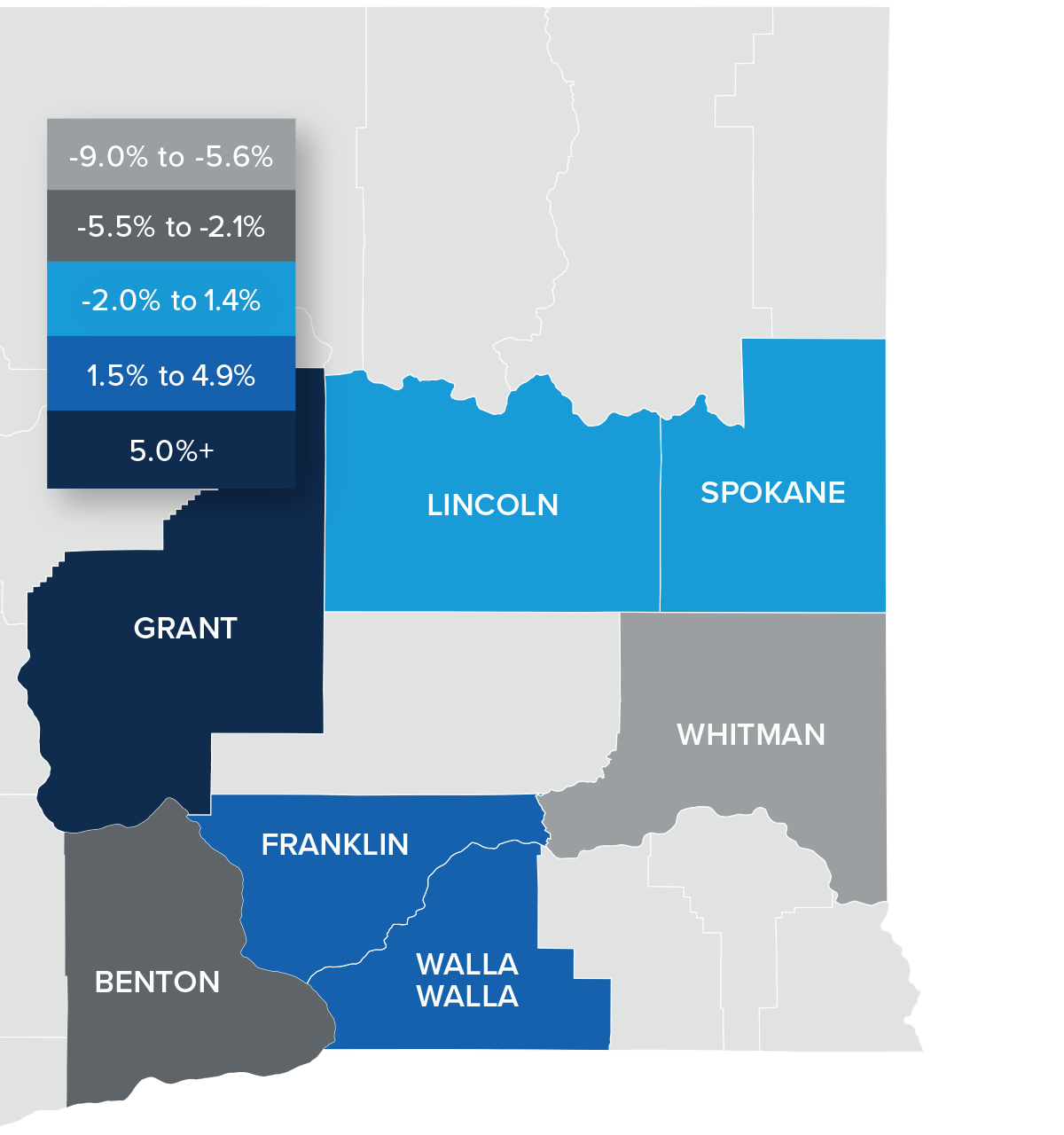

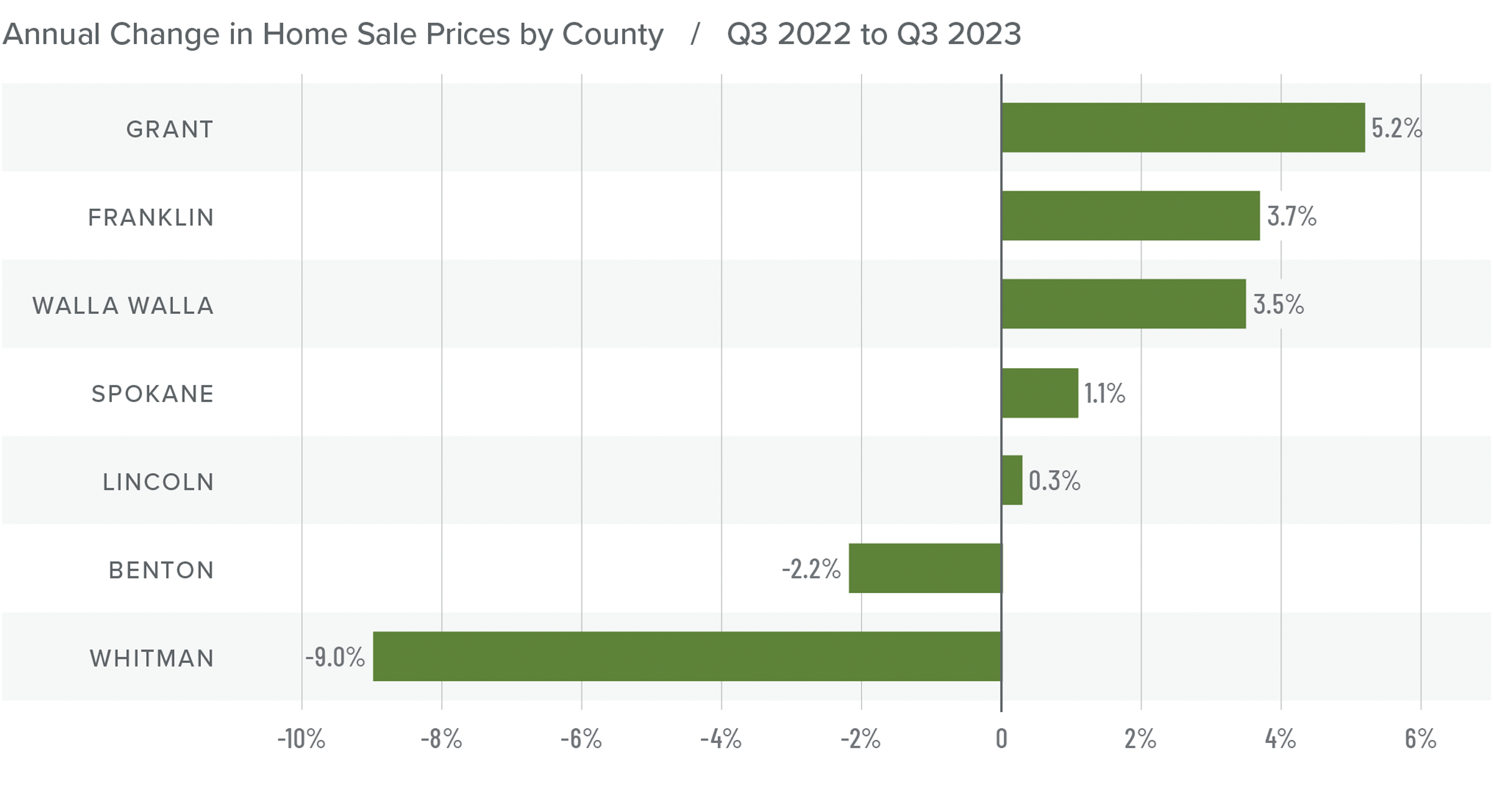

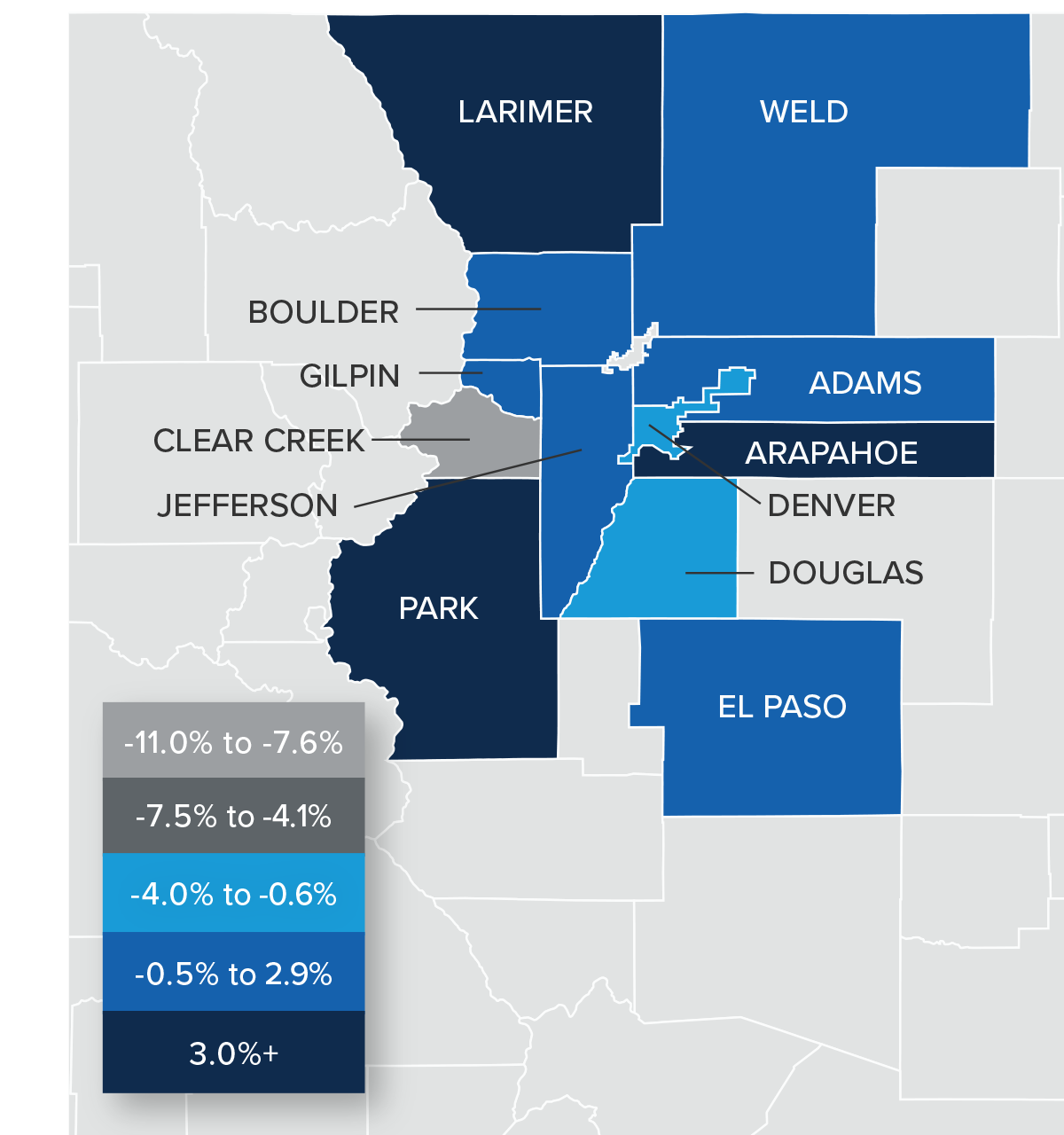

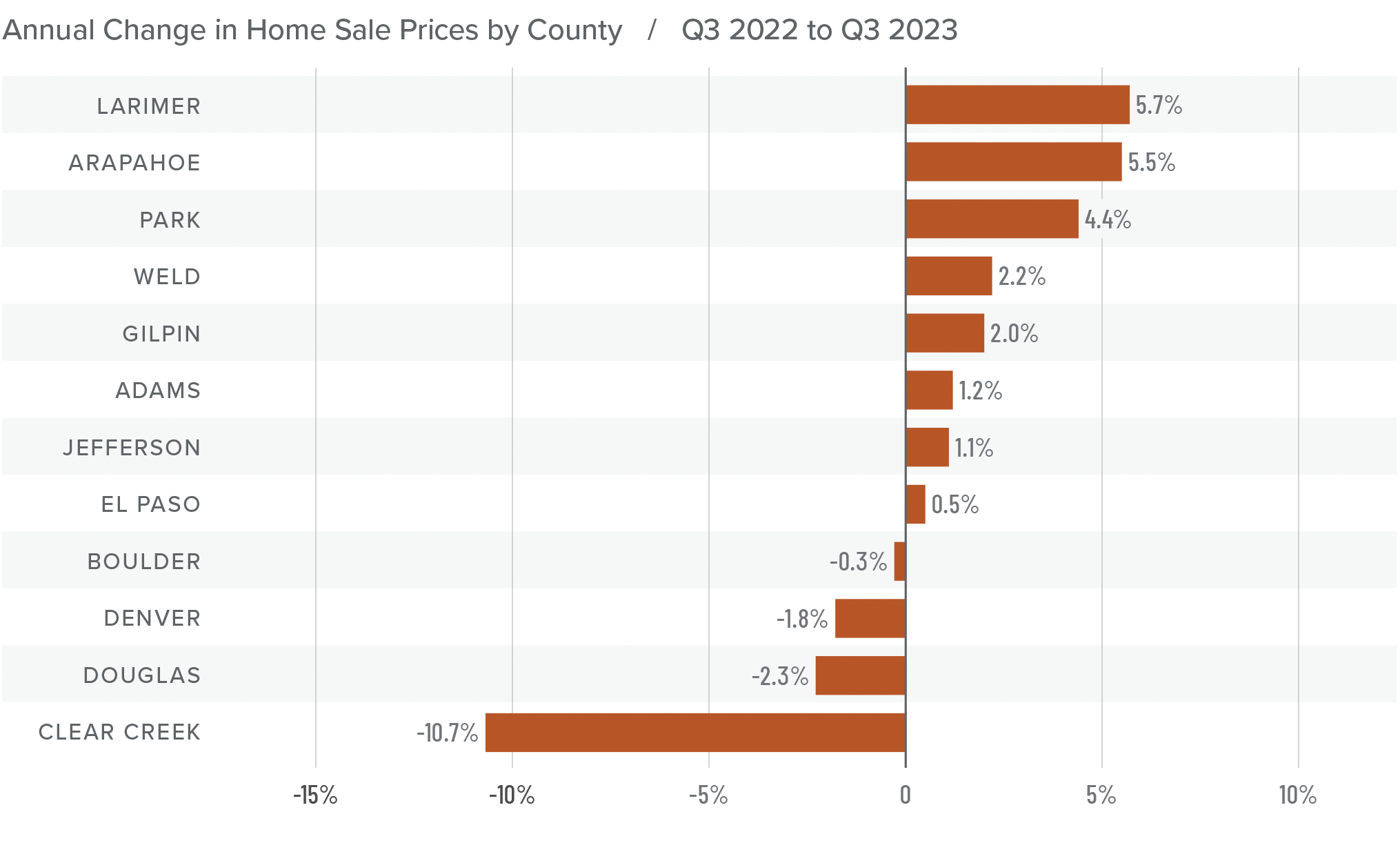

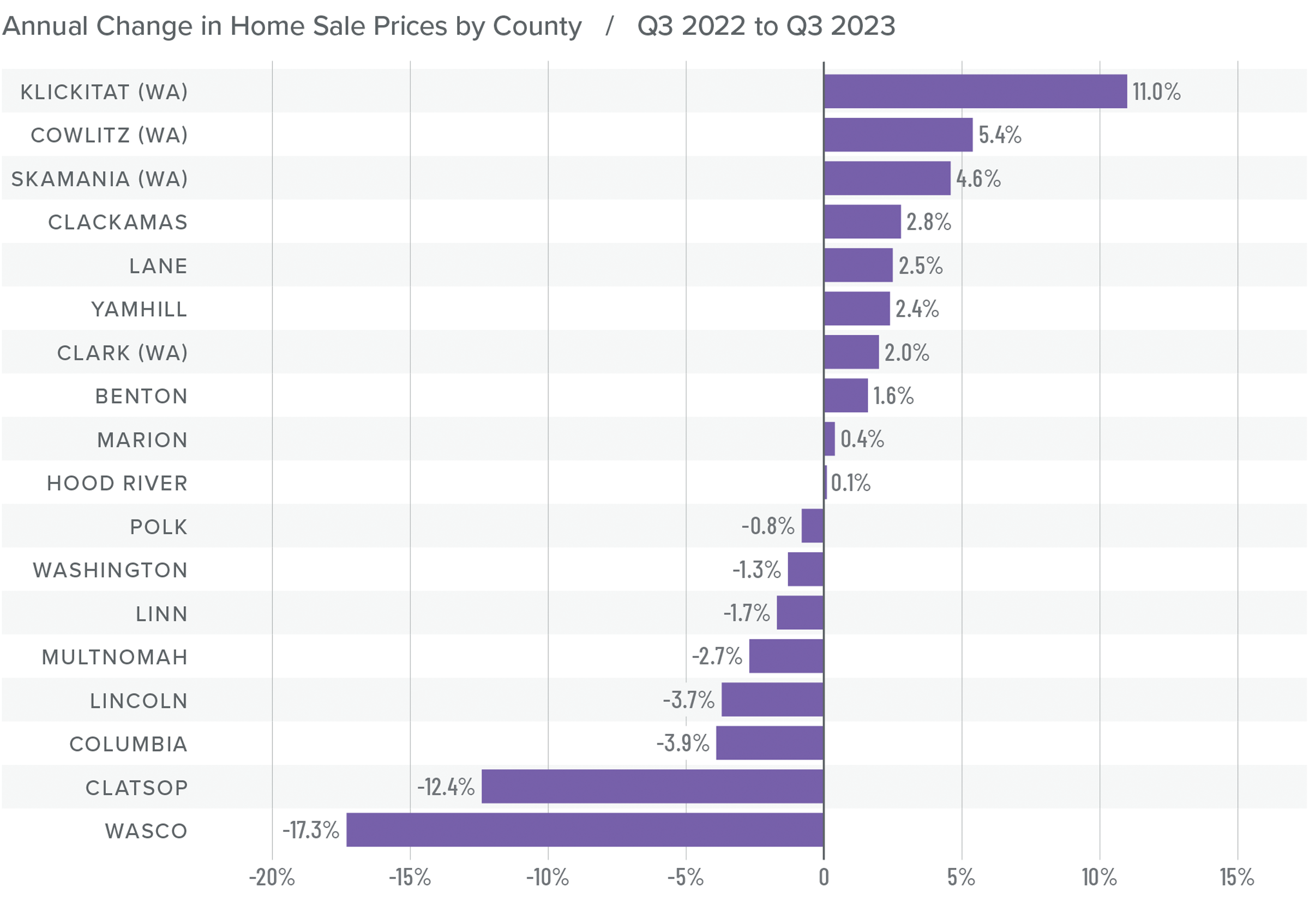

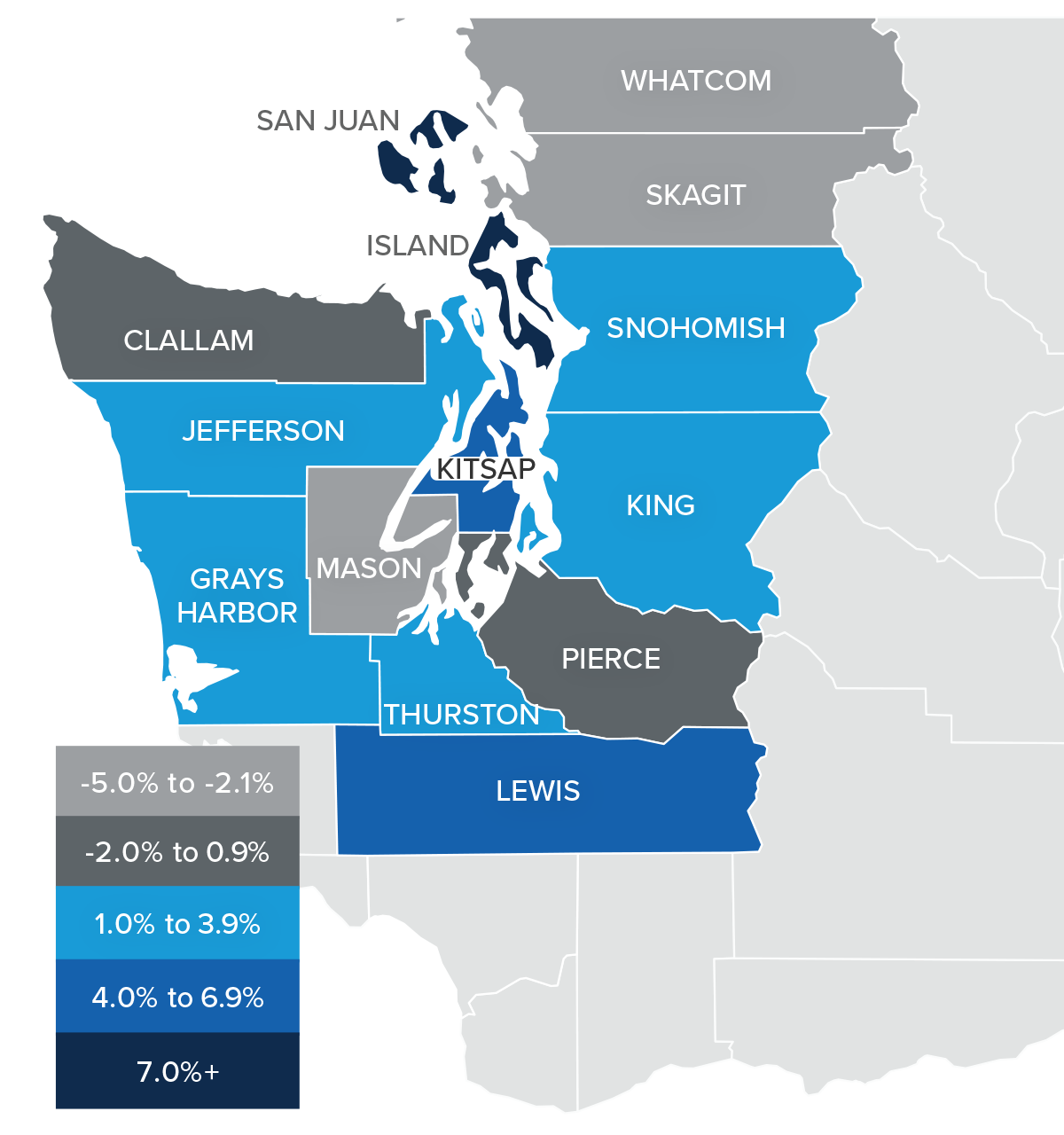

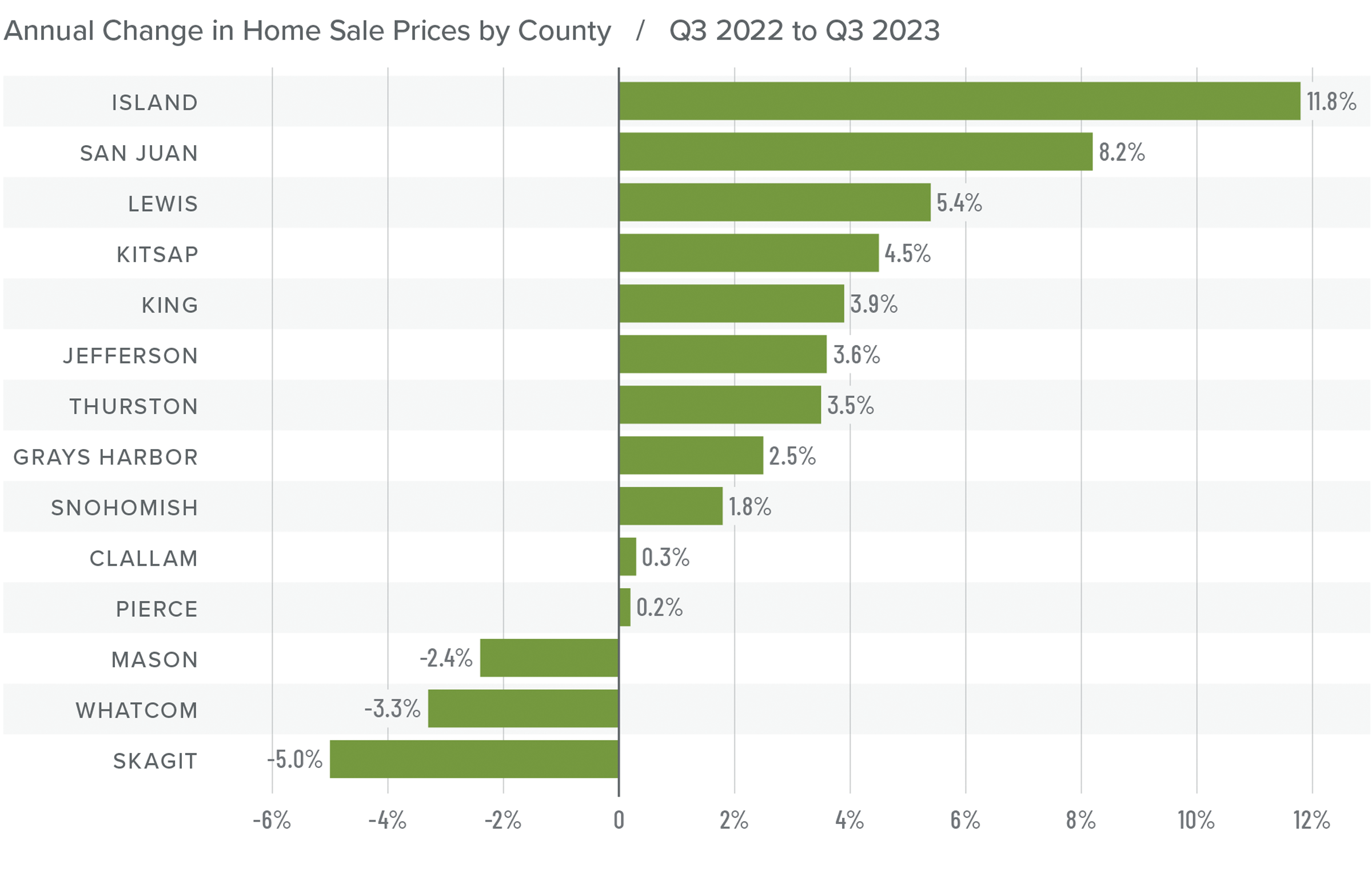

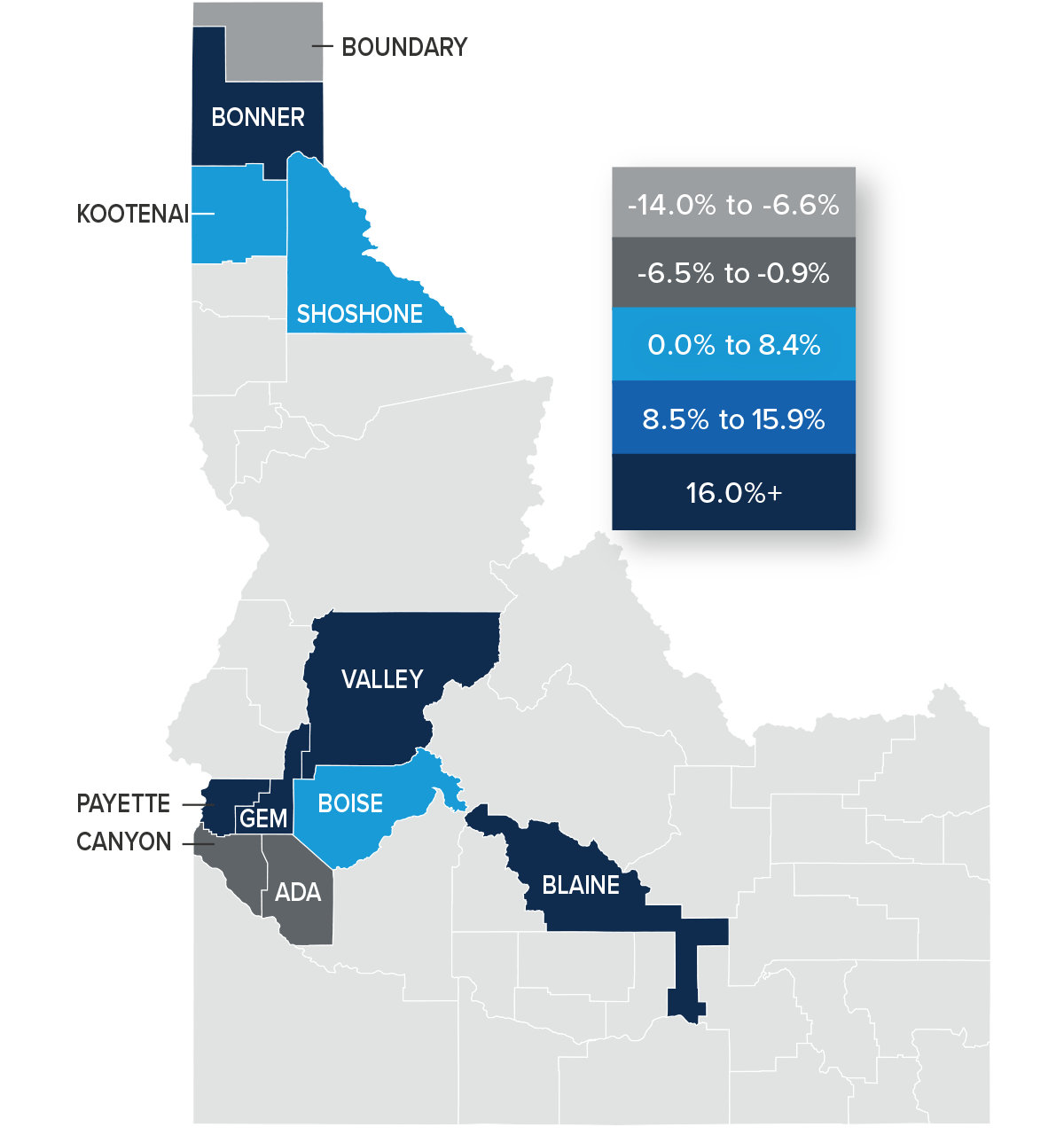

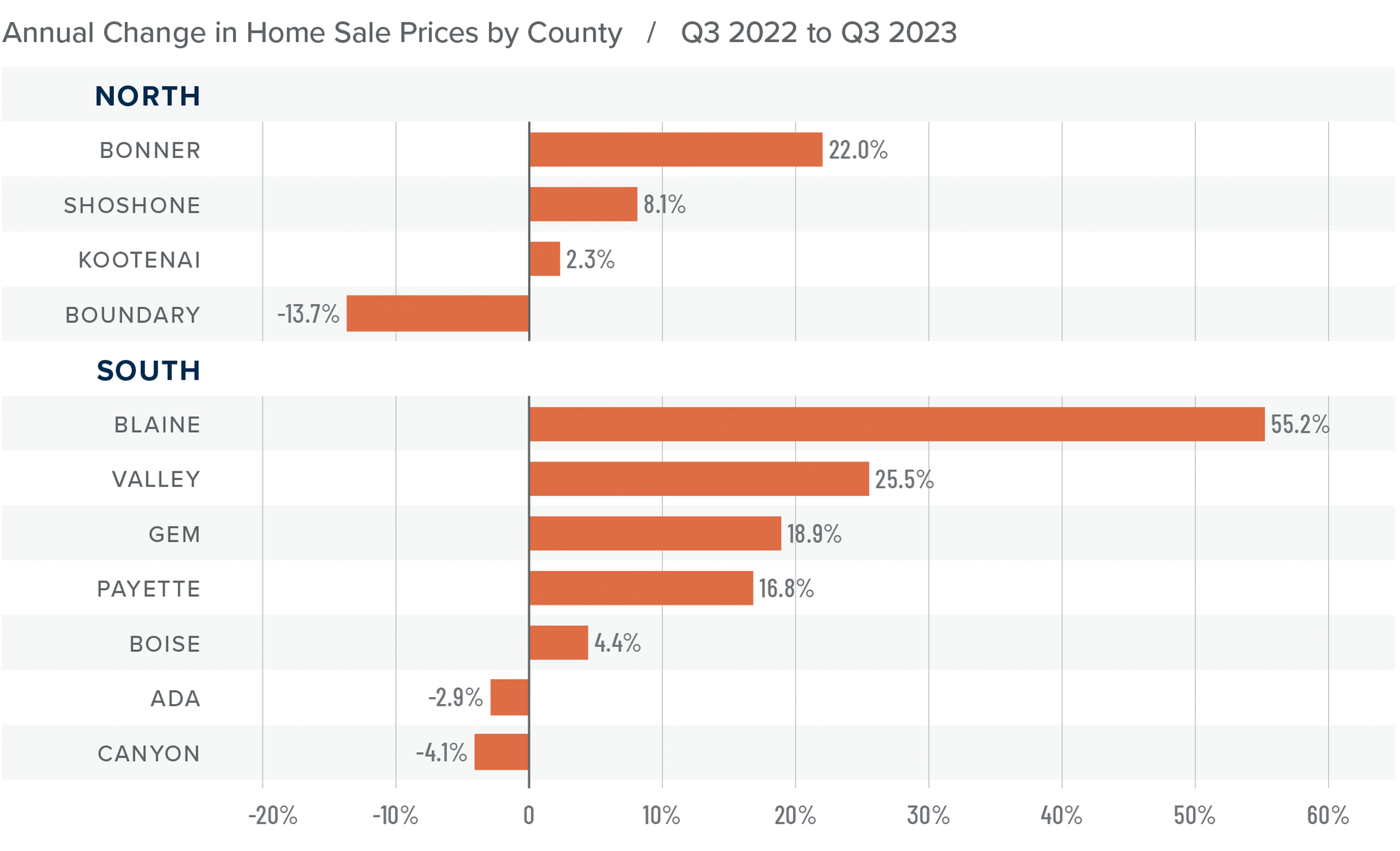

Idaho Home Prices

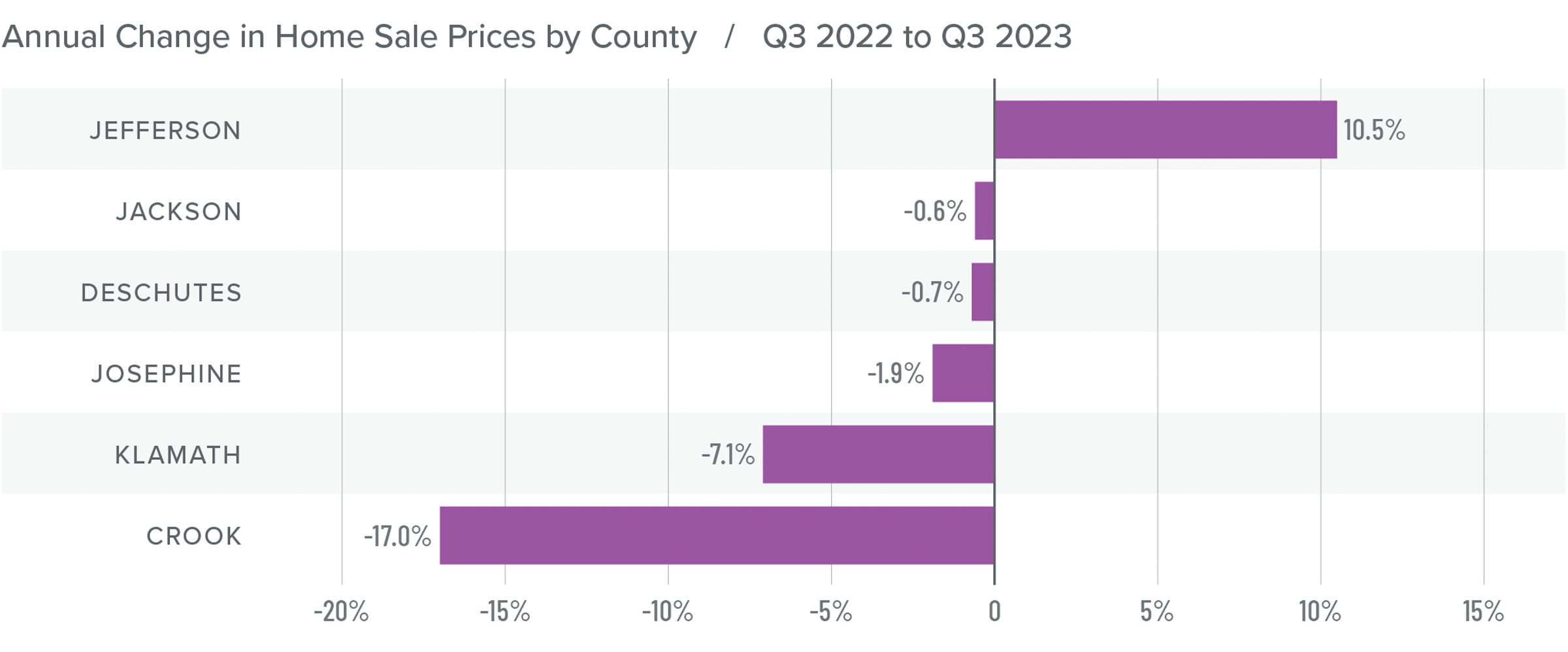

❱ The average home price in the region rose 2.7% year over year to $636,148. Sale prices were 5.1% higher than in the second quarter of 2023.

❱ Compared to the second quarter of 2023, prices rose an average of 5.9% in the northern market areas covered by this report. Sale prices were up 4.2% in the southern part of the state.

❱ Only one county in the northern market areas and two in the southern markets saw prices fall year over year. Compared to the second quarter, prices rose in all markets other than Shoshone and Boundary counties in the northern market area.

❱ Median list prices were up 9.5% from the second quarter. However, in the southern part of the state, every county except Payette and Blaine counties saw list prices fall. Only Boundary County in the northern markets saw list prices fall. This may suggest that sellers are starting to adjust their expectations given significant increases in financing costs.

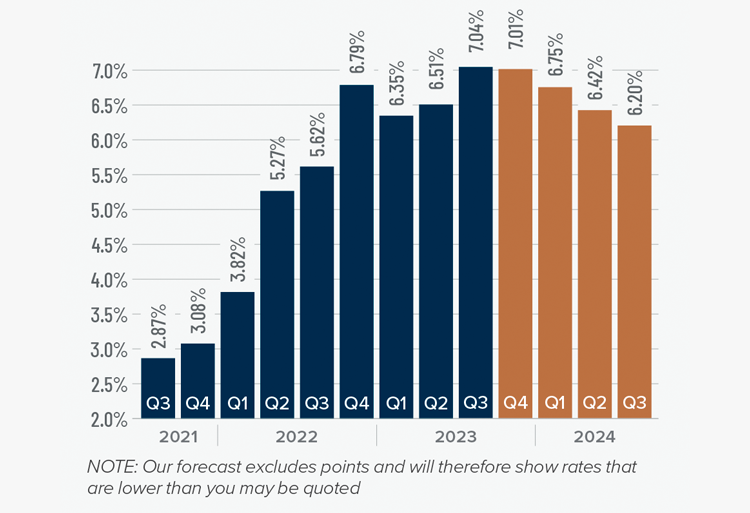

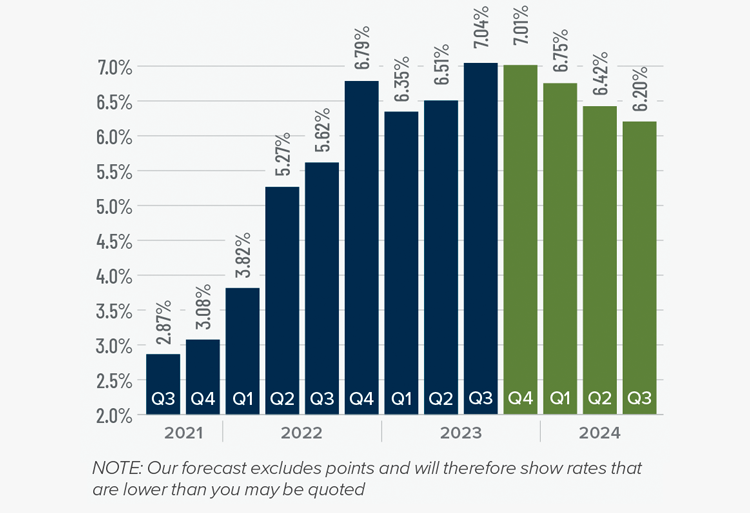

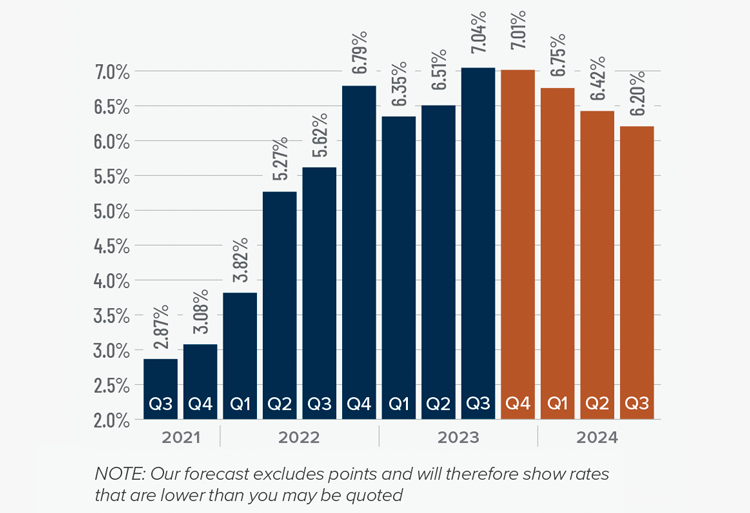

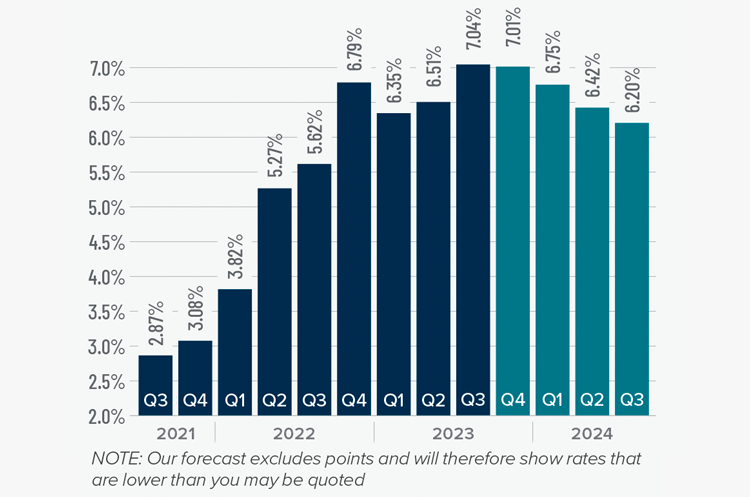

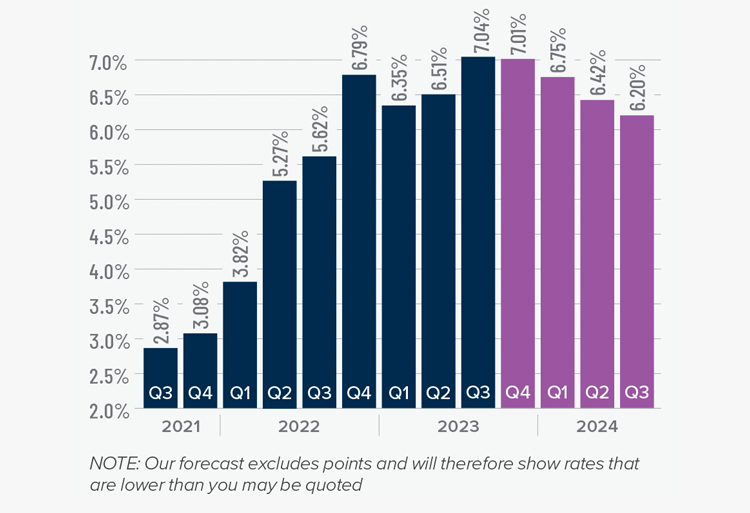

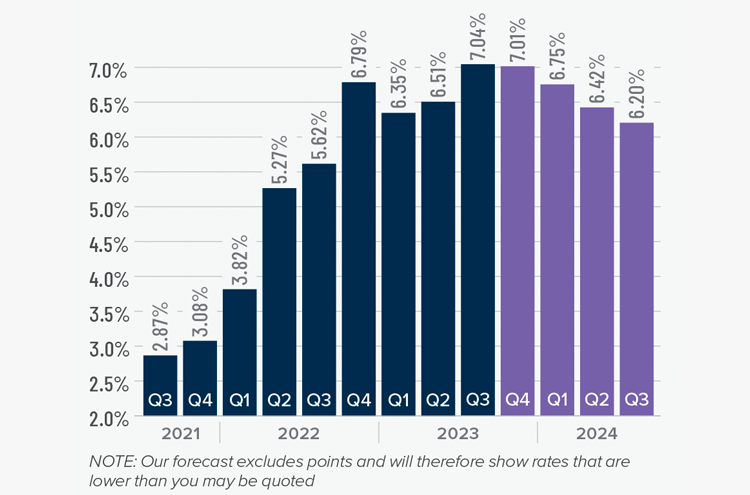

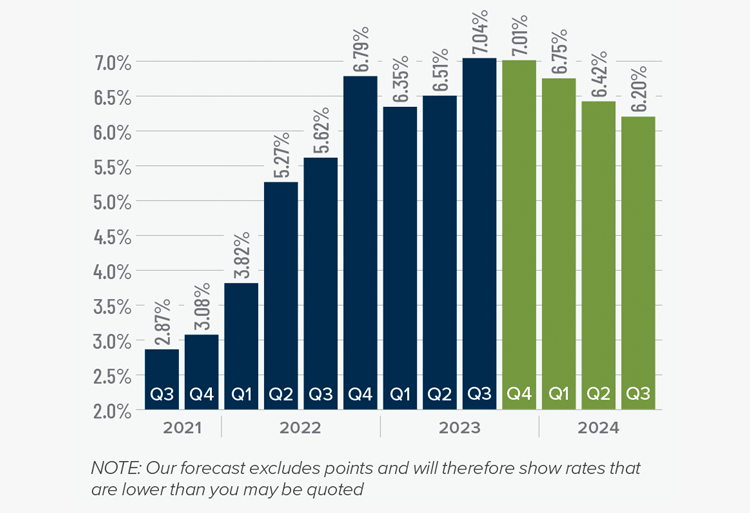

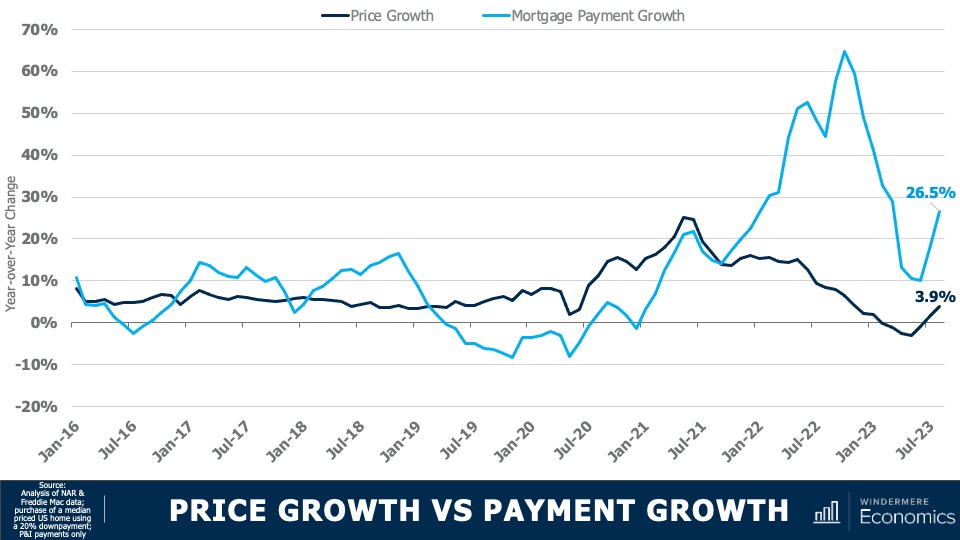

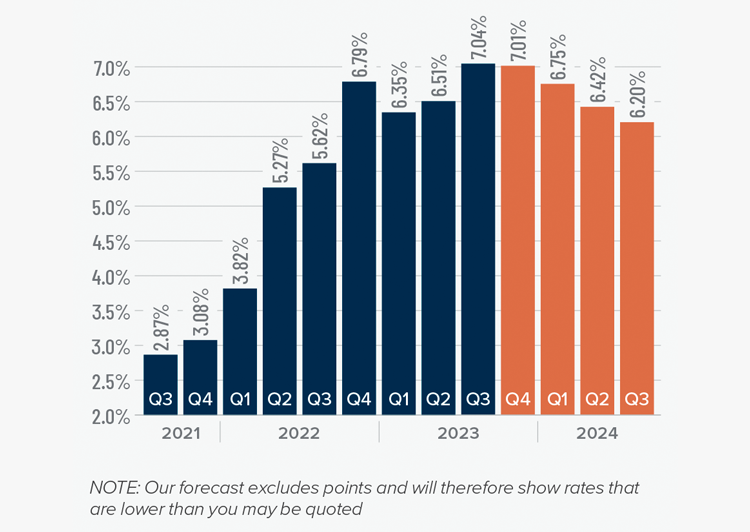

Mortgage Rates

Mortgage rates continued trending higher in the third quarter of 2023 and are now at levels we have not seen since the fall of 2000. Mortgage rates are tied to the interest rate (yield) on 10-year treasuries, and they move in the opposite direction of the economy. Unfortunately for mortgage rates, the economy remains relatively buoyant, and though inflation is down significantly from its high, it is still elevated. These major factors and many minor ones are pushing Treasury yields higher, which is pushing mortgage rates up. Given the current position of the Federal Reserve, which intends to keep rates “higher for longer,” it is unlikely that home buyers will get much reprieve when it comes to borrowing costs any time soon.

With such a persistently positive economy, I have had to revise my forecast yet again. I now believe rates will hold at current levels before starting to trend down in the spring of next year.

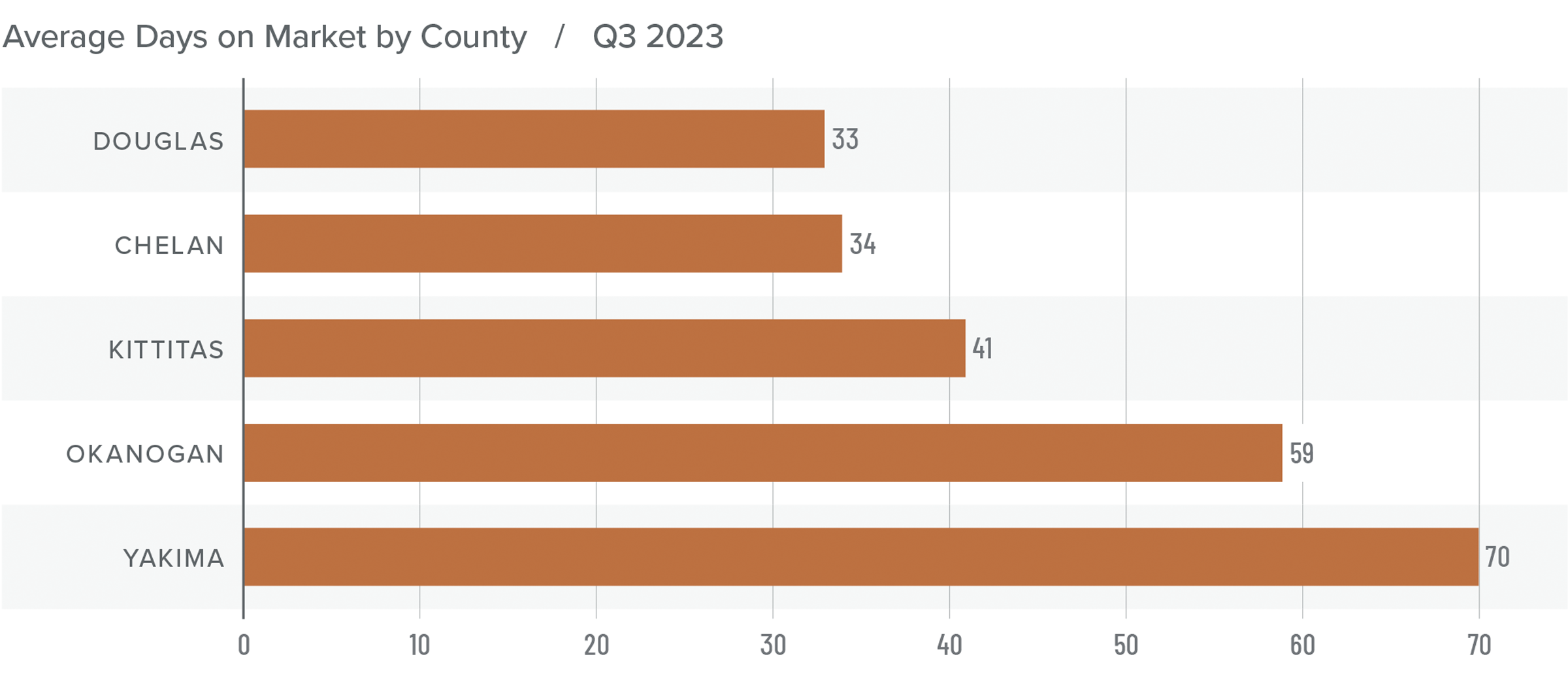

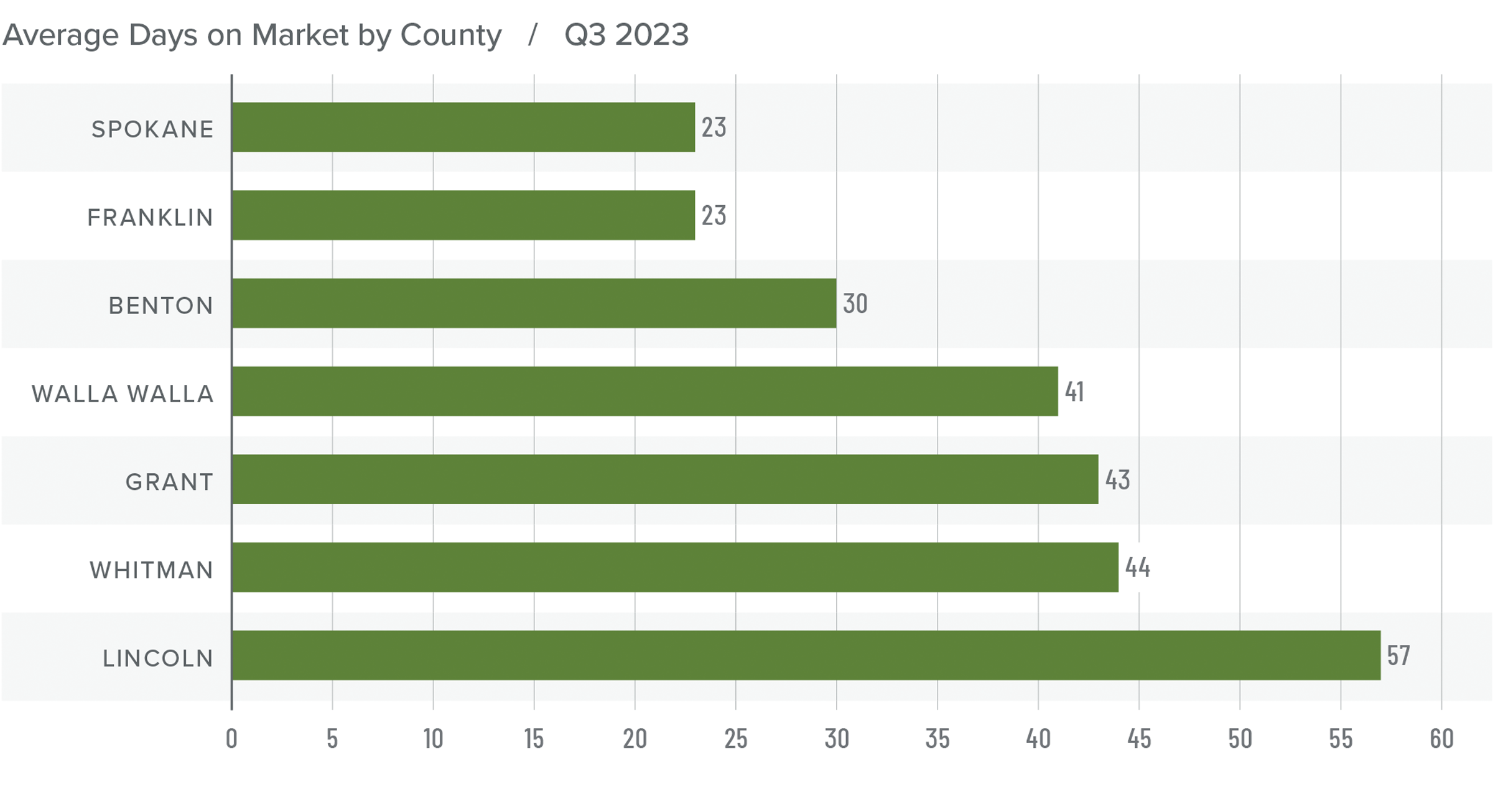

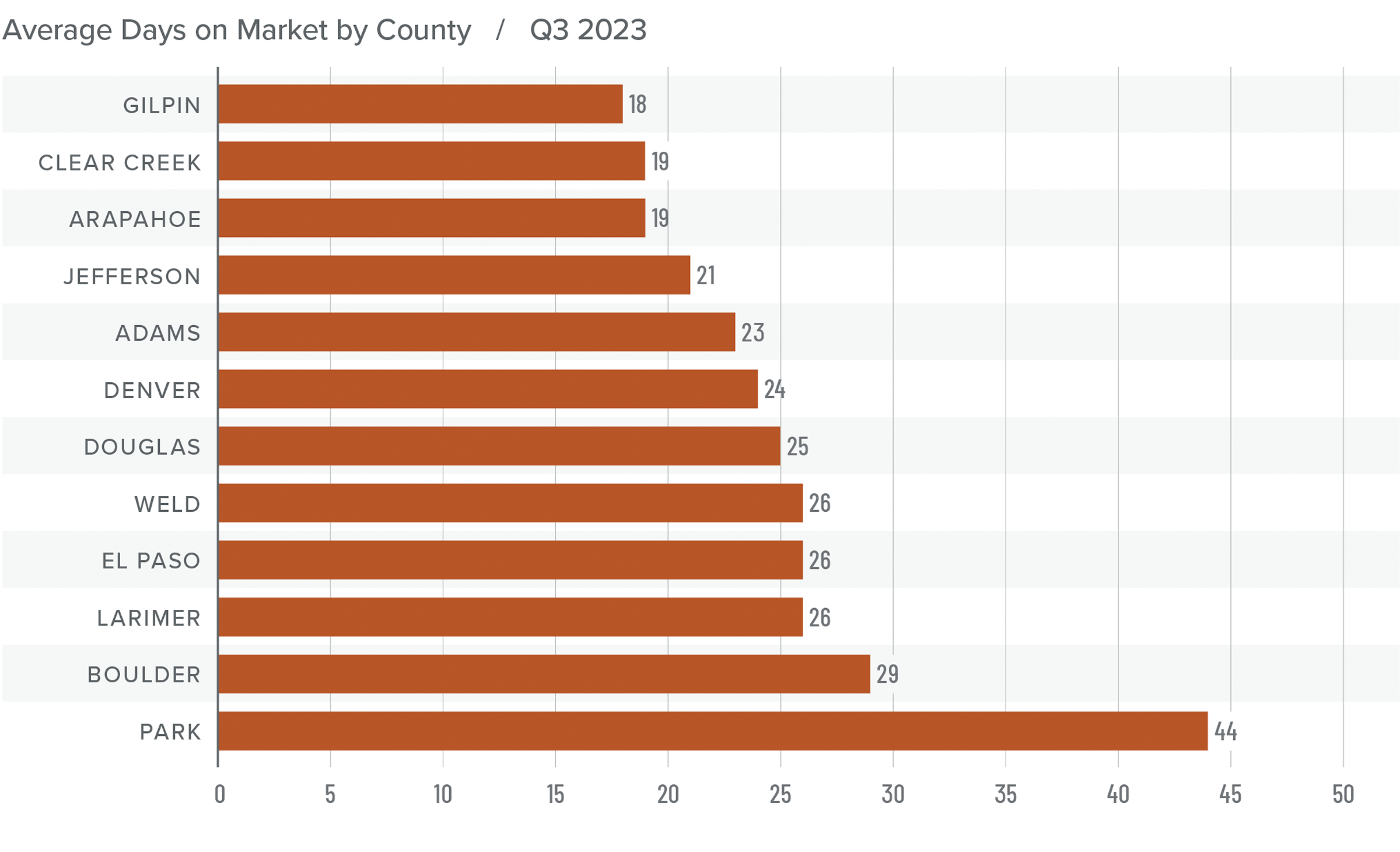

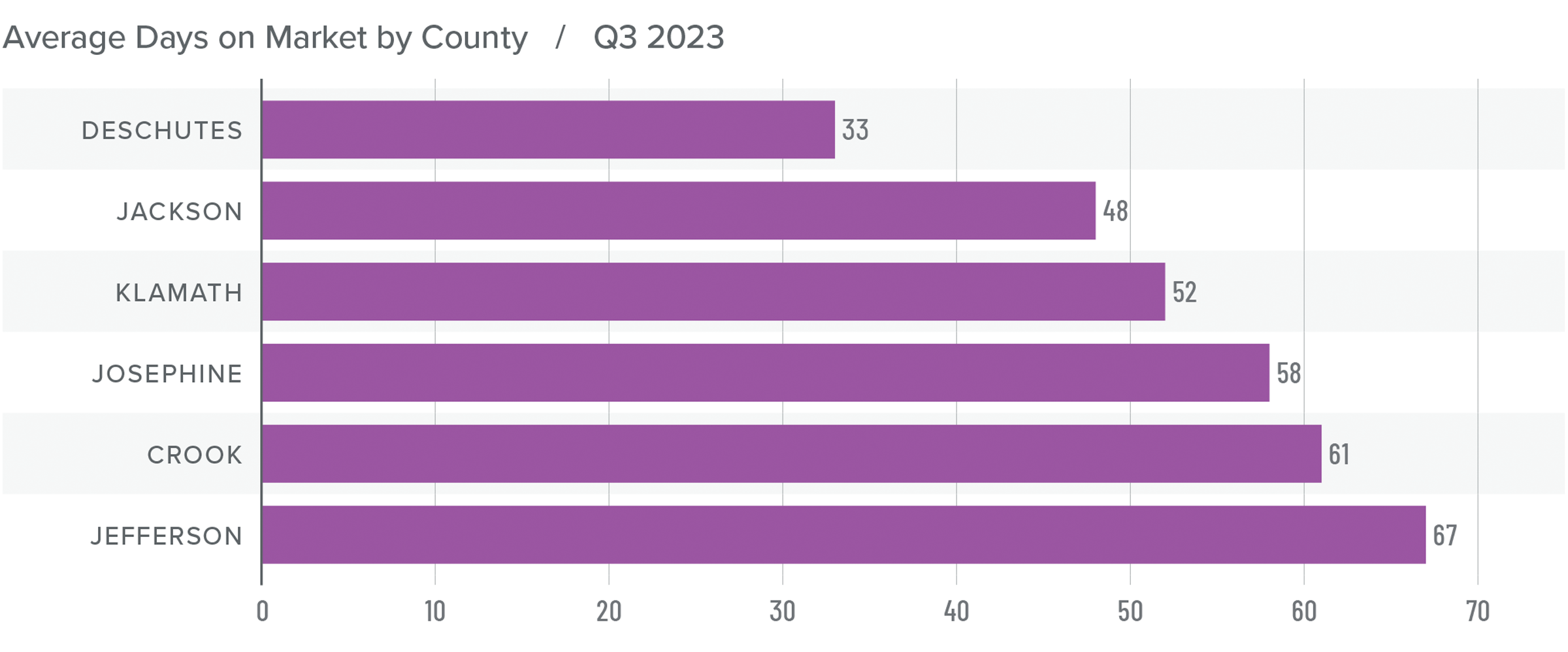

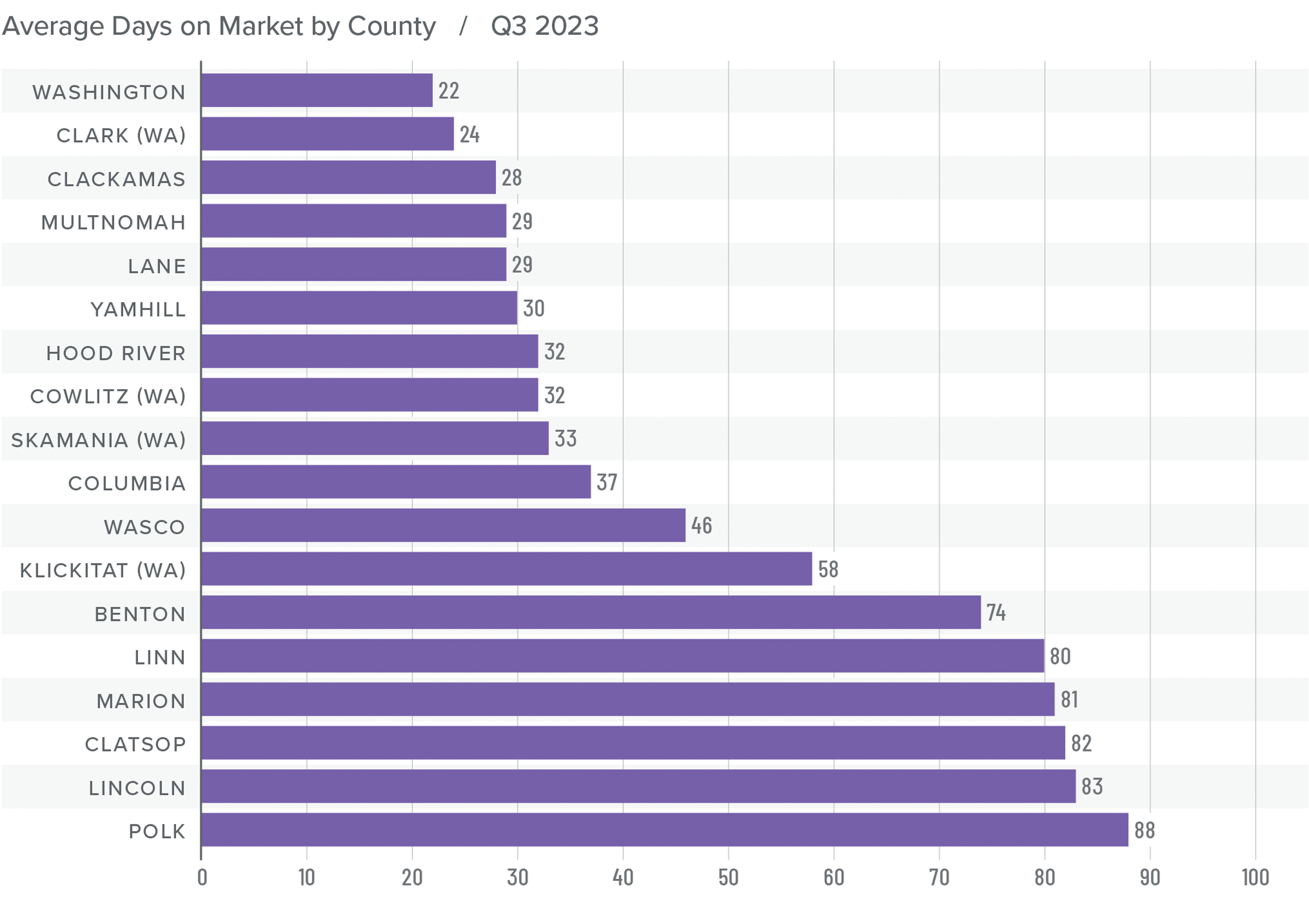

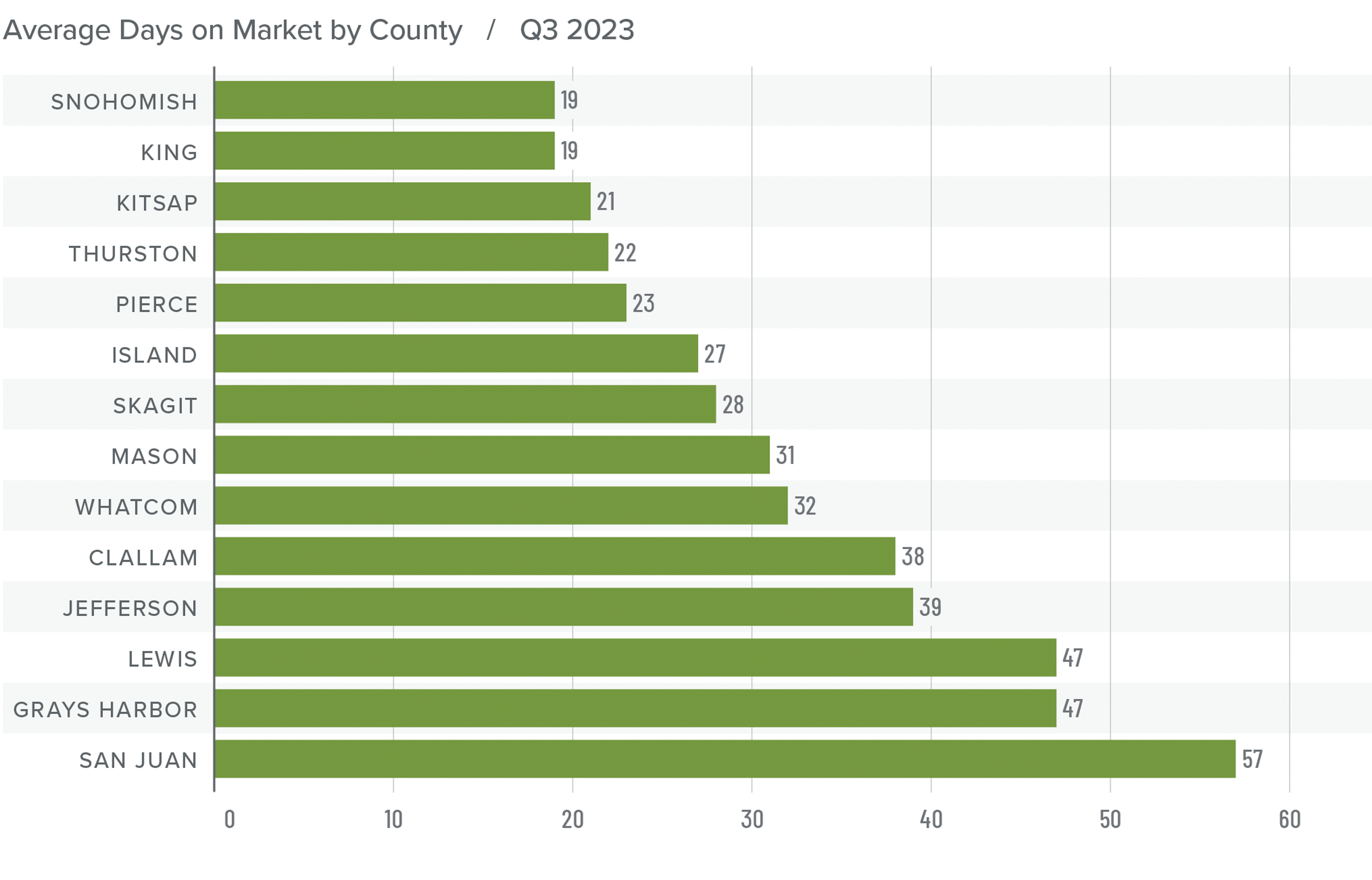

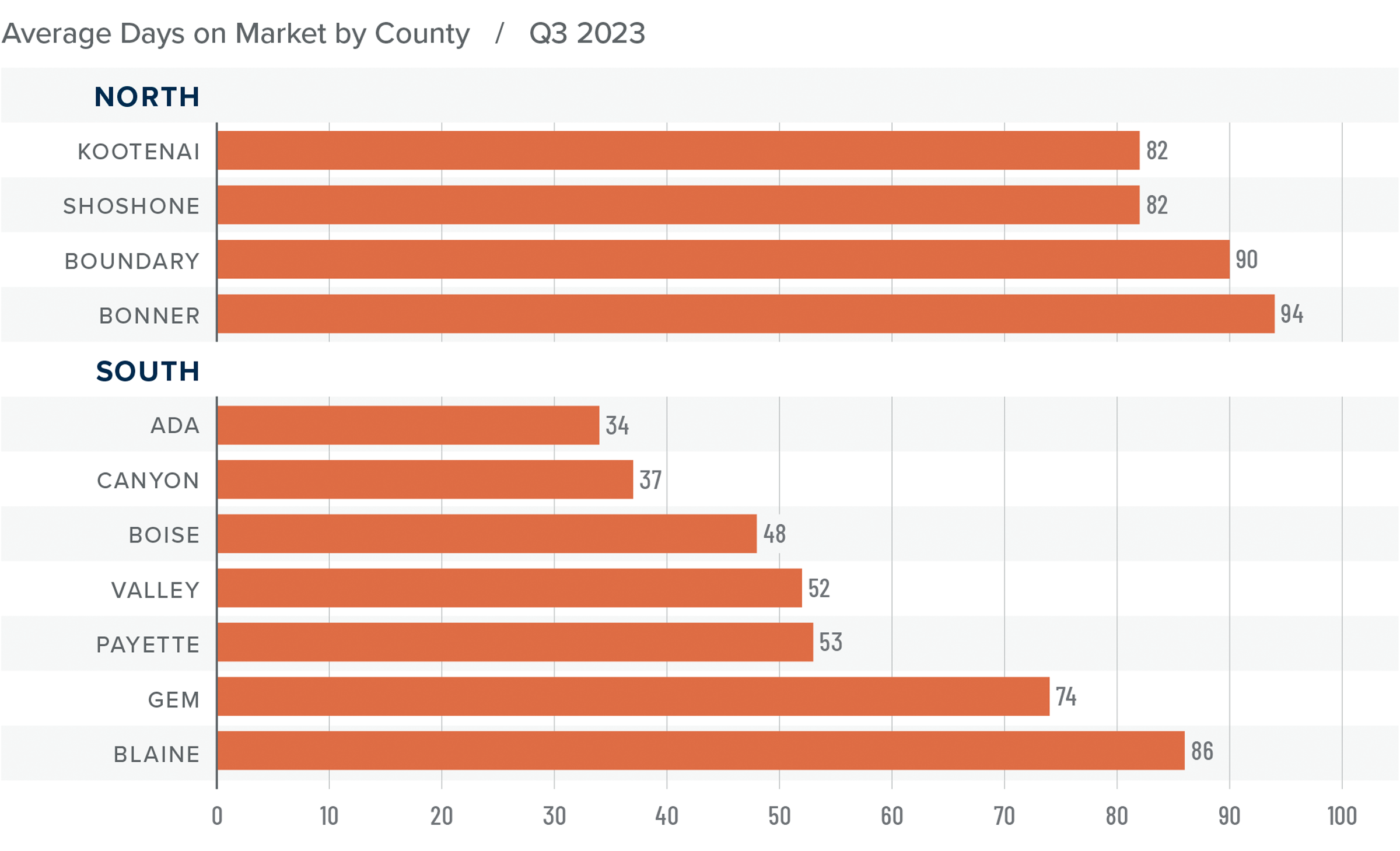

Idaho Days on Market

❱ The average time it took to sell a home in the region rose 16 days compared to the third quarter of 2022. It took an average of nine fewer days for a home to sell than in the second quarter of this year.

❱ In both Northern and Southern Idaho, days on market rose in all counties compared to the same period of 2022. Compared to the second quarter of this year, market time rose in every county in the northern part of the state. In the southern areas, market time fell in all counties except Payette and Gem.

❱ It took an average of 87 days to sell a home in Northern Idaho and 55 days in the southern counties covered by this report.

❱ Homes sold the fastest in Ada County in the southern part of the state. In Northern Idaho, Shoshone and Kootenai counties had the shortest market time.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

There appears to be a disconnect in the market right now. Pending and closed sales are down while listings are higher, which should favor home buyers. However, list and sale prices are higher, which typically favors sellers.

Given the rapid increases in home prices over the past two years, significantly higher mortgage rates will start impacting the market at some point. The question is when.

All things considered, the market favors neither buyers or sellers. As such, the needle stays in the balanced quadrant, with neither side having the upper hand.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link